[ad_1]

An increasingly small percentage of oil and natural gas wells is supplying the majority of U.S. production, according to a new report from the Energy Information Administration (EIA) based on Enverus data.

The trend is because of the proliferation of horizontal wells combined with hydraulic fracturing in the Lower 48, researchers said.

“Oil and natural gas wells drilled horizontally through hydrocarbon-bearing formations are among the most productive wells in the United States,” researchers said.

They added, “Horizontal drilling and hydraulic fracturing have greatly increased both oil and natural gas production rates of onshore wells in the United States.”

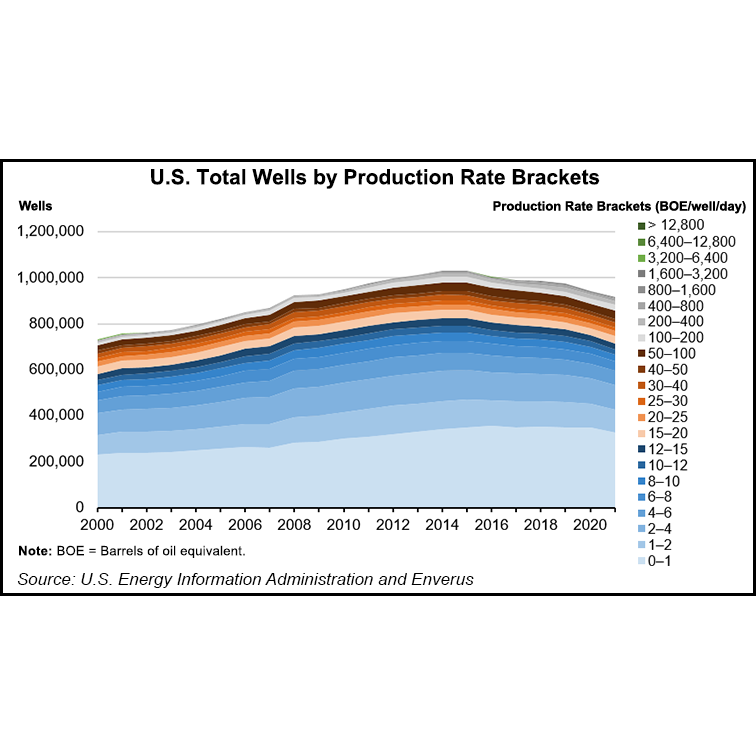

The total number of producing wells in the United States declined by about 11.1% from a peak of more than 1,031,183 wells in 2014 to about 916,934 wells in 2021, EIA researchers said.

U.S. oil production rose by 28% over the same span to average 11.25 million b/d in 2021, versus 8.79 million b/d in 2014.

