[ad_1]

imaginima

As we think about the rise in e-commerce, I have been interested to find companies that develop technologies to improve the way businesses operate their e-commerce businesses. Berkshire Grey (NASDAQ:BGRY) is one such company.

Investment thesis

I think that Berkshire Grey has a long runway to go given their leadership position in providing supply chains with robotic solutions enabled by artificial intelligence. The investment case for Berkshire Grey is as follows:

- Compelling industry tailwinds for automation due to increasing demands by customers for faster delivery times, increasing competitive pressures in the e-commerce and retail industry, and increasing shortage of labour needed for a labour intensive, manual processes utilised in e-commerce today.

- Large market opportunity of $280 billion for Berkshire Grey across verticals and this is growing at a decent CAGR of 12% from now till 2030.

- Berkshire Grey has obtained business from top strategic accounts and the relationships with these accounts continue to grow and will lead the way for future growth for the company in the years to come.

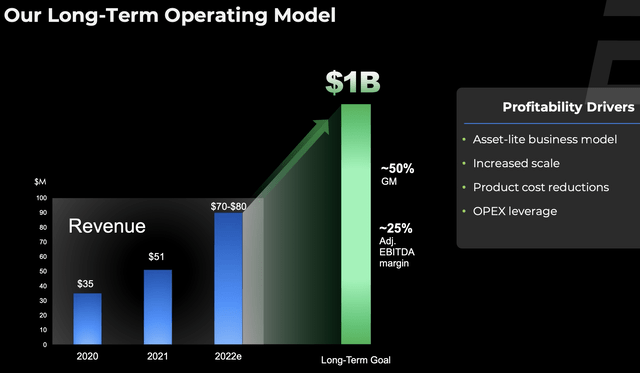

- The company is executing well based on its long term operating model, with goals to achieve revenues of $1 billion, gross margins of 50% and adjusted EBITDA margins of 25% in the long run.

Overview

Berkshire Grey describes itself as a company that is leading in robotic solutions that are enabled by artificial intelligence and these solutions ultimately help to value add by automating the supply chain processes of today.

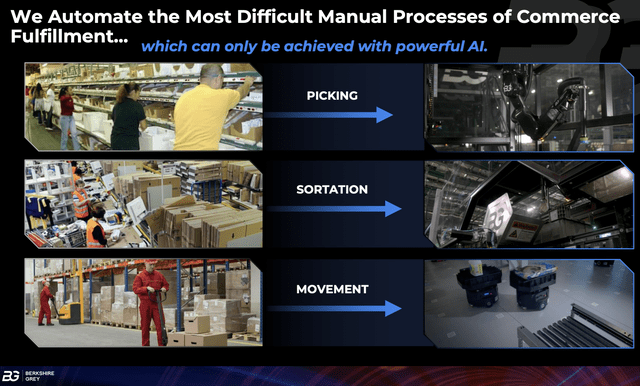

As can be seen below, the company’s products help to replace the manual labour and relatively inefficient picking, sorting and moving processes in e-commerce fulfilment by automating processes and making this more seamless and automatic using the power of artificial intelligence.

Berkshire Grey automation suite (Berkshire Grey slides)

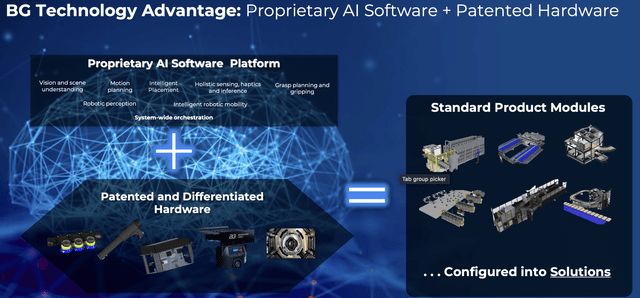

Furthermore, when looking at the offerings Berkshire Grey is able to provide its customers, it ranges across the entire suite of solutions needed for e-commerce applications. Not only does it have a range of hardware that is patented and differentiated from competitors, it also has a proprietary artificial intelligence software platform that adds further value for customers. The result is that Berkshire Grey is able to provide solutions in modules that customers are able to pick and select based on their customised needs. I was able to find several evidences of third part independent appraisals of Berkshire Grey’s technology and this was evident as Frost & Sullivan named the company the enabling technology leader for intelligent robotic automation in 2022. Furthermore, Berkshire Grey also won the SupplyTech Innovation of the Year Award earlier in the year as well. These awards and recognition are the early indications that Berkshire Grey’s innovations are bringing value add in terms of performance, impact and functionality, for example, to its customers. I think that as more companies are aware of these innovative products, we will start to see the company’s order book grow significantly.

