[ad_1]

JLL expects the Metro Manila real estate market to see continued gradual market recovery, and sustained momentum in the third quarter, owing to increasing return-to-office by occupiers.

The second quarter of 2022 saw real estate momentum being carried by sustained positive market sentiment, according to real estate consultancy firm JLL Philippines.

Rising leasing volumes

In Metro Manila, office leasing volumes continue to climb, with a 21.2 percent increase compared to the previous quarter.

Demand in the second quarter of 2022 is diversified, meaning there are different sectors leasing spaces compared to the IT-BPM-driven first quarter. Non-IT-BPM services account for 45 percent of demand, while IT-BPM and Pogo players represent 42.7 percent and 12 percent, respectively.

Office move-outs and rightsizing are still ongoing. Office vacancies continue to stabilize, playing at 17.5 percent for the past four quarters, despite the market seeing 54,090 sqm in new supply in the second quarter. The gap between headline and transacted rates continues to narrow, closing in at 9 percent in the second quarter of 2022.

Retail, residential, hospitality

Move-ins are gradually outpacing move-outs in the retail industry. The food and beverage sector continue to lead both move-ins (22.1 percent) and move-outs (23.6 percent).

“The improving demand and the absence of supply saw vacancy ease,” said Janlo de los Reyes, head of Research and Strategic Consulting at JLL Philippines. “Rents are gradually climbing, and lease terms are returning to pre- pandemic arrangements.”

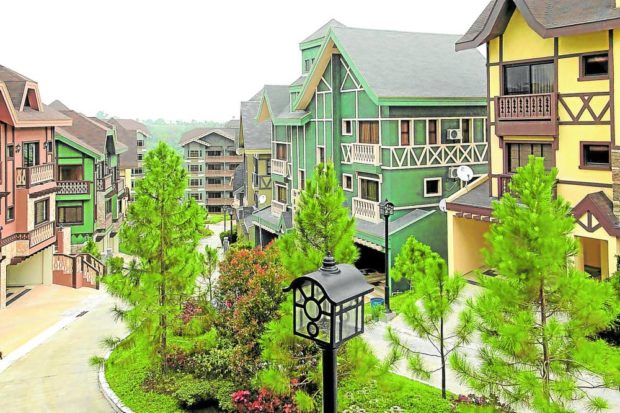

In the residential sector, return-to-office and soft rentals continue to drive leasing demand, as people are moving back from the province to stay in units near their workplaces. Residential sales continue to move sideways, while prices maintain growth uptick behind flexible terms.

Premium developments remain to be a good investment option.

In the hospitality sector, occupancy levels decline as demand slows down. It must be noted that select segments (luxury, economy and midscale) registered smaller occupancy decline. Room rates are picking up, but the average as of the second quarter of 2022 (P6,100 per room per night) is still far from pre-pandemic rates (P9,100 per room per night in 2019).

The luxury segment continues to lead room rates, averaging P15,390 per room per night in the last quarter, owing to the reopening of club rooms and exclusive access areas. Economy rates closed at an average of P2,280 per room per night.

Investing in logistics

Charlie McNaught, director for Logistics and Industrial at JLL, said that it is timely to invest in the logistics and industrial sector as the global allocation increased.

“The overwhelmingly strong demand from e-commerce, third party logistics (3PLs) and fast-moving consumer goods (FMCGs) is being met with a critical lack of modern logistics supply, suitable for the occupational needs of these occupiers,” he said.

He also touched on growing subsectors such as cold storage and urban logistics.

“Further to this, we are seeing demand from sub-sectors such as cold storage and urban logistics to supplement the backlog of requirements due to increased demand from grocery and next day delivery,” he added.

According to JLL it is timely to invest in the logistics and industrial sector as the global allocation increased.

McNaught further reiterated the benefits of investing in logistics and industrial as a sector: optimizing underutilized land assets, stable long-term income returns, strong occupation backdrop leading to rental growth, diversification and resilience in a non-certain market.

Outlook

JLL expects the Metro Manila real estate market to see continued gradual market recovery, and sustained momentum in the third quarter, owing to increasing return-to-office (RTO) by occupiers.

On the topic of RTO, De los Reyes cited JLL Work Dynamics’ six key workforce preferences. The latest edition of the JLL Workforce Preferences Barometer showed that (1) hybrid work has reached an optimal point; (2) the employers are now expected to support hybrid work in many different ways; (3) enabling hybrid work shows your people that you are a flexible and empathetic employer; (4) the long term success of hybrid work will rely on a holistic approach to performance and value creation; (5) companies have an opportunity to reinvent their EVP (employee value proposition); and (6) the responsible employer of the future will focus on taking care of the health of their people.

De los Reyes also presented highlights from the State of the Nation Address which may affect the real estate market, such as increased incentives outside Metro Manila; increased focus on infrastructure specifically on transport and railway; and digital business expansion, which is seen to affect data centers. Removing lockdowns is also cited as a key point, as it will encourage organizations to operate at business-as-usual (pre-pandemic) levels.

Read Next

Subscribe to INQUIRER PLUS to get access to The Philippine Daily Inquirer & other 70+ titles, share up to 5 gadgets, listen to the news, download as early as 4am & share articles on social media. Call 896 6000.

[ad_2]

Source link