[ad_1]

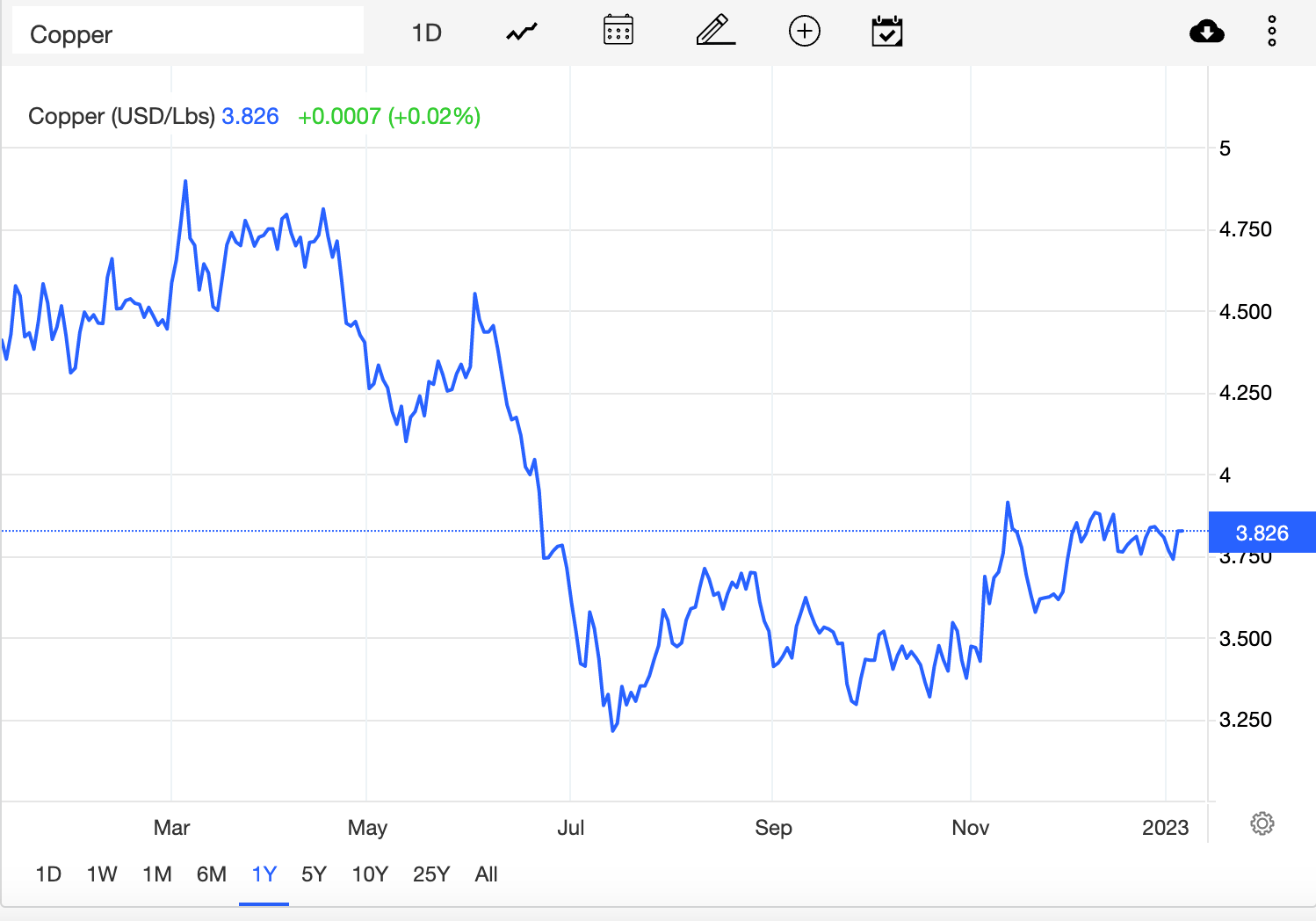

The bottom fell out of what was looking like a stellar future for the copper market, some time around mid-July last year.

With roiling inflation came zealous central banks and the fears of a global recession, weaker demand from Chinese manufacturing giants and China’s zero-Covid policy, a higher dollar… hell, if you don’t know the story by now 2023 is going to come as a terrible shock.

If 2022’s crash movements took anyone by surprise then that’s probably because they forgot to watch copper.

History’s proven that movements in the copper price are a pretty decent measurement of the size of the fight in your economic backyard.

With inventories low and China apparently now pretending COVID’s no longer a thing, keen punters reckon copper has just a whiff of a showstopper

Let me repeat, in my best Discovery Channel condescension : Since ancient times, this malleable, durable, fashionable, machinable, ductile and incredibly useful red metal has been in constant demand.

