[ad_1]

SlobodanMiljevic

Macro-economic Overview

A progressive reopening of the Chinese economy coupled with Brazilian political reform could spell serious upside for industrial national icon’s like Companhia Siderurgica Nacional (NYSE:SID).

The company’s positioning across steel, mining, logistics and energy positions it extremely well to reap risk adjusted upside as money managers look increasingly towards emerging markets for ameliorated growth prospects. Accordingly, I remain upbeat on the firm.

Latin America’s biggest economy- a commodities powerhouse – has historically been the export kingpin for iron ore, oil, coffee, sugar cane or even cattle. In the space of only 20 years, its 213 million strong population, one of the continent’s most diverse, has embarked on a roller coaster ride of politics, corruption scandals, state interventionism, and a liberal markets free-for-all.

In fact, centuries of political to-and-fro has been seemingly jammed into solely a couple of decades. Leftists, centrists, and right-leaning political figure heads have all taken a swing at righting some of the country’s pressing issues – wealth disparity, crime, education or even healthcare.

Yet despite a plethora of socio-economic issues, the country appears to hold its own on the world stage. Its $1.6T economy, which recently posted 3.2% year-on-year economic growth, has received a shot in the arm by a commodities boom.

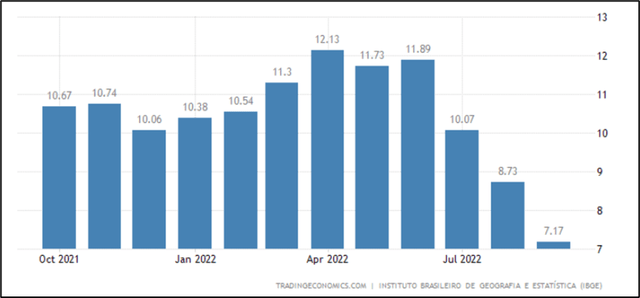

Price increases have remained comparably tame, with annual inflation easing to 7.17% in September 2022, down from 8.73% a month earlier. Only one data point -granted – but that has been the best reading since April 2021. Right now, nothing suggests a commodity focused behemoth like Brazil is about to fall off an economic cliff.

Source: Trading Economics

Eye-watering inflation has been recently tapering with Brazil’s CPI, food inflation & transportation costs all easing.

The wildcard remains the newly elected government. Luiz Inacio Lula da Silva’s slim victory over President Bolsonaro underscores widespread divisiveness ever-present in Brazilian politics.

Persuading financial markets that fiscal responsibility is a cornerstone of his political manifesto will be crucial. While Jair Bolsonaro’s pro-market politics may be dead and buried, any interventionist super loose Lula imposed fiscal giveaway may be countered with a swift broadside from global credit markets – just ask Kwasi Kwarteng.

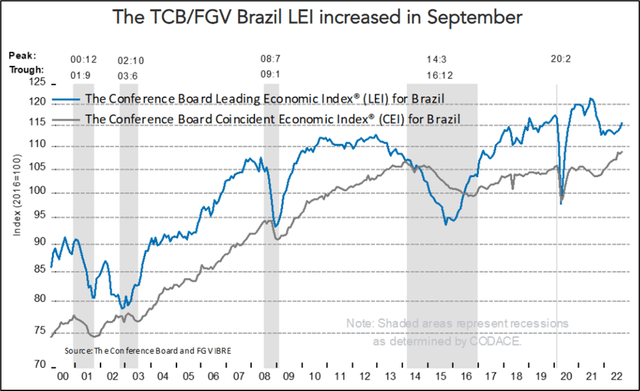

The Conference Board

The Conference Board Leading Economic Index – detailed research completed in conjunction with Fundacao Getulio Vargas highlights some forward-looking positives for the Brazilian economy.

Company Introduction

Companhia Siderurgica Nacional is Brazil’s premier integrated steel producer. Present in multiple strategic sectors such as steel, mining, logistics, cement, and energy, the $3.5B Brazilian commodities venture was birthed in the early 1940s during the country’s industrialization.

