[ad_1]

Synopsis

While the company’s financial performance has been robust and it has a healthy balance sheet, sustaining growth rates and profitability could be a challenge, given the uncertainties related to Covid-19 and higher capital expenditure likely in the next three to five years.

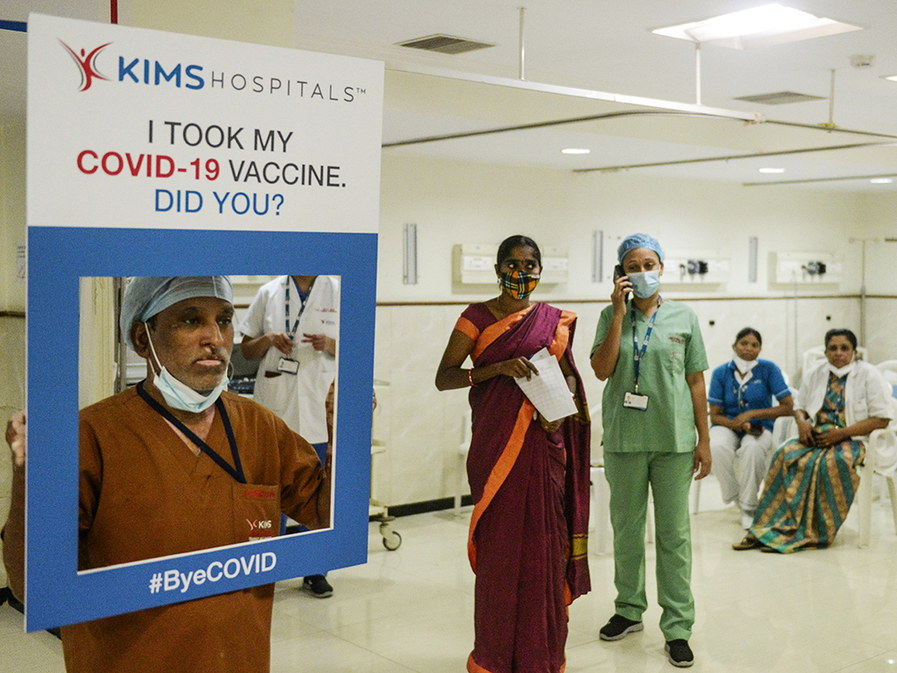

Thanks to the bull run in stock markets, 2021 has been an action-packed year for initial public offerings (IPOs). Last week, the INR2,144 crore IPO of Krishna Institute of Medical Sciences (KIMS Hospitals) was subscribed 3.9 times. The IPO of the Hyderabad-based company has come at a time when healthcare is in the forefront due to the Covid-19 pandemic and hospital stocks have surged in the last one year. Investors’ interest in pharmaceutical

- FONT SIZE

AbcSmall

AbcMedium

AbcLarge

Sign in to read the full article

You’ve got this Prime Story as a Free Gift

₹399/month

Monthly

PLAN

Billed Amount ₹399

₹208/month

(Save 49%)

Yearly

PLAN

Billed Amount ₹2,499

15

Days Trial

+Includes DocuBay and TimesPrime Membership.

₹150/month

(Save 63%)

2-Year

PLAN

Billed Amount ₹3,599

15

Days Trial

+Includes DocuBay and TimesPrime Membership.

Already a Member? Sign In now

Why ?

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Clean experience with

Minimal AdsComment & Engage with ET Prime community Exclusive invites to Virtual Events with Industry Leaders A trusted team of Journalists & Analysts who can best filter signal from noise

[ad_2]

Source link