[ad_1]

itchySan

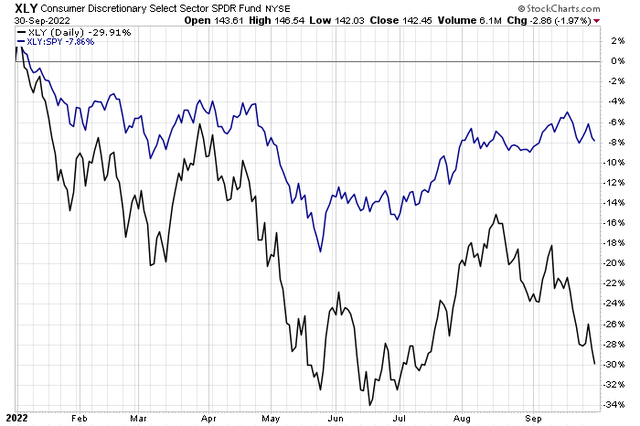

Amid a broad market selloff since mid-August, with the S&P 500 falling more than 17%, a risk-on sector like Consumer Discretionary would be expected to underperform. That has not been the case, however.

The Consumer Discretionary Select Sector SPDR ETF (XLY) bottomed against the SPX back in May and has rallied on a relative basis ever since. One small-cap consumer durables stock, though, has suffered mightily in that time and has a key earnings report this week.

Discretionary Trending Up vs SPX Since May

StockCharts

According to CFRA Research, Helen of Troy Limited (NASDAQ:HELE) provides various consumer products in the United States, Canada, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through three segments: Home & Outdoor, Health & Wellness, and Beauty. The stock is down more than 60% in 2022.

The Bermuda-based $2.3 billion market cap Household Durables industry company within the Consumer Discretionary sector trades at a below-market GAAP trailing 12-month price-to-earnings multiple of 12.3 and does not pay a dividend, according to The Wall Street Journal.

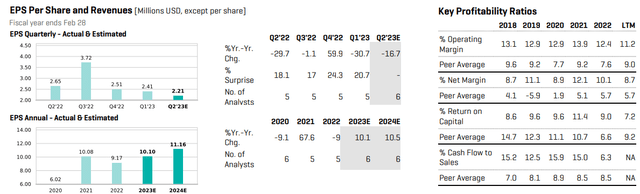

On earnings and valuation, HELE is expected to show profit growth this year and next year, but this coming quarter should verify as a negative year-on-year earnings period. With a somewhat low P/E ratio and a B forward P/E rating by Seeking Alpha, the fundamental backdrop does not look too bad, but growth and profitability readings do not suggest it’s a screaming buy.

Helen of Troy: Earnings Outlook & Profitability Ratios

CFRA Research

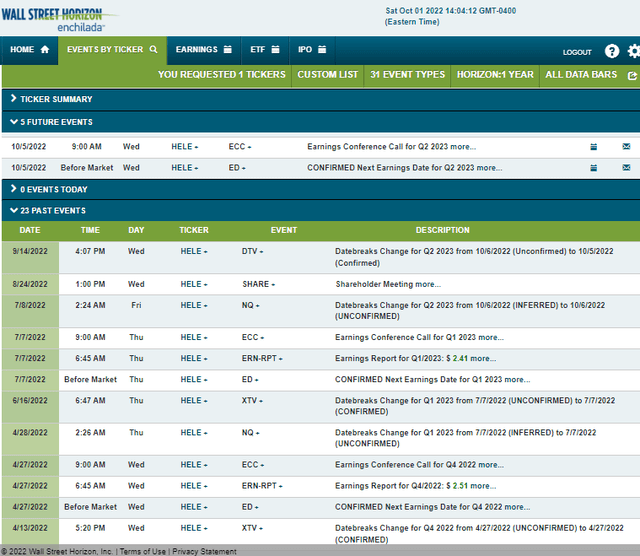

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed earnings date of Wednesday, Oct. 5 BMO with a conference call immediately after the results are released. You can listen live here. HELE’s corporate event calendar is light through the end of the year aside from the quarterly report.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

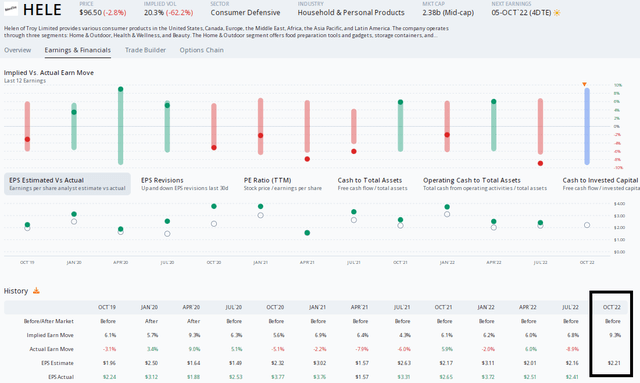

Digging into Helen of Troy’s Q2 earnings expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS estimate of $2.21 which would be a decline from $2.65 of per-share profits earned in the same quarter a year ago.

Meanwhile, traders expect a big stock price swing after Wednesday morning’s results hit the tape. The options market has priced in a high 9.3% earnings-related share price swing using the nearest-expiring at-the-money straddle. In fact, no other quarterly report has featured a wider implied move in the last three years, per ORATS figures (a 9.3% implied earnings move was also seen in April 2020).

Remarkably, the company has beaten the consensus EPS forecast in each quarter over the last three years, as well. Unfortunately, the stock price has a volatile history despite the beats. Shares have traded lower after six of the past eight reports. Given that, I’m cautious on the stock ahead of Wednesday morning and the options are not cheap.

HELE: An Expensive Straddle & EPS Drop Y/Y Forecast

ORATS

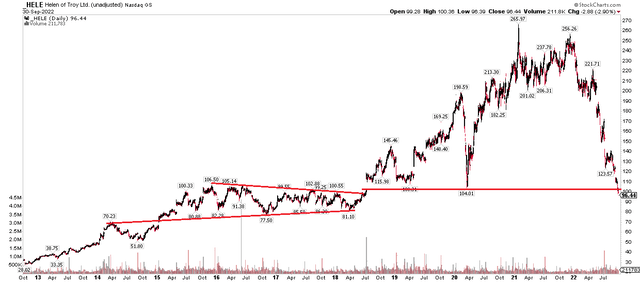

The Technical Take

While the options picture should make the bulls a bit nervous, the technical chart also illustrates a bearish canvas. The stock just recently broke down through support in the mid to high $100s and I see next support in the $80s.

Given such downside momentum, I see shares moving lower into the mid-$80s, but Helen of Troy should bring out the buyers there based on heavy congestion from 2015 through the middle part of 2018.

But what was once support becomes future resistance, so the $104 to $108 range could be problematic on an upside move. Another layer of resistance is seen just shy of $150.

HELE: Shares Break Support, Eye the mid-$80s

StockCharts

The Bottom Line

Options are pricey on HELE and the stock chart and valuation are not overly compelling for this cyclical retailer. There could be more downside room to come. Selling out of the money calls while being long higher-strike calls as a hedge (bear call credit spread) or simply waiting for a pullback in shares is the prudent move here. The technicals and valuation turn better about 10% lower on the stock price.

[ad_2]

Source link