And it’s not even a metal (it’s an element, first and foremost) and one with wonderfully high thermal and electrical conductivity.

It’s uncannily resistant to time age, ache, penury and corrosion, and in the hands of a trained smithy can be cast easily, quickly and with great accuracy and precision.

Mix a bit of it with tin, and in the hands of a trained berserker it can mow down entire civilisations and bring on that seemingly endless summer, we now call The Bronze Age.

From coins to crypto miners, copper’s an increasingly essential part of the way this modern world is working.

Gardner: The copper canary is back in the mineshaft

High volatile and typically very liquidity, copper is attractive to traders, who also watch the price closely for any confirmation or implication for global growth or a lurking recession.

When copper bottomed out in mid ’22, traders, in the parlance of the Digital Age, suddenly knew ‘sh*t was getting real.’

After crashing to a 2 year low, Mark Gardner at Maqro Capital says copper turned itself around touching $3.90 before Christmas.

“Although base metal markets remain highly volatile and prices have retreated significantly since the record highs seen in March.”

Mark notes that exploration and mine development have been low of late, leading to historically low inventories and forward supply concerns.

Commodity trader Trafigura warned this week of copper stocks falling to record lows with current inventories being enough to supply world consumption for just 4.9 days. On top of this, the mining giant Glencore has flagged a supply shortfall of 50 million tonnes in 2023.

“The reason behind the gap is there are few incentives or motivations to mine copper.

“Prices are low, it is increasingly scarce, copper grades are decreasing historically and pressure on governments from the green lobby to not approve new mines due to copper’s environmentally unfriendly processing methods are just a few reasons its all become too hard to be a copper miner.

“At mature mines, the quality of ore is deteriorating, meaning output either slips or more rock has to be processed to produce the same amount. And meanwhile, the industry’s pipeline of committed projects is running dry. New deposits are getting trickier and pricier to both find and develop. Supplies are already so tight that producers are trying to squeeze tiny nuggets out of junky waste rocks.

Soaring inflation is also driving up the cost of production, Mark says.

“That means the average incentive price, or the value needed to make mining attractive, is now roughly 30% higher than it was 2018 at about $9,000 a ton, (according to Goldman Sachs).”

“Despite all of this, prices are down 21% for the year, largely on the “common truth” that copper is the canary in the mineshaft (ED: I think that’s a pun) for slowing economic growth and the collapse of the Chinese property market.

