[ad_1]

Junko Kimura/Getty Images News

Japan is one of the largest and most developed economies in the world. And, its flagship Nikkei Index has 225 different companies in it. There’s no shortage of quality firms in Japan. In other words, there’s more to pick from than just Nintendo (OTCPK:NTDOY) or Sony (SONY) if you want to invest in Japan.

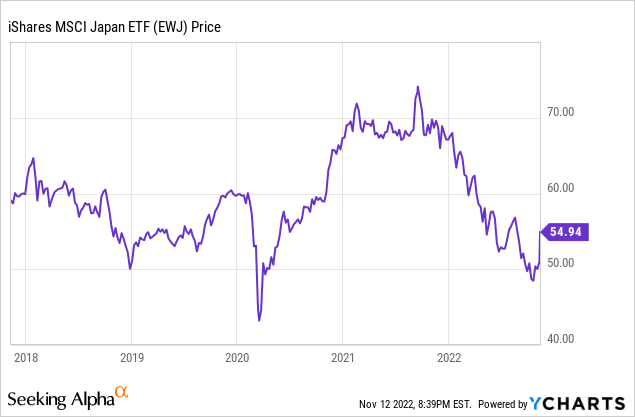

And now is an opportune time to be looking around in Japan. The Nikkei has been rangebound in recent years. Then in 2022, the value of the Japanese Yen has plummeted in comparison to the U.S. Dollar. As a result, the iShares MSCI Japan ETF (EWJ) had fallen back to near five-year lows before last week’s rally:

While the Japan ETF is a fine way to get exposure to Japan, it’s also an interesting time to kick the tires on individual companies. I’ve looked through many companies in the Nikkei Index and selected a couple for my portfolio. I’d already been buying cosmetics company Shiseido (OTCPK:SSDOY) and now I’m adding a second name to my Japanese holdings.

Most of you probably haven’t heard of Murata Manufacturing (OTCPK:MRAAY) (Tokyo-6981). If you have, however, there’s a good chance it’s because of the Murata Boy robot pictured above.

The Murata Boy debuted in 2005, and is a robot that can ride a bicycle. It included the following features:

- gyro sensors (for stability and redressing)

- a shock sensor (for impact detection)

- an angular velocity sensor

- a temperature monitor

- a CCD camera

- an ultrasonic sensor (for obstacle detection)

- an infrared sensor (for detecting human movement)

- an EMI filter (to reduce electronic interference)

- Wi-Fi and energy-efficient close-distance Bluetooth modules (for interaction)

These additional features were also manufactured with Murata electronics to highlight the range of the company’s capabilities.

In 2008, the company released the Murata Girl robot, which is similar in function, except this time it rode a unicycle. Both were capable of features such as climbing up hills and riding along tightropes, showing off the functionality of Murata’s various electronic sensors, filters, etc.

Robot bicycles are unlikely to ever be a significant commercial market opportunity. However, it serves as a good entry point to understanding what Murata, the company, is all about.

Murata was founded in 1944 by inventor and engineer Akira Murata as his personal operations venture. Akira would go on to lead the company as CEO, incredibly enough, until 1991. Another Murata family member continues to carry out CEO duties to this day.

Murata carries out a mind-bogglingly extensive line of operations including but not limited to:

- Multilayer ceramic capacitors

- Connectors

- Isolators

- Power Supplies

- Batteries

- Bluetooth modules

- Piezoelectric sensors

- Ceramic filters

- SAW filters

Of these, multilayer ceramic capacitors “MLCCs” are the most important line of business. MLCCs are used in countless electronics applications. Indeed, the world uses more than 2.5 trillion MLCCs each and every year. Murata alone manufactures more than 100 billion of them per month.

The primary markets for these are in smartphones, computers, audiovisual purposes, appliances, and automobiles. Smartphones have been a highly competitive industry, with major players such as Apple (AAPL) driving down margins considerably due to its massive scale.

Additionally, the amount of electronic gear needed in a smartphone is relatively small. While the amount of phones sold globally has been massive, it actually hasn’t led to that much sales growth for the four MLCC leaders (of which Murata is far and away the #1).

To that point, a Credit Suisse report found that automobiles are consuming 10x as much MLCC material (on an average selling price basis) as smartphones. And the amount of MLCCs going into cars keeps increasing at a rapid rate as more and more of the car goes digital. Electric cars require a great deal of electronic materials that internal combustion engine ones didn’t. Similar needs happen for having a car that is always connected to the internet, or ones which can drive autonomously and need a wide array of sensors, monitors, and other gear to conduct themselves safely.

The pandemic showed this reliance on electronic equipment in automobiles. The auto industry was indeed one of the most hard-hit of any by the various supply chain shortages as producers couldn’t get enough electronic equipment and semiconductor chips to put into their cars and trucks.

Long story short, industry estimates suggest there will be more than 5 trillion MLCC’s needed every year within the next few years, again doubling the size of the industry from where it is today. And Murata has more than 50% market share in the higher-end part of the MLCC market. This is before getting to anything else the company does in other electronics.

The rest of the bull case is simple and short. Murata has a competitive edge since it’s the biggest player in its niche and has both a cost and R&D advantage over peers.

