[ad_1]

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

I’m bullish oil and gas.

This should be no secret and I’ve been bullish since Nord Stream 2 was completed and Putin slowed down flows of existing gas into Europe as a way of blackmailing the Germans to speed up the approval process. The Europeans had also massively under-ordered (according to Putin) because of the green movement and wind was low in Europe so renewables weren’t producing as much.

Then one thing led to another and now there’s a war in Ukraine and Queenslanders are being asked to ease up on the power consumption.

What a farce.

Good podcast to listen to is the most recent Macro Voices with guest Dr Anas Alhajji who is well and truly in the know when it comes to oil markets.

OPEC call him when they have a question, apparently.

Okay that’s a bit much but if you want an overview on what’s ahead listen to this. Europe straight up doesn’t have the capacity to heat itself all while the US is massively thin on stockpiles with driving season just firing up. Getting things moving will be hard with hurricane season in the Gulf of Mexico expected to be a doozy, halting production and transportation.

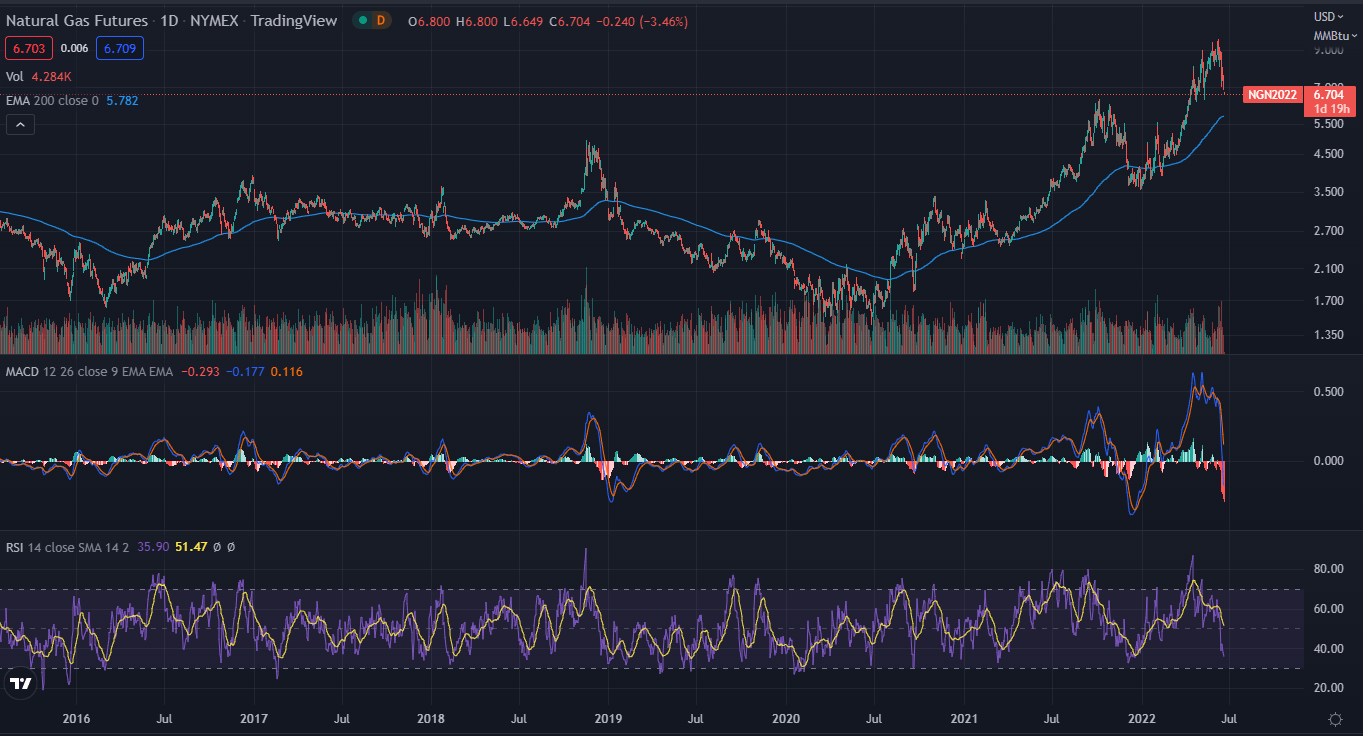

There’s just one problem: the charts look unbuyable

Crude is no different.

But I’ll be finding ways to participate in the oil & gas moves as directly as possible.