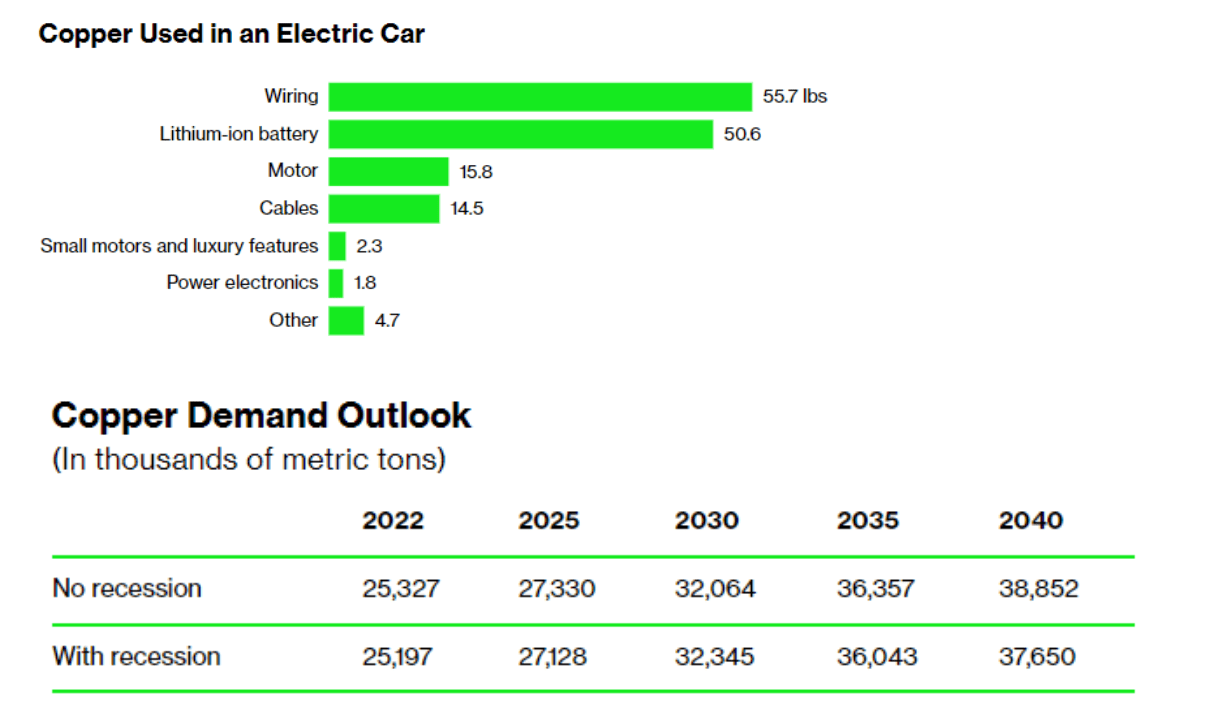

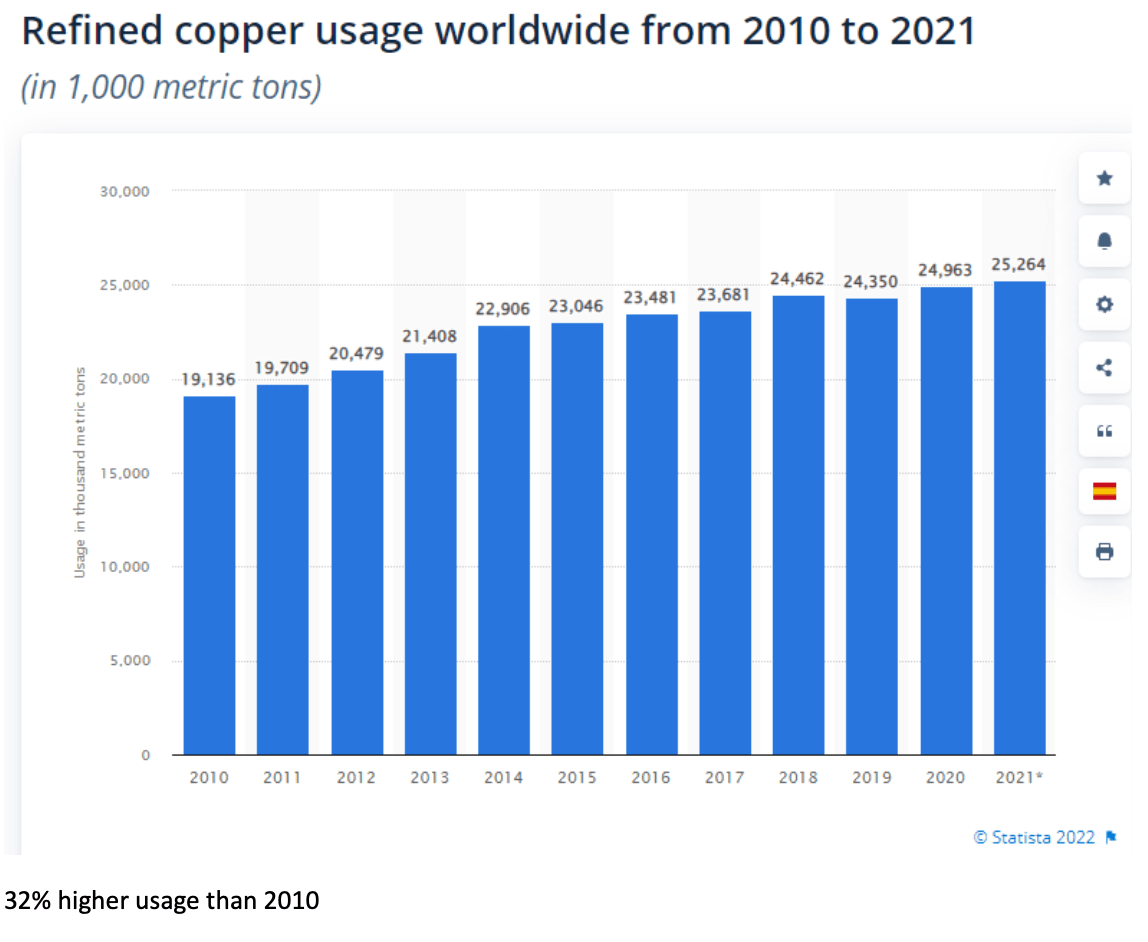

“However, with most predicting a shallow recession next year, this reasoning seems flawed as infrastructure projects break ground after most governments post-pandemic spending spree, the pace of the EV revolution and China likely to rebound next year, the concern should be over impending shortage, not a macroeconomic theory that has passed its used-by date.”