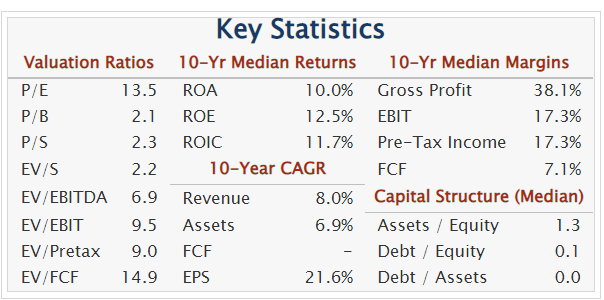

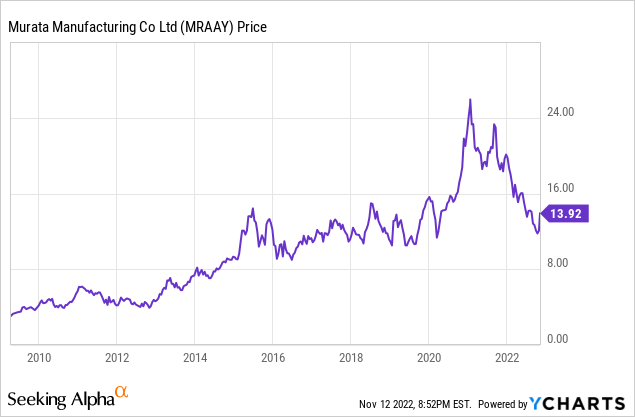

Meanwhile, the stock is tantalizing cheap after this year’s blitz of selling in all things tech along with the decline in Japanese assets in particular:

Murata Valuation Stats (QuickFS)

That’s right folks, we’re at 13.5x earnings and 7x EV/EBITDA for a company that has grown earnings at a double-digit compounded clip and earns respectable profit margins. Free cash flow is down this year, but Murata is at roughly 11x EV/Normalized FCF now as well.

I know anything related to the tech industry, smartphones and automobiles is out of favor at the moment, but the valuation is quite compelling for a large mission-essential tech player. You simply can’t manufacture a good deal of modern electronics without MLCCs and other Murata products.

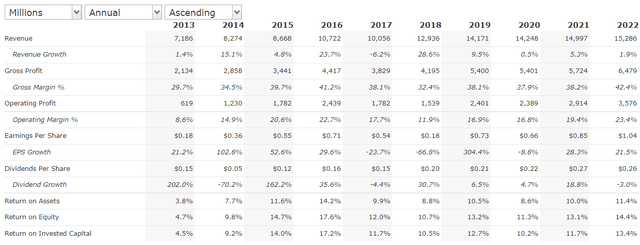

As financial stats may be harder to find for Japanese companies, I’ve reproduced its 10-year results (in dollars) below:

Murata 10-year results (QuickFS)

As you can see, the business has enjoyed considerable success. Revenues have more than doubled over the past decade. Meanwhile, gross margin is up from 30% to 42% as the company has focused on producing higher-value components while exiting some commodity businesses.

Another selling point for Murata is its impeccable balance sheet. The company has almost no debt outstanding and indeed holds a roughly $3 billion net cash position. This gives Murata ample room to make acquisitions, buy back stock, build new manufacturing capacity, or do whatever else management may deem necessary to grow and optimize the business.

The company is not primarily an income play, however it has doubled its dividend over the past decade and shares yield almost 2% thanks to the recent decline in the stock price.

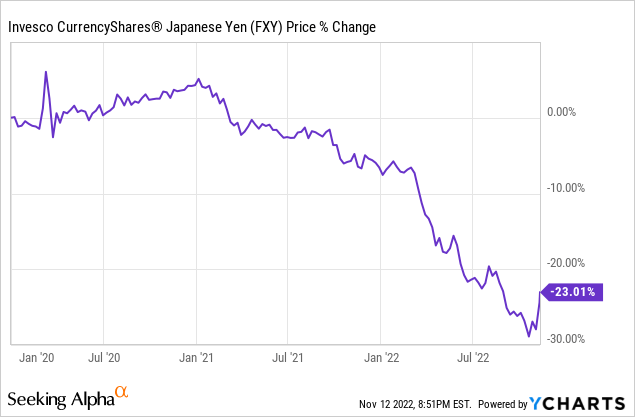

Don’t forget that as it operates in Japan, Murata is getting a tailwind from the weaker yen. Indeed, management has forecast that profits will be up despite input price and inflation pressures primarily because the Yen has slumped so far. For those of us buying with dollars, shares are more than 20% cheaper thanks to the sharp and sudden decline in the yen since the start of 2021.

The world needs more electronic components to make all sorts of things going forward, particularly more advanced models of cars. Murata is exceptionally good at this role and has massive market share in the high-margin part of its niche. The business has grown at a solid rate on the top line and a tremendous one in terms of earnings and cash flow. This shouldn’t trade at 13x earnings for too long.

Meanwhile, with the twin factors of tech industry worries and the falling yen, MRAAY stock (in dollars) is back to where it was trading around five years ago. As you can see, the stock had been a steady winner, rising from $4 coming out of the 2008 financial crisis to a peak of $25 last year. Now, with shares nearly half off, this is a great time to pick up this electronics play with a long-term tailwind from electric cars at a discounted price.

[ad_2]

Source link