[ad_1]

The UK jeopardises future North Sea oil and gas production and the country’s reliance on carbon intensive overseas vendors if the windfall tax is toughened up tomorrow, argued an investment analyst group.

Investec predicts that expanding and raising the Energy Profits Levy will have damaging “medium term consequences” such as a more rapid decline in North Sea production, accelerated decommissioning in existing projects and a greater dependence on higher emission imports.

It could also have”implications for the wider supply chain” with around 120,000 jobs linked to the North Sea across multiple sectors of the economy including transport, infrastructure and manufacturing.

The investment group expects a 25-75 per cent drop in the value of exploration projects over the duration of the tax, and has reduced its recommendation on Harbour, the largest UK North Sea producer.

It has now dropped its recommendation from buy to hold, reflecting higher uncertainty around the development of the continental shelf.

This follows equally gloomy forecasting from investment group Stifel, which warned last week that the UK risks no new investment in the North Sea oil and gas sector if taxes are hiked.

The Government has been approached for comment.

Windfall tax set to be hiked at fiscal statement

Investec’s research is predicated on the windfall tax being hiked from 25 to 35 per cent – in line with media expectations – and extended from 2025 to 2028 at the fiscal statement tomorrow.

This would mean the overall tax take from the North Sea would increase from its special 40 per cent corporation tax rate to 75 per cent for the full year.

The Government is scrambling to shore up the nation’s finances, and hopes to raise a further £13bn from bolstering the windfall tax to plug a £50bn fiscal black hole following pandemic spending, roaring inflation and the market reaction to the mini-budget unveiled under the previous administration.

It is also under intense political pressure amid an escalating cost of living crisis, with a deep potentially two-year recession looming and households grappling with record energy bills.

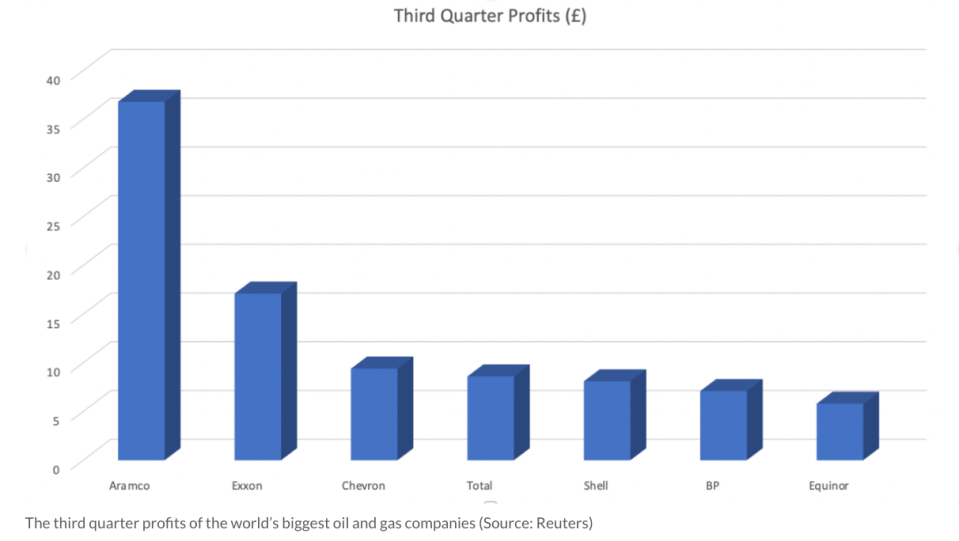

North Sea oil and gas firms including energy giants BP and Shell have been basking in record quarterly profits fuelled by soaring oil and gas prices following Russia’s invasion of Ukraine and a supply squeeze on Europe.

Investec predicts the tax will result in “lower investment levels” and a greater reliance on overseas imports, with the UK already importing over half its gas needs via Norway and increasingly Qatari and US liquefied natural gas.

This follows industry body Offshore Energies UK previously warning that, without further investment, the UK risks relying on overseas partners for 70 per cent of its oil and 80 per cent of its gas needs by the end of the decade.

As well as being a potential supply security issue, LNG is around seven to eight times more emissions intensive than the North Sea domestic gas production, making it more challenging for the UK to meet its net zero goals and to include the energy source in hydrogen projects.

Industry urges to keep investment relief

City AM. revealed earlier this month energy firms have been pushing the Government to extend investment relief alongside any expansion of the windfall tax, however it is still unclear whether this will happen.

Industry operators have argued expanding the investment relief is crucial for maintaining investment in the UK, with Downing Street pushing for North Sea oil gas exploration and development as part of its energy security strategy.

The Government is being pushed to scrap investment relief entirely, both from Labour which has also called for the windfall tax to be backdated to January 2022, and from environmental think tanks such as Green Alliance.

It has called for the Government to increase the windfall tax rate to 78 per cent, estimating this would raise £33.3bn by 2027.

Dustin Benton, policy director at Green Alliance, told City A.M.: “Oil and gas companies have been making eye watering profits all year and there’s every reason to think that will continue over the next few years. The chancellor should raise the Energy Profit Levy at least in line with Norway’s. It’s just next door and their industry has received plenty of investment, there’s no reason why British taxpayers should be losing out”.

Meanwhile, industry body Offshore Energies UK published its latest report on the potential exploration potential for oil and gas reserves.

It calculates the UK still contains oil and gas reserves equivalent to 15bn barrels, enough to help meet consumption needs for for 30 years – echoing the findings in its economic report earlier this year.

Mark Wilson, OEUK’s operations director said: “ The UK Continental Shelf is a mature basin, with North Sea oil and gas production peaking in 2000 so careful management of the remaining resources is vital to avoid rapidly increasing reliance on imports.

“Supporting this industry and its exploration activities is essential to the UK delivering a homegrown transition to cleaner energies, retaining the benefits in taxes paid, jobs supported, and our wider economic contribution.”

Irrespective of the windfall tax, the Climate Change Committee and North Sea Transition Authority do expect the UK to become a net importer of oil and gas over time.

Adam Bell, head of policy at Stonehaven, told City A.M. this was an inevitability that could not be pegged back by further North Sea oil and gas development.

He said: “Certainly there are fields like Cambo currently not being exploited, but there’s no world in which the UK stops being a net importer of oil and gas.”

This is a key challenge for the UK as it scrambles to secure a long term LNG deal with US and to bolster both renewables and nuclear power generation.

The CCC currently predicts half of the UK’s energy requirements between now and 2050 will still be met by oil and gas, and as much as 64 per cent of UK energy needs between 2022 and 2037.

[ad_2]

Source link