Playing in the futures market does not exactly go well with many of my clients’ risk profiles so it’s looking like OOO (BetaShares Crude Oil Index ETF – Currency Hedged, synthetic) is the ETF you need to buy locally if you’re needing a solid foothold in the direct energy space and don’t want to be holding any company risk.

It only covers WTI crude though. There’s one in the States that covers natural gas called UNG. That’s getting a close look from me.

But wait on it because when you look at these charts you have to be thinking there’ll be a chance later on down the road.

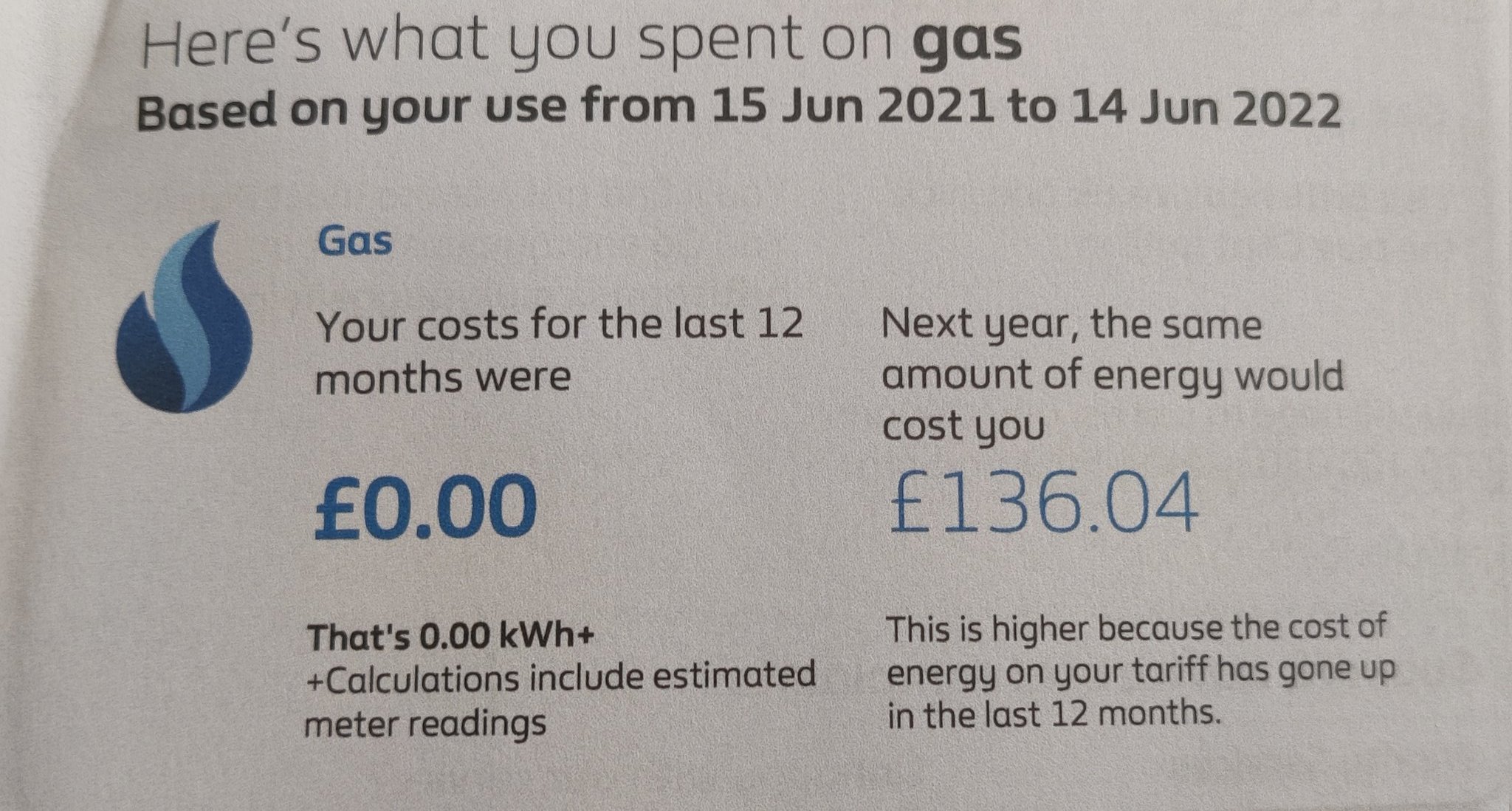

But for as long as this is the norm I’ll be happy to be long oil for the medium-term.

Crude to $250. Just not… you know… right now.

Still short META, buying copper on big dips, adding to the China new economy and generally trying to avoid too much equities exposure.

You’re so Money!

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

[ad_2]

Source link