With beefed up industrial assets including plants, mines, an integrated steel mill, port terminals, railway facilities and interests in hydroelectric power generation, its 24,000 employees cover the complete commodities value chain.

The firm offers a diverse product range including iron ore, flat steel products, hot rolled, cold rolled coils and sheets, galvanized products, and even structural steel pitched at construction, consumer durables and automotive applications.

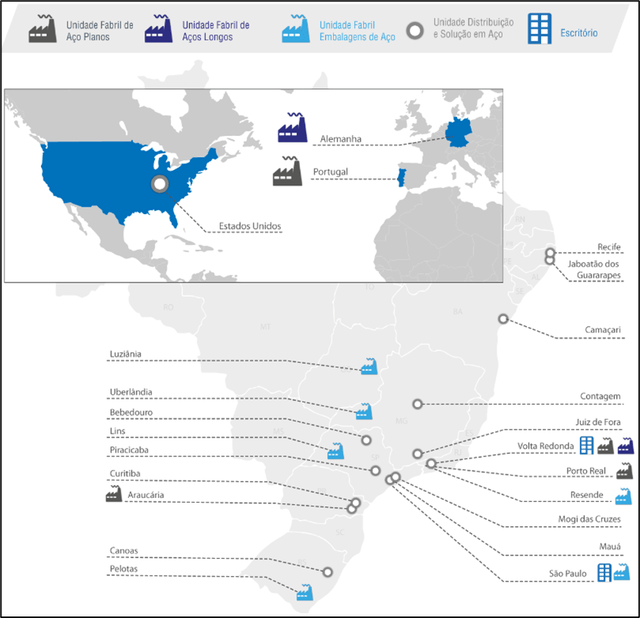

Companhia Siderurgica Nacional

CSN’s industrial footprint includes steel manufacturing assets in Germany, Portugal, and the United States.

Simplified Income Statement

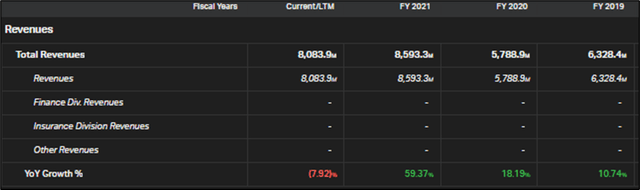

Since FY 2019, annual sales growth has progressed steadily – from $5.7B in sales FY 2019 to almost $8.6B in FY 2021. Despite China’s recent slowing, a boost in sales has firmly cemented the company’s financial standing.

Koyfin

Revenues have progressed in line with a bullish commodities environment spurred by Chinese industrial demand.

From FY 2020 to FY 2021, operating income has tripled (from $1.095B FY 2020 to $3.2B FY 2021). The company’s $2.1B in FY 2021 net income has translated into net diluted earnings per share of $1.60, a company record.

Dividends from CSN make up part of the total return, with the company disbursing $0.38/ share – albeit a yield of circa 5.50%.

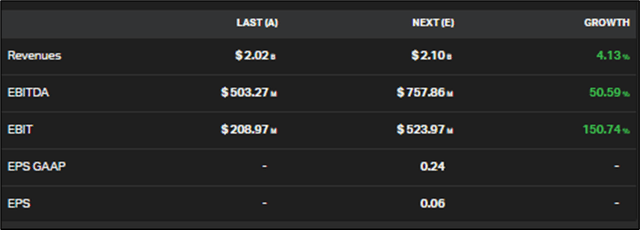

Analysts have penned in a progressive slowing beyond 2023 as the global economy starts to rollover. Between now and then, the outlook, particularly should China’s policy makers make a U-turn on Covid policy remains resolutely positive.

Koyfin

Analyst forecasts for EBITDA are bullish despite a progressive slowing of company numbers.

