[ad_1]

Ultima_Gaina/iStock via Getty Images

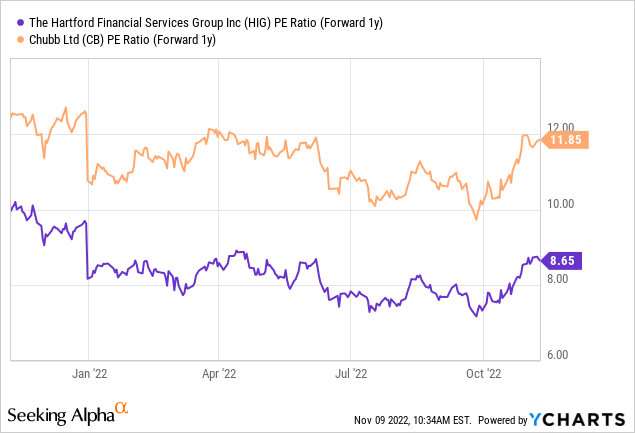

Coming off a mixed earnings result in Q3, near-term business trends look set to be choppy for Hartford Financial Services (NYSE:HIG), a leading provider of property and casualty (P&C) insurance, group life, and disability products, among others. All eyes will be on the underlying loss ratio development in the coming quarters, but for long-term investors, HIG’s more diversified mix relative to peers makes it an interesting vehicle to navigate the current macro environment. Capital allocation optionality is attractive as well, mainly from the resilient capital return program. A takeout scenario could also still be on the table, even after HIG rebuffed Chubb’s (CB) latest offer last year, as the discounted P/E valuation could attract shareholder activism down the line. Coupled with the mid to long-term margin expansion potential from the cost side (e.g., the guidance for higher cost savings from Hartford Next), the stock is worth a look, in my view.

A Headline Earnings Beat but Headwinds Remain

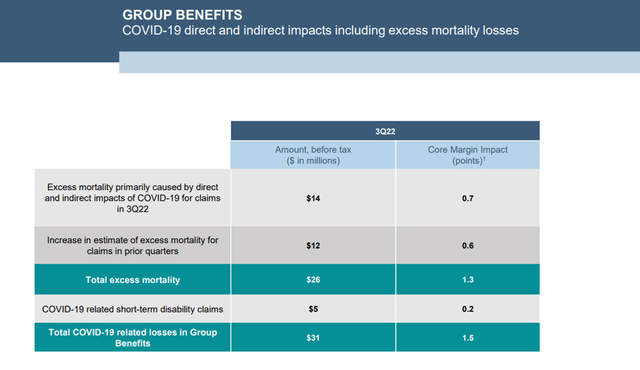

HIG’s revenue and core earnings margin came ahead of consensus this time around, driven by alternative investment outperformance and more favorable prior-year reserve development (PYD). This was partly offset, however, by higher cat losses (i.e., dollar losses incurred due to catastrophic events) and COVID benefit claims. On the latter point, COVID excess mortality losses were down YoY at $26m (vs. $212m in Q3 2021) but up QoQ from the ~$10m in Q2 2022. COVID short-term disability claims also stood at $5m, which, together with the excess mortality losses, led to modest core margin compression for the quarter. Even excluding excess mortality, though, the group life loss ratio would still have deteriorated YoY due to a less favorable life premium waiver reserve development and higher expense reserve assumptions.

Hartford Financial Services

Still, the results will come as a welcome relief to investors. While much of the delta was due to higher investment income (vs. recurring income from operations), the upside in core investment (excluding alternatives) should sustain for a while, in my view, with elevated rates supporting base yields. In addition, group benefits margins and mutual fund fees also benefited the earnings result; these drivers tend to fluctuate, though, and could reverse in the upcoming quarters.

That said, HIG remains an earnings compounder and has ample capital available for deployment. Thus far, the priority seems to be on buybacks, with ~$350m spent for the quarter. Expect more buybacks down the line, with the stock trading at an undemanding valuation and ample room remaining for the repurchase authorization to be raised (note the authorization has been raised several times already since resuming activity in early 2021).

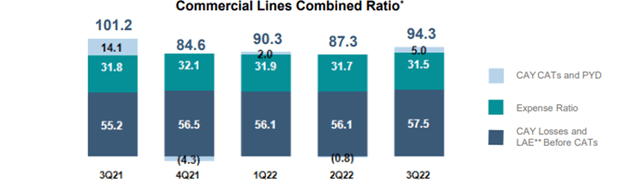

Workers’ Compensation Outlook Weighs on Commercial Lines

Worryingly, the underlying loss ratio (i.e., insurance claims net of adjustments as a proportion of total earned premiums) of 57.5% deteriorated by 2.3%pts YoY, driven mainly by commercial non-cat property losses running ~1%pt above expectations. Even excluding the impact of non-cat property losses, however, the underlying loss ratio would have deteriorated by a smaller ~30bps YoY due to a higher workers’ compensation loss ratio.

Hartford Financial Services

Why is soft pricing in workers’ compensation a concern? For one, HIG derives almost half of its commercial lines premiums here – well above the workers’ comp contribution of its peers. There will also be a regulatory approval process to implement price hikes in the compensation line, so the road ahead is far from straightforward. Most importantly, though, until loss trends deteriorate (not anytime soon, given HIG’s vulnerable small-account customer base), increasing prices and protecting segment margins will be difficult.

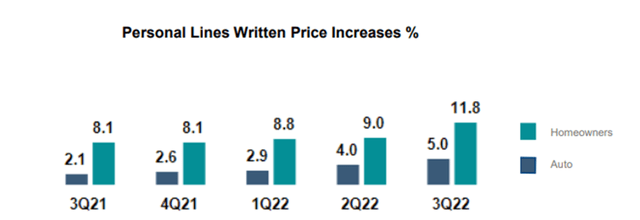

Volatility in Personal Lines but There are Silver Linings

While the personal lines business did report solid premium growth, the underlying loss ratio deteriorated ~4.4pts YoY to 68.8% on higher severity in homeowners and auto. Yet, the silver lining is that HIG successfully pushed through earned price increases this time around. To recap, pricing trends saw an uptick in homes at a renewal written price increase of +11.8% in Q3, while auto also saw a +5.0% increase. With written premium growth still going strong at +5% YoY, the highest level recorded since 2016, there is clearly pricing power to be tapped here.

Hartford Financial Services

Alongside automobile policy in force growth, HIG has a clear path to insulating margins in personal lines against pressures from inflation-driven auto severity (mainly due to elevated used car prices caused by the current demand/supply imbalance, as well as the resulting effects on replacement values and repair costs).

A Mixed Earnings Result but the Future is Bright

Looking through the near-term headwinds, HIG remains well-positioned to generate steady EPS growth over the mid to long term, helped by cost reduction-driven margin gains and share buybacks. While the Q3 result was mixed, the updated guidance of higher cost savings from Hartford Next bodes well for margins going forward. While speculators looking into HIG as a takeout candidate may be disappointed following CB’s acquisition of Cigna’s (CI) Asia business, I suspect an activist-driven price floor (a la Paulson back in 2012/2013) could emerge should results continue to miss targets. In the meantime, the discounted P/E multiple offers long-term investors an attractive entry point.

[ad_2]

Source link