Proprietary AI software and patented hardware (Berkshire Grey’s 2Q22 slides)

The case for e-commerce automation

While the idea of e-commerce has been around for some time, the way e-commerce is carried out has been largely manual and requires large amount of labour. For example, in the height of the covid-19 pandemic, there was a shortage of manpower for e-commerce. Even after the pandemic, Amazon (AMZN) reportedly stated in an internal memo that they expect to run out of staff in as soon as 2 years. As such, if the largest e-commerce company in the world is experiencing a shortage of manpower needed to sustain its e-commerce business, many of the smaller e-commerce companies and retailers could see a larger challenge in having sufficient labour for normal e-commerce operations.

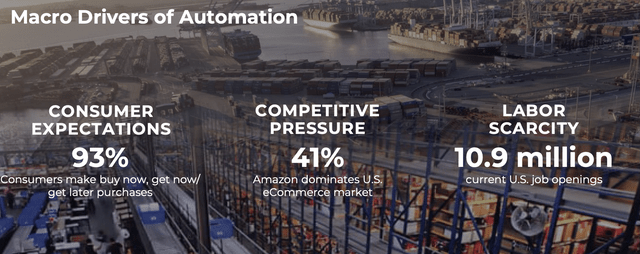

As can be seen below, apart from the scarce labour resources available for the labour intensive e-commerce processes of today, there are also other pressures that work in favour of e-commerce automation. First, consumers are increasingly demanding that they receive their deliveries as soon as within the day or in the next day or two. With 93% of consumers expecting a buy now and get now scenario, companies are scrambling to find ways to do so and one such way is through robotic automation of their existing processes to streamline and speed up these processes to meet the demands of consumers. Second, while I have mentioned Amazon above and although it may be the top player in the market with 41% share of the US e-commerce market, the other smaller players that are competing with Amazon needs to keep up with technological advancements in robotics and automation that Amazon is able to afford in terms of research and development. As such, Berkshire Grey is important to all the other players other than Amazon that needs to replace their current processes to convert them into more automatic processes leveraging the power of artificial intelligence and robotics.

The case for automation (Berkshire Grey slides)

Market opportunity

When thinking about the market opportunity for Berkshire Grey, I think that the industry for warehouse and fulfilment centre automation is growing as the demands and pressures to automate increases as mentioned above. According to independent research on the world’s demand for warehouse automation by 2030, it expects the market to grow to $147 billion with an expected CAGR of 12% over the period.

Apart from the opportunity from warehouse automation, the company attempted to target verticals outside of e-commerce, including retail grocery, packaging handling and third party logistics. As such, the company expects its total addressable market to be around $280 billion today.

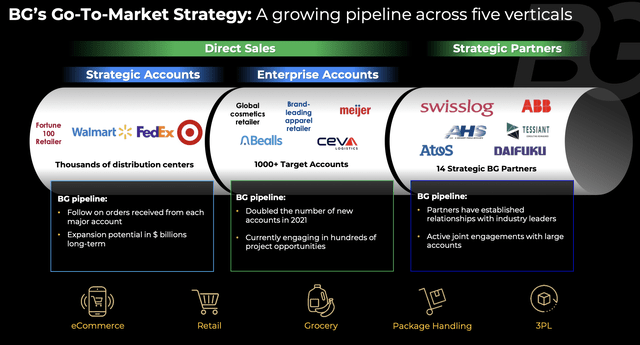

Berkshire Grey Go-To-Market strategy (Berkshire Grey 2Q22 slides)

In terms of its strategy to expand and grow, the company has identified what it terms “strategic accounts”. These are fortune 100 retailers like Walmart (WMT), FedEx (FDX) and Target (TGT). I think that it’s interesting that these 3 Fortune 100 retailers are already in some ways customers of Berkshire Grey and that these accounts are thus very important strategically for the company as it adopts a land and expand model. It has identified another 1,000 enterprise accounts which is in its pipeline to bring about additional opportunities.