Simplified Balance Sheet

CSN’s balance sheet remains strong despite a few line-item standouts meriting further investigation. Cash and equivalents remain healthy ($2.9B in FY 2021 up from $270M in FY 2019) with that number suspected to taper as the company deploys capital into operating assets and distributions.

Inventory has doubled (from $927M in FY 2020 to $1.9B in FY 2021), justifying further scrutiny to determine if sizable stock increases are a sign of a long-term slowing in demand or a product of supply chain bottlenecking.

Receivables have held at around $500M over the past couple of years, with improvements made in extending cash outflows through a ~$200M increase in payables (from $900M in FY 2020 to $1.1B in FY 2021).

Current liabilities had ballooned, mainly through adjustments to taxes payable and unearned revenues but now appear to be pointing in the right direction.

Long term debt has held between ~$5B and ~6B over last few years, creating an interest expense of ~$400M in FY 2021. Goodwill has downsized through annual testing and impairment recognition, reducing from $668M in FY 2021 and providing relief that some of the accounting skeletons have already been pulled out of the closet.

All in, there are no big accounting items in the balance sheet that should be scaring investors presently.

Simplified Cash Flow Statement

Big income tax charges have taken some of the shine of CSN’s cash flow statements. A $400M charge in Q1 2022 along with sizable reductions in receivables saw the company print -$810M in operating cash flow. Since then, the Brazilian steel venture has posted between ~$500M and ~$600M in operating cash flow over the past 3 quarters.

Capex has figured meaningfully in cash flow from investing with the company putting roughly $150M per quarter into plant, property, and equipment. Cash acquisitions ($884M in Q3 2022 penned in to acquire LafargeHolcim’s cement assets) also are an important standout not only for company strategy but also for investing cash flows.

Recourse to credit markets to partly fund strategic acquisitions and payoff maturing debt are highlights in cash flows from investing. Over the last 12 months, CSN has issued ~$3.3B, paid-off ~$1.9B, bought back circa $600M of stock and handed out $234M in dividends.

Valuation & Risk

CSN trades at a NTW price to earnings ratio of 5.7X. Price to sales over the next 12 months trades at a rock-bottom 0.4x with EV/EBITDA expected to print around 3.7X.

Those valuations have pushed to the upside but remain substantially behind multiples witnessed a couple of years back (The company was posting a P/E ratio north of 10x only 2 years ago)

The company’s market cap has sizably regressed also (from ~$7.4B in FY 2021 to only ~$3.5B today) Upside abounds, particularly if we see positive shifts in the Chinese economy. Debt loading, which has fluctuated between $6B – $7B, has managed to positively juice returns of equity.

Sizable risks do present themselves for the company – none other more prominent than policy from a newly crowned leftist government. FX exposure, credit risk – particularly for a company regularly having recourse to credit markets for acquisitions and industrial expansion – also should figure on any investor risk register. Investors should keep a watchful eye on pro-business changes in government policy along with any strength in the Brazilian Real for signs of positive Brazilian risk appetite.

Commodity prices – which have been artificially capped by a strong US dollar – require close observation because positive Brazilian GDP growth correlates with a bullish commodity environment.

In Conclusion

Companhia Siderurgica Nacional is a prominent Brazilian steel manufacturer. With its integrated, heavily verticalized supply chain comprised of mines, railways and port infrastructure, it distinguishes itself from competitors such as Arcelor Brazil, Metallurgica Gerdau, and Usiminas.

Focus on high value-added products destined for infrastructure, consumer durables and automotive industries is a corporate strong point, while interests in hydro-electric power generation allow the firm to control energy inputs into product manufacturing.

Access to low-cost high-grade iron ore, an abundant labor market, and competitive sources of energy provide tailwinds for the Brazilian industrial conglomerate. Accordingly, the company is worth keeping an eye on should we see business-friendly Brazilian government policy or a re-opening in China.

[ad_2]

Source link