[ad_1]

Belgian software and 3D printing service provider Materialise (MTLS) managed to increase its revenue by 15% in Q2 2022 by carrying out a major shift in its target verticals.

As reported in its latest financials, the company generated revenue of €58 million Q2 2022, 15% more than the €50.7 million it brought in during Q2 2021 and a 20% rise on the €48 million it attracted in the pre-COVID period of Q2 2019.

On Materialise’s earnings call, its CEO Fried Vancraen explained how this jump was the result of a “significant change” in the focus of its manufacturing arm, to prioritize “promising 3D printing segments and verticals.” In fact, Vancraen said that shifting its focus away from automotive prototyping has allowed the firm to expand in industrial and medical, and it grew these projects by 25% in Q2 2022 alone.

“We have refused to grow low margin automotive prototyping projects in plastics,” Vancraen said on the call. “Instead, in the legacy automotive subcontracting, we have been focusing our efforts where we have a large competitive edge, for instance, on large stereo-lithography parts printed on our mammoth printers. As part of that same strategy, we are also focusing on the automotive sector, but exclusively on the metal side to bring metal parts turnover back to pre-COVID levels as quickly as possible.”

Materialise’s Q2 2022 financials

Materialise reports its financials across three main segments: Software, Medical and Manufacturing, with the latter traditionally being its highest earner. This continued to be the case in Q2 2022, with the division bringing in €26.6 million, 14% more than it did in Q2 2021 and an 8% increase on its Q2 2019 earnings. According to Vancraen, this growth was driven by its “core manufacturing business lines.”

Having seen “solid order intake,” the CEO added that things “look promising for revenue in the next few months.” However, Vancraen also explained that Materialise’s new growth business lines such as its eyewear and motion offerings are “experiencing fluctuating quarterly growth rates,” thus they’ll require more time to contribute significantly to the segment’s revenue.

Medical was the company’s fastest-growing division in Q2 2022, having brought in €21 million, a 19% rise on the €17.5 million it generated in Q2 2021. Due to convergence between Materialise’s Software and Medical offerings, the former accounted for 18% of the segment’s total revenue, and its sales in this area grew by 52% in Q2 2022, even with €2 million of these ultimately being deferred.

Software, meanwhile, was the firm’s lowest earner in Q2 2022, attracting €10.6 million in revenue, 6% more than it did in Q2 2021. This growth was primarily driven by a 12.7% rise in renewed licenses and deferred revenue, with non-recurring sales falling 9.5%. On the call, Materialise’s CFO Johan Albrecht said it’s now looking to turn “positive feedback” on its new CO-AM platform into “significant sales growth.”

| Revenue (€) | Q2 2021 | Q2 2022 | Difference (%) | Q2 2019 | Q2 2022 | Difference (%) |

| Software | 10m | 10.6m | +6.1 | 9.3m | 10.6m | +14 |

| Medical | 17.5m | 20.9m | +18.9 | 14.6m | 20.9m | +43.2 |

| Manufacturing | 23.3m | 26.6m | +14.2 | 24.6m | 26.6m | +8.1 |

| Total | 50.7m | 58m | +14.5 | 48.4m | 58m | +19.8 |

Materialise’s vertical realignment

Although Materialise moved away from polymer 3D printing in the automotive sector during Q2 2022, it did so while seeking out new opportunities with the ACTech manufacturing business it acquired in 2017. Before COVID, the Germany-based firm focused on developing new internal combustion engines for cars, but it has since shifted to complex casted parts for electric vehicle (EV) drivetrains and chassis.

The ACTech factory has also increased the size of the components it’s able to handle with sand 3D printing. As a result, Vancraen told analysts on Materialise’s earnings call that it expects to be able to access “new market opportunities” in agricultural, mining, construction and marine vehicles, in addition to the creation of heavy duty EV engine parts.

In order to take full advantage of these opportunities, the company is now planning to build another 9,000 sq. meter facility near ACTech’s existing factory. The site, which comes as part of a wider €23 million investment in capacity, is set to improve its sand printing, mold assembly and casting capabilities, while facilitating Materialise’s drive towards high-value sustainability-focused verticals.

Manufacturing aside, Materialise expanded its Software offering during Q2 2022 as well. In May, the firm launched CO-AM, a cloud-based program that grants access to a variety of software tools (including third-party ones) for planning, managing and optimizing the 3D printing workflow. At launch, the platform was marketed as having aerospace, automotive, medical and energy applications.

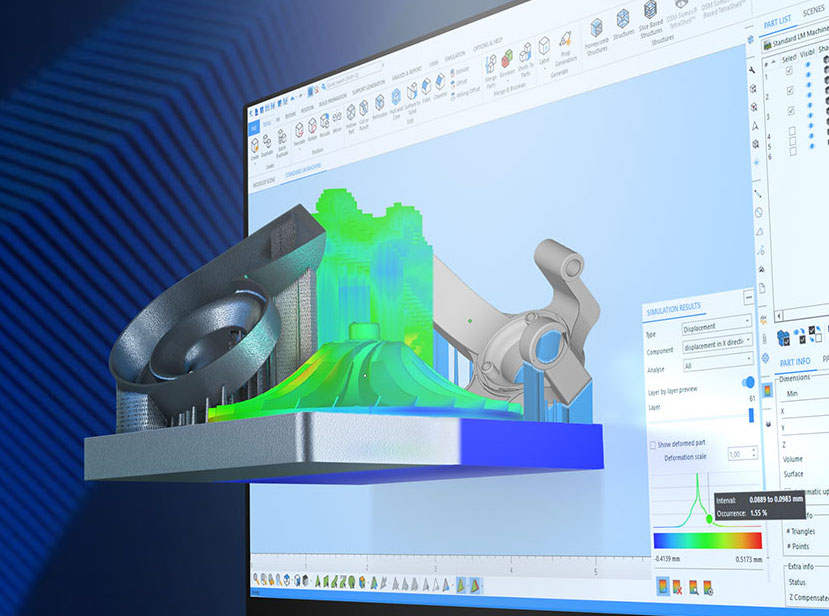

Likewise, the company launched its much-anticipated Magics 26 3D printing software during the period. Showcased at Rapid+TCT, the latest version of the program now includes native CAD-based workflow support, enabling users to modify and iterate on CAD files directly in Magics. The feature has the potential to make the program more attractive to those that regularly switch between design and build preparation, as it should help reduce their time spent redesigning parts.

Continuing to invest in future growth

Having achieved a net profit of €900,000 during Q2 2022, Materialise finished the period in a healthy cash position, with cash and equivalents of €168 million. Despite this figure being 14% less than the €196 million it reported after FY 2021, and ongoing macroeconomic issues, the firm’s Executive Chairman Peter Leys wrapped up its earnings call by reiterating that it plans to continue investing in growth.

“At the beginning of the year we announced that we intended to accelerate our investments in particular in our CO-AM platform,” concluded Leys. “Since then, global inflation and the effects of the war on talent have become higher and more persistent than initially expected. Despite these worsening macroeconomic circumstances, we currently intend to continue to execute on our growth plans, even if these efforts will weigh more on our bottom line this year than we had initially anticipated.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Materialise’s Metal Competence Center in Bremen, Germany. Photo via Materialise.

[ad_2]

Source link