Large customer accounts and strong order book

During its listing on the stock exchange, the company has disclosed that it counts Walmart, FedEx and Target as its customers. I looked into the capital expenditure budgets of Walmart, FedEx and Target to get a clearer understanding about the quantity and the growth rates of the capital budgets of these large accounts and how much they are spending to upgrade and renew their supply chains.

In 2021, Walmart increased its capital expenditures by 28% to $13 billion while Target increased capital expenditures in 2021 by 34% to $3.5 billion. FedEx’s capital expenditures remained stable at around $6 billion in 2021. Their total capital expenditure added up to around $23 billion, although only a portion of it would go to warehouse and supply chain automation needs like the products that Berkshire Grey offers.

In addition, there were encouraging news prior to the second quarter results of Berkshire Grey. The company announced that it is expanding its relationship with FedEx. I am of the view that this expansion of the relationship with FedEx shows the compelling value add that Berkshire Grey’s products brings to its clients and the opportunity for Berkshire Grey to expand its current scope of business with its large strategic accounts.

Along with this announcement, Berkshire Grey also said that with the condition that FedEx orders or makes payment for at least $200 million in Berkshire Grey’s products and services by end 2025, the 25 million warrants that Berkshire Grey granted FedEx would vest. While during the management call the management has also said that they expect the actual number of orders from FedEx in the long term to be far greater than this $200 million.

Improving financially

While the long term operating model may still be many years away, I am glad that management has communicated this early and is rather confident of achieving this over time. Based on their long term operating model, they expect to generate $1 billion in revenues while achieving 50% gross margins and 25% adjusted EBITDA margins.

Long term operating model (Berkshire Grey 2Q22 slides)

In the current second quarter results, management has demonstrated their ability to improve gross margins. The improvement in gross margins comes from the realisation of efficiencies for its more mature products, continued progress in reducing product costs, and lastly to increase average selling price to boost margins.

Management shared some examples of product cost reduction initiatives, which includes a design change of a negative margin product that led to deployment times being reduced and the overall costs of product was reduced by 10% as a result of these design changes. Another example of a more recently launched product for which the company carried out design changes saw the product cost reduced by 20% and these reduction in costs will become increasingly material over the year.

I think that these gross margin improvements have been rather encouraging as it shows that efficiency improvements and product designs as a result of cost reduction focus is working to bring overall gross margins up for the company. As a result, I expect the gross margins to turn positive in 2023 and beyond. If the management manages to achieve this in 2023, there will be more confidence by the market in pricing in their ability to achieve their long term goal of 50% gross margins.

Valuation

Since Berkshire Grey is a relatively early stage company with no profitability, my valuation target for the company will be based on forecasted revenues. Based on my revenue estimates of about $270 million of revenues in 2024, I apply a 2024 P/S multiple of 5x to the 2024 revenues. I then discount that back by a higher discount rate of 18% to account for the higher risk profile of Berkshire Grey.

Based on these assumptions, my target price for Berkshire Grey is $3.90, which implies an upside of 86% from current levels. I think that the P/S multiple of Berkshire Grey is reasonable given that the company is expected to grow at 80% revenue CAGR over the next 2 years.

Risks

Need to raise capital

As highlighted by the company, due to their relative early stage of development and current cash burn rates, they expect that they would need to raise capital to execute their business plan. Although management remains confident that when they need to raise capital they will be able to do so, there is the risk that the company may not raise as much as it needs or that the company may need capital during a severe market downturn when capital has dried up.

Execution risks

As with all early stage companies with a lack of track record, they need to be able to show stellar execution skills. This is important for Berkshire Grey as management has provided long term goals for margins and revenues and investors need to be able to see increasing visibility into the company’s ability to achieve these goals set out from the beginning.

Conclusion

I think that Berkshire Grey is onto something big. As a leader in robotic automation of supply chain processes and leveraging the power of artificial intelligence, the company has a long runway to go as e-commerce companies and retailers realise the importance of automation in their businesses and processes. As highlighted above, there are several competitive pressures, customer demands and labour pressures that will likely drive automation in the industry and perhaps even accelerate it in the years to come. With its large addressable market and strategic accounts with fortune 100 retailers, Berkshire Grey should continue its rapid growth profile in the years to come as its existing customers expand their relationships with Berkshire Grey to incorporate more automation in their processes. Furthermore, the company is showing good promise in being able to achieve its long term operating model and is striving to improve gross margins with good results. Based on my target price of $3.90 for Berkshire Grey, there is an upside of 86% from current levels.

[ad_2]

Source link