[ad_1]

The bulls are still reluctant to take charge of Dalal Street since the recent sell-off, which took away more than seven percent of the Nifty50’s value. During this period, some of the stocks owned by star investors including the big bull — Rakesh Jhunjhunwala — have corrected up to 10 percent during this period.

Some of these stocks have lost one fourth of their value in just three months.

Does it make it an opportune time to add some of these names to your portfolio?

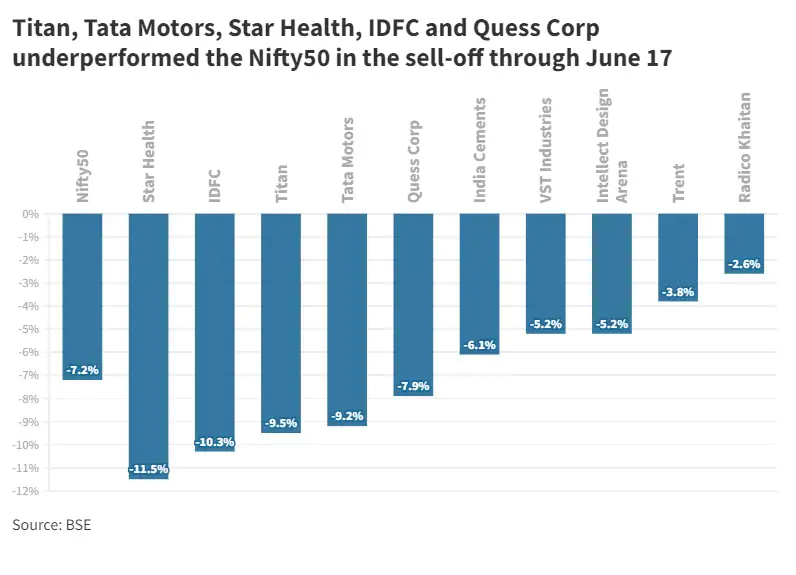

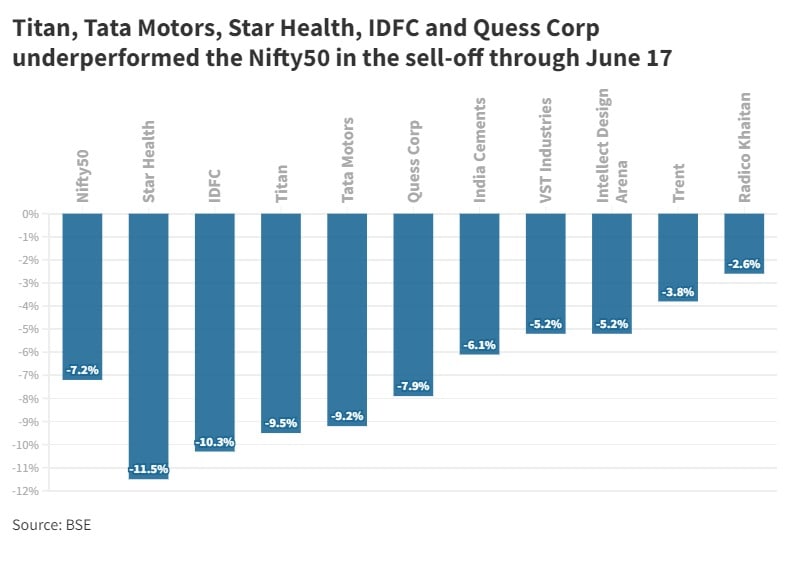

The market has been within kissing distance of bear territory for much of the past few weeks. Even in the six-day-long sell-off till June 17 — which took away nearly 1,200 points from the Nifty50 index, stocks such as Titan, Tata Motors, Trent, Quess and Radico Khaitan have lost 3-10 percent of their value.

| Stock | Return | ||

| One month | Three months | Six months | |

| Titan | -5.6% | -25% | -19.6% |

| Tata Motors | -6.8% | -8.2% | -18.5 |

| Star Health | -19.4% | -8.9% | -24% |

| VST Industries | -8.3% | -3.3% | -6.8% |

| India% Cements | -12.6% | -26.6% | -19.9% |

| IDFC | -11.7% | -26.6% | -29.2% |

| Quess | -4.4% | 8.6% | -27.9% |

| Radico Khaitan | -3.9% | -16.9% | -35.8% |

| Intellect Design | -2% | -23.4% | -17% |

Rakesh Jhunjhunwala

Titan, Tata Motors and Star Health fell up to 11.5 percent during the six-day period.

At the end of March 2022, Rakesh Jhunjhunwala and his wife Rekha Jhunjhunwala held a 5.05 percent stake in Titan and 11.29 percent in Star Health. The big bull held a 1.21 percent interest in Tata Motors.

Here’s what brokerages make of the three stocks:

| Stock | Brokerage | Rating | Target price |

| Titan | Geojit | Hold | 2,330 |

| Titan | Motilal Oswal | Buy | 2,900 |

| Titan | HDFC Securities | Sell | 1,750 |

| Tata Motors | Motilal Oswal | Buy | 485 |

| Tata Motors | Prabhudas Lilladher | Buy | 372 |

| Tata Motors | HDFC Securities | Reduce | 398 |

| Star Health | ICICI Direct | Buy | 825 |

| Star Health | Motilal Oswal | Buy | 840 |

Radhakishan Damani

Damani owns retail chain-operator Avenue Supermarts (DMart).

| Stock | Radhakishan Damani stake |

| VST Industries | 1.63% |

| India Cements | 11.34% |

| DMart | 34.3% |

ICICI Direct has a ‘buy’ call on DMart with a target price of Rs 4,530, which implies an upside of almost 30 percent from Wednesday’s closing price.

| Stock | Brokerage | Rating | Target price |

| VST Industries | ICICI Direct | Hold | 3,425 |

| India Cements | Motilal Oswal | Neutral | 155 |

| DMart | HDFC Securities | Sell | 2,500 |

| DMart | ICICI Direct | Buy | 4,530 |

Ashish Dhawan

| Stock | Ashish Dhawan stake |

| IDFC | 3.51% |

| Quess Corp | 1.86% |

Mukul Agrawal

| Stock | Mukul Agrawal stake |

| Radico Khaitan | 1.05% |

| Intellect Design Arena | 1.75% |

Portfolio cloning

The act of replicating the portfolio of more successful investors or fund managers is known as portfolio cloning.

Should you do it?

Money managers generally suggest against using cloning as a strategy.

“Even though portfolio cloning can turn out to be positive in some cases, it is a very dangerous strategy because you don’t know at what price the fund manager or investor has bought the stock,” Raj Vyas, Portfolio Manager at Teji Mandi, told CNBCTV18.com.

“The target investor/manager might have entered when the price was below the fair value. You may be buying when it is already above it,” he explained.

One can look at aspects such as the past performance, the selection process, the strategy (growth or value), the nature of other bets (diversified or concentrated) and the frequency of buying while going for cloning, Vyas added.

[ad_2]

Source link