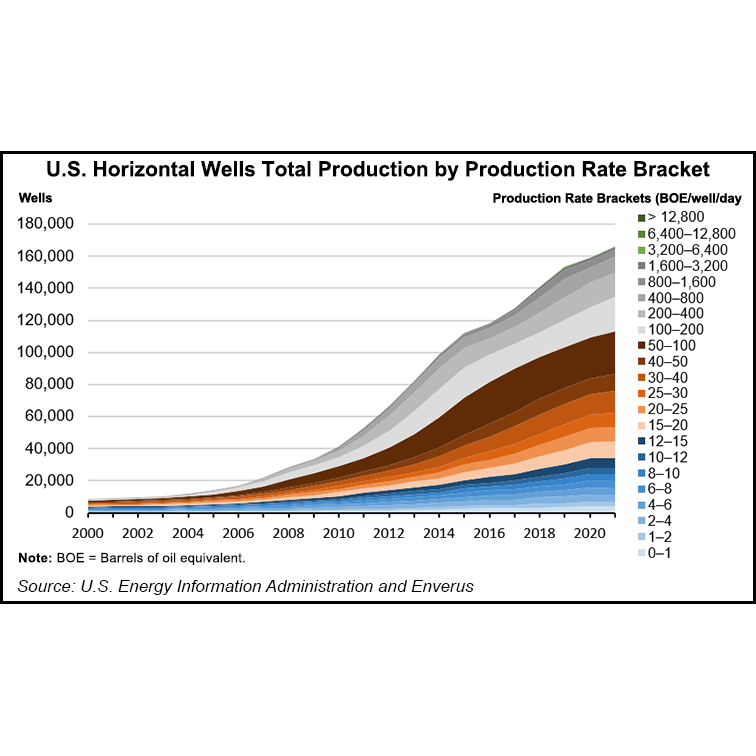

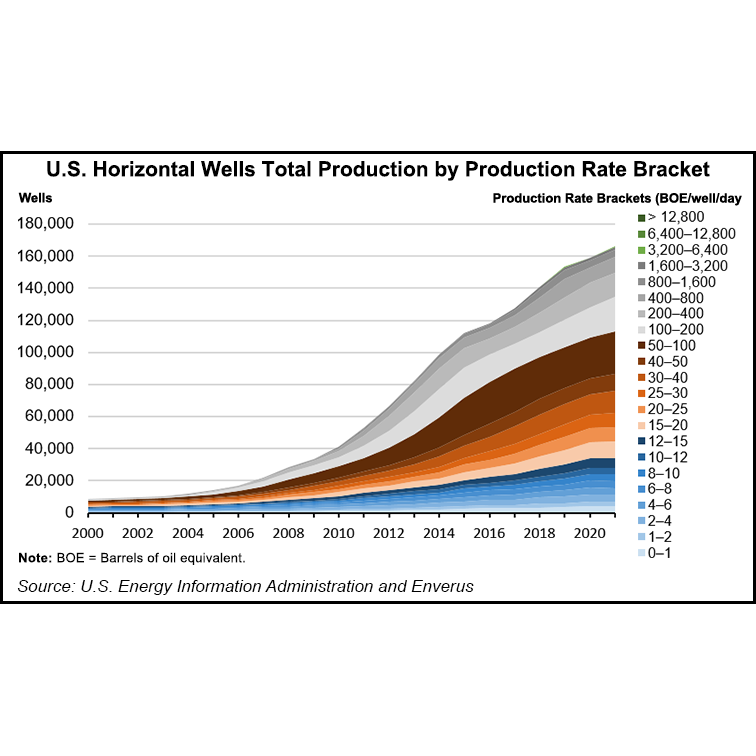

The total number of horizontally drilled wells grew by 67.9%, from just under 99,000 wells in 2014 to about 166,160 wells in 2021, the EIA team added.

Horizontal wells’ share of the overall well count stood at 18.1% as of 2021, up from 5.4% in 2011.

According to EIA, 77.9% of U.S. wells produced less than 15 boe/d in 2021, while only 6.4% of wells produced more than 100 boe/d.

However, wells producing 100 boe/d or more supplied 75% of oil production and 74% of natural gas production in 2021. By comparison, in 2011, the 100 boe/d or more well category supplied 57% and 55% of oil and natural gas production, respectively.

Horizontal wells accounted for 89.5% of the wells that produced 100 boe/d or more in 2021, up from 52.7% in 2011.

The EIA team noted that marginal wells nearing the end of their economically useful lives, aka stripper wells, produced about 7% of total U.S. oil and natural gas in 2021. The Internal Revenue Service defines a stripper well as one that produces 15 b/d or less of oil, or 90,000 cubic feet/d or less of natural gas, over a calendar year.

Stripper wells supplied 16% of oil and 14% of natural gas output in 2011.

Will Horizontal Wells Become More Productive?

Horizontal wells are not without their challenges, however.

“The decline rates of hydraulically fractured horizontal wells within shale or tight formations are typically greater than for wells drilled vertically into conventional reservoirs,” the EIA team said.

In addition, the depletion of top-tier inventory is likely to make it harder for operators to improve well productivity, according to Enverus vice president Steve Diederichs.

“We don’t expect per-foot recoveries to improve as inventory in the best rock quality of most plays is beginning to deplete, and more and more activity pivots to secondary parts of plays both from a geographic view and stratigraphic view,” Diederichs told NGI. “Said another way, operators are drilling primary intervals in lower quality regions” and increasing the rate at which secondary intervals are drilled on a percentage basis.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

He added that, “Longer laterals will help productivity on a per-well basis, but the rate of lengthening has slowed in many cases as basin averages reach about two miles.”

For example, the average lateral length in the Permian Basin’s Delaware sub-basin is up only 1% year/year to an average of 8,934 feet, Diederichs explained. The Bakken Shale is up 2% to 10,143 feet, the Permian Midland is up 5% to 10,789 feet and the Marcellus Shale is actually down 3% to 10,510 feet.

He said that Enverus expects well productivity on a per-foot basis to decline or stay flat at best over the coming years. He cited the lack of “any obvious technological improvement on the horizon like there was” from 2014 to 2021.

“Most technology improvements are now focusing on efficiencies, cost reduction and improving cycle times, like simul-frac, right-sized completions and improvements in spud-to-spud times,” Diederichs said.

[ad_2]

Source link