[ad_1]

eDriving Launches Non-Telematics Version of Mentor Driver App

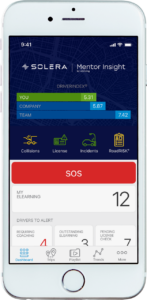

New Jersey-based eDriving announced the availability of Mentor Insight, the non-telematics version of its driver safety app, Mentor.

Mentor Insight offers many of the same tools to help improve driver behavior, including risk assessment, predictive driver scoring, eLearning, manager coaching, and gamification, but without telematics-based monitoring of driver behavior behind the wheel.

The company said its new product is for those “companies not yet ready to navigate the privacy concerns that often accompany a full-scale implementation of telematics-based safety applications, as well as companies that may have a telematics solution in place but would like to leverage Mentor’s additional features.”

Mentor Insight works by providing a comprehensive view of driver risk to help sharpen defensive driver knowledge, behavior, and attitudes, all while protecting driver privacy. Its features include:

- Driver Risk Scoring – All drivers receive a DriverINDEX score, which combines collision, incident, and license check data, plus RoadRISK risk assessment results in one driver score, facilitating benchmarking and identification of an organization’s most at-risk drivers for training and coaching.

- eLearning – More than 300 short, interactive eLearning modules help engage drivers and promote safer behavior behind the wheel

- Manager Coaching toolkit – Templates to help managers coach their at-risk drivers using custom formats suitable for monthly meetings, annual reviews, and post-collision/violation.

- Gamification – Friendly competition and ongoing safety-focused communication enabling drivers to set up groups in which they can see fellow team members’ progress/scores and use emojis and chat functions to send motivational messages.

Mentor Insight also offers an integrated Personal SOS function alert for emergency response services powered by Bosch and Sfara. The Personal SOS alert can be triggered by drivers to request assistance if they feel unwell or concerned about their safety at any time, in any place.

eDriving is a Solera company, Solera is a global provider of integrated vehicle lifecycle and fleet management and vehicle claims data and services. Solera’s brands include Identifix, Audatex, DealerSocket, Omnitracs, eDriving/Mentor, Explore, CAP HPIand Autodata.

Comcast’s Notion, Nationwide Enhance Leak Sensor Premium Discounts

Notion, part of TV cable service provider Comcast, is now offering leak detection and security systems that could result in insurance premium discounts for homeowners The offering, called Notion PRO, can provide sensors to monitor for water leaks, open doors and windows, alarms and temperature changes. Homeowners can upgrade to the service for $10 a month, but users “may be eligible to save up to 15% on their home insurance premiums,” the company said in a news release.

Nationwide Mutual Insurance Co. announced in March that it had teamed up with Notion on the sensor program, but said premium discounts would amount to only about $50 annually. The 15% appears to be a significant increase in the credit to homeowners.

“Risks like water leaks often go undetected until they’ve already done extensive damage. It’s great to work with a partner like Notion who is continuously looking for new ways to help homeowners proactively monitor for risks,” said Sarah Jacobs, vice president of product development at Nationwide Mutual Insurance Co.

The Comcast company joins a growing list of service providers and insurers now offering the sensors to help minimize losses. Chubb, one of the world’s largest insurance companies, early this year began offering 3% discounts on premiums for the use of its sensors and up to 8% for the use of water-line shutoff devices.

HUB Launches Personal Lines Platform

Hub International has launched a digital platform for transactional personal insurance insurance such as home and auto.

The launch if the new platform, called VIU by HUB, follows HUB’s acquisition of Insureon, a digital platform focused on the commercial space.

HUB is hoping to “dramatically change the consumer experience,” said Marc Cohen, president and CEO of HUB.

VIU by HUB will allow customers to engage with HUB how and when they want, obtain fast quoting that minimizes the need for manual research, get options and coverage, and aggregate their policies in one place.

VIU by HUB will deliver insurance through its retail direct-to-consumer channel. Additionally, with its new strategic partnership program, HUB is partnering with auto dealerships, mortgage brokers, real estate agents and bankers, and other industries o offer insurance through its branded or white labeled VIU by HUB platform.

Topics

InsurTech

Tech

Interested in Insurtech?

Get automatic alerts for this topic.

[ad_2]

Source link