[ad_1]

Mini

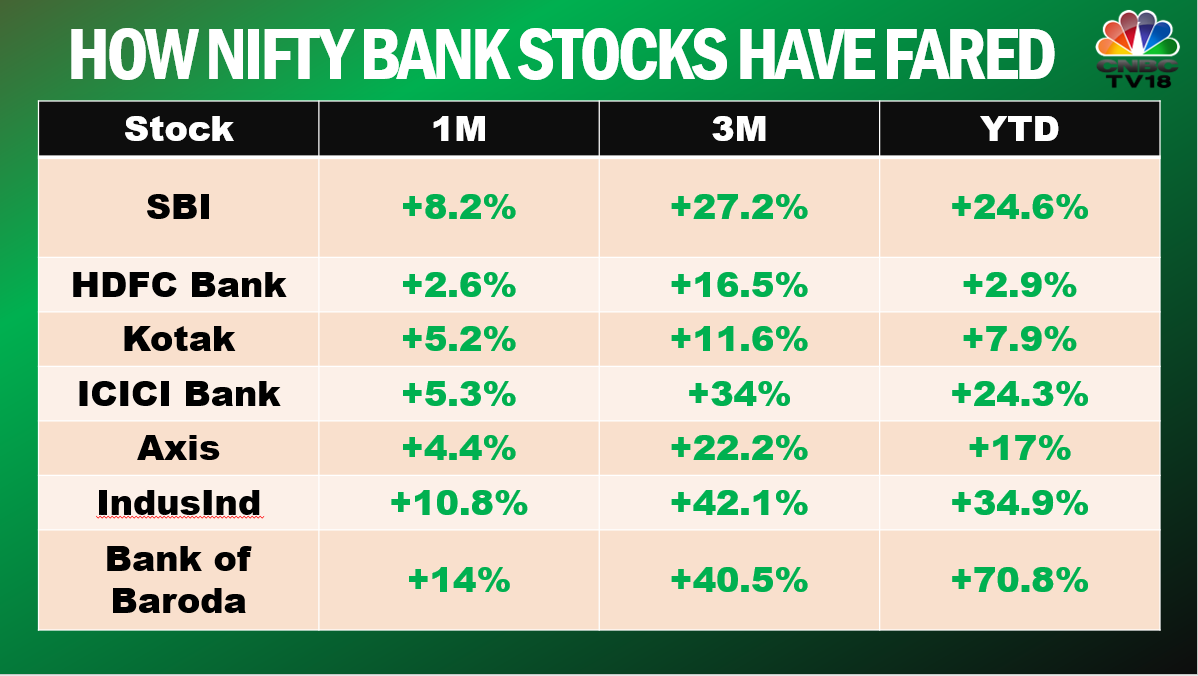

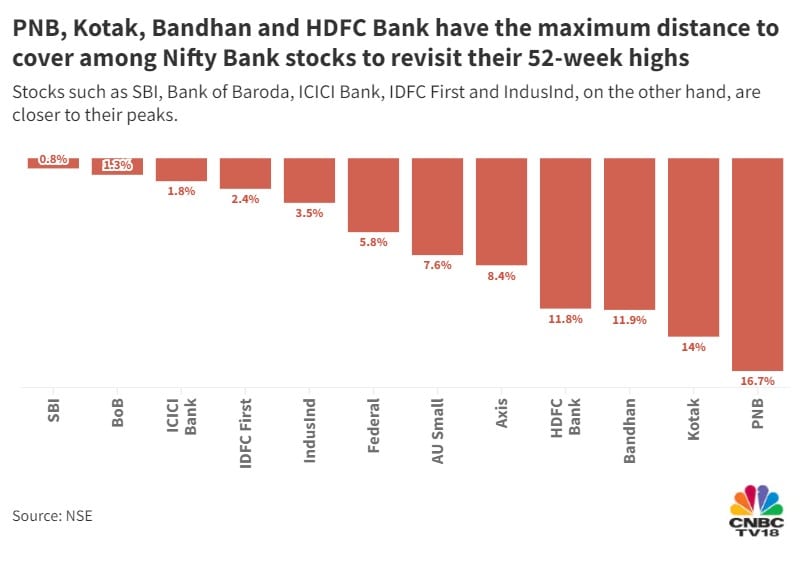

Record highs in stocks such as SBI, ICICI Bank and Bank of Baroda have created just that in the Nifty Bank: a (much awaited) record high. Many prominent voices on Dalal Street are reading this as an early sign of fresh highs in headline index Nifty50.

Andrew Holland, CEO of Avendus Capital Alternate Strategies, expects momentum in banking stocks to continue on Dalal Street, he told CNBC-TV18.

Here’s what’s aiding the surge in banking stocks

:

The banking space is riding on the back of healthy loan growth, optimistic management commentary and endorsements by brokerages, say analysts.

“The Nifty Bank may outperform the market for the next 6-8 months, given its outperformance to the market year to date… SBI has already become the seventh largest company by market value,” AK Prabhakar, Head of Research at IDBI Capital Markets, told CNBCTV18.com.

Giving the rationale behind his optimism, Prabhakar said: “If banking segment is growing at 15 percent, stocks are not priced for that growth.”

RBI data released during the weekend showed credit growth in the country’s commercial banks — a key measure of demand for financial institutions — surged to a nearly nine-year high of 15.5 percent in the week ended August 26.

The data comes at a time when the lenders are hopeful of a pickup in business momentum on the back of aggressive hikes in COVID-era interest rates and the onset of the festive season, which typically aids consumer demand as people tend to borrow more.

SBI is seeing uniform loan growth across retail segments, its Chairman Dinesh Kumar Khara told CNBC-TV18 in an exclusive interaction last week, sounding confident that his bank will finish clock loan growth of at least 15 percent in the year ending March 2023.

“We have very clear visibility of the demand, which is there, and hopefully going forward, as the busy season kicks in, and of course, already the festival season has kicked, I am quite confident that we will continue to have decent retail growth,” Khara said.

Meanwhile, Morgan Stanley has maintained an ‘overweight’ rating each on SBI and IndusInd, with target prices of Rs 675 and Rs 1,400 apiece respectively.

“The Bank Nifty is being driven by strong fundamentals. Bank credit growth around 16 percent and bank non-performing assets (bad loans) at 10-year lows are adequate positive triggers when a strong rally is on,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

He also pointed out that banking stocks were depressed by the relentless selling by FII from Oct 2021 to July this year.

“Now that FIIs have joined the party, banking stocks are getting their due. India’s capacity utilisation crossing 75 percent and green shoots of a capex cycle also bode well for banking stocks,” he told CNBCTV18.com.

Can the bulls expect fresh lifetime highs in Nifty50 anytime soon?

Vijayakumar believes the current market momentum, backed by the Nifty Bank, appears strong enough to take headline indices to new record highs.

However, here’s a word of caution. “The global risk off environment and high valuations in India are areas of concern,” he said.

[ad_2]

Source link