Copper (USD/Lbs) over 12 months

Investment thesis: 2 views on solving the Oz problem

As our own Josh Chiat pointed out, BHP’s (ASX:BHP) $9.6 billion deal to acquire OZ Minerals (ASX:OZL) does create a problem for ASX investors. Suddenly, the ASX minus OZL looks a little bare in the copper cupboard, Oz was the go to copper stock in almost every sensible fund manager’s portfolio.

Mark Gardner says prices are down on the “common truth” that copper is the canary in the mineshaft (excuse the pun) for slowing economic growth, but with most predicting a shallow recession, of greater concern should be historically low inventories, increasing scarcity, decreasing historical grades and resistance against environmentally unfriendly processing methods stalling new mines being developed

At mature mines, the quality of ore is deteriorating, meaning output either slips or more rock has to be processed to produce the same amount. And meanwhile, the industry’s pipeline of committed projects is running dry. New deposits are getting trickier and pricier to both find and develop

Globally, supplies are already so tight that producers are trying to squeeze tiny nuggets out of junky waste rocks.

In the US, companies are running into permitting roadblocks.

Soaring inflation is also driving up the cost of production. That means the average incentive price, or the value needed to make mining attractive, is now roughly 30% higher than it was 2018 at about $9,000 a ton, according to Goldman Sachs.

Market cap: $424 million

Change: -47.2%

For Gardner, Aeris was a clear 3rd choice behind OZL and Sandfire Resources (ASX:SFR).

“Unfortunately, OZ Minerals has been scooped up at a premium by BHP, and Sandfire has a massive capex pipeline over the next few years which makes it risky from a project standpoint.

“So AIS looks to have the best risk/reward and upside of the 3. Aeris has 5 tenements with 4 in production in 2023. The combined mine life of the 5 projects is 18 years with 57-71kt of production expected from the group next year and 780kt in reserves. ”

Aeris Resources has been a confusing one to track in 2022 given a big share consolidation and the $234 million deal to acquire Round Oak Minerals, owner of the Jaguar and Mt Colin copper and base metals mines, something that brought Washington H. Soul Pattison onto its register as a 30% shareholder.

Josh says both its Tritton copper and Cracow gold mines saw costs rise above guidance through FY22, producing 18,581t copper at AISC of A$5.10/lb (guidance was set at 18,500t–19,500t at $4.60-4.85/lb) at Tritton and 53,920oz gold at $1911/oz at Cracow (guidance 56,000-59,000oz at AISC of $1,775-1,825/oz).

Aeris expects operations to grow significantly in FY23, with guidance of 32,000-40,000t copper, 24,000-29,000t zinc, 60-78,000oz fold and 1.1-1.3Moz silver, with a copper equivalent production rate, as Mark says, of 57,000-71,000t and forecast FY23, delivering an expected EBITDA of $140-170m.

A very recent and welcome addition to the local ETF stockpile. Launched on the ASX late October — Reuben says XMET provides “exposure to global copper, lithium, nickel, cobalt, graphite, manganese, silver, and rare earths producers.”

XMET – Performance since inception (October 2022):

Mark says XMET’s a buy for solid copper exposure.

“So this new ETF (from Betashares) looks like a great mix of materials needed in the energy transition.

“With around 40% copper, 20% nickel and 20% Lithium. With a lack of options in Australia for copper investment outside the big, diversified miners which are primarily driven by the Iron ore price.

“XMET pulls together some of the best international copper miners in Canada and the US, while to leverage the commodities most likely to have firm demand for the foreseeable future,” Mark says.

Carl’s Copper Buys – Er… some copper

Carl Capolingua from Think Markets says ‘The Copper Doc’ is stuck in the middle at the moment.

The likely forecast is that global growth will “head into the toilet in 2023.”

Yet supply remains very tight at both London and Shanghai Metals Exchange warehouses and he adds the long-term demand story from the EV revolution continues to excite investors looking for the next big investment theme.

“But… if I had a dollar for each time I’ve heard copper labelled as the “Next Lithium” over the last few months, well I’d have at least 20 bucks – enough to buy four or five pounds of copper.

“Not that I would, however. The chart just doesn’t support it – not until a close above the 14 November peak high of 3.96 that is. Looking at the number of peaks and supply candles punctuating the zone between 3.93 and 3.96, it’s clearly the key make or break level.

“I know ASX-listed copper producers are high on investors’ shopping list lately (next lithium believer, huh?).”

So never one to disappoint, Carl suggests the best way to play any impending boom in copper prices is just by buying the commodity itself.

“Mining companies are temperamental things, and many a boom in a particular commodity has occurred with less than coincident performances in companies trying to find or produce that commodity for a profit.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

[ad_2]

Source link