[ad_1]

Ninoon

When we last covered NorthWest Healthcare Properties Real Estate Investment Trust (OTC:NWHUF), (TSX:NWH.UN:CA), we gave it a tentative bullish rating while highlighting the risks that were present as well. Specifically, we said,

We have a bullish view here based on the reasons above but risks continue to be high as well. For one, NorthWest might go and buy someone else, perhaps a US focused medical office REIT at a 30% premium. Alternatively, it might just sit on its hands and let the moment pass. While hospitals remain immune, we think medical office space may face increased competition from repurposed regular office space.

Source: A Sale Might Unlock value

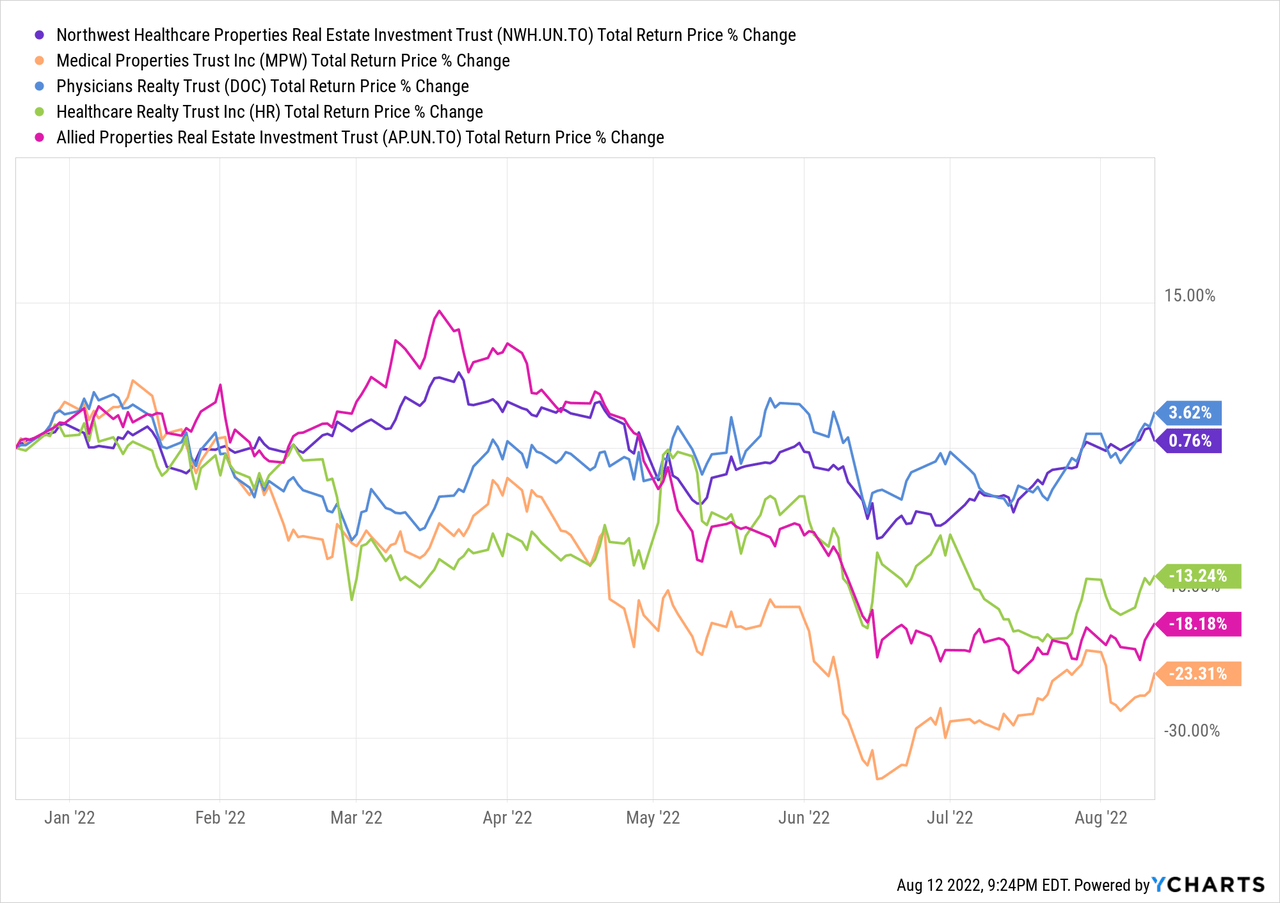

What has NWHUF done since then? Well, the total return is just a shade above zero, but investors won’t be too upset about that. In its peer group, and we are using a broad brush here, only Physicians Realty Trust (DOC) did better.

Medical Properties Trust (MPW) got totally clobbered and Healthcare Realty Trust (HR) is clawing its way back from moderate losses. Allied Properties Real Estate Investment Trust (APYRF), (AP.UN:CA) arguably the least like NWHUF, delivered negative 18% returns. At this point, we would like to see if NWHUF still deserves a buy, or are there better prospects in the peer group.

Q2-2022

Q2-2022 was marked by strong (3.6%) same property net operating income or NOI growth as the REIT benefitted annual rent changes. The portfolio occupancy at 97%, and addition of new properties and renewals kept weighted average lease expiry at 14.1 years. That starting description had nothing that investors would dislike. After all, who won’t want stability in such a tumultuous market.

NWHUF also stressed that its strategy was working, and its management platform was delivering the results that were promised.

In-place capital commitments and deployed fee bearing capital total $10.8 billion and $5.6 billion, respectively. The REIT’s funds management business continues to rapidly scale up and on completion of the UK and US joint ventures is expected to have deployed and committed capital of $14.1 billion and $7.3 billion, respectively. At a target ownership level of between 20% – 30% across its capital platforms the REIT anticipates generating market leading growth in both adjusted funds from operations (AFFO) and NAV on a per unit basis as a result of leveraging its capital light model and internally generated capital to fund growth.

Source: Q2-2022 Financials

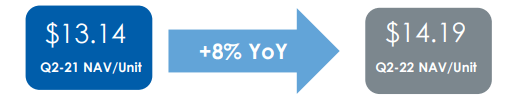

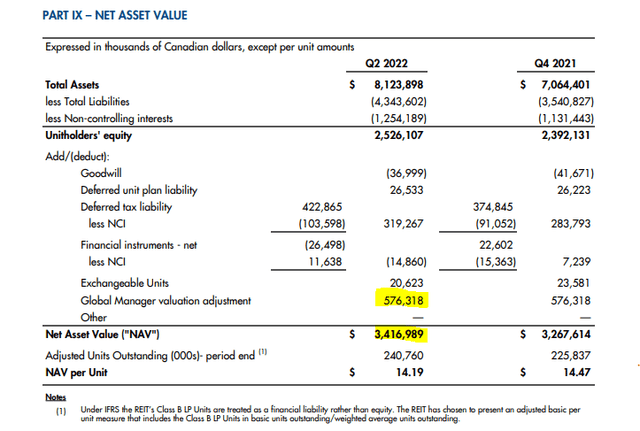

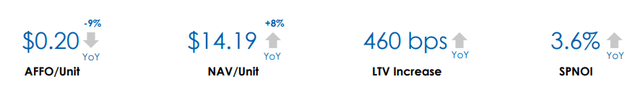

The NAV portion was validated by the year-over-year changes as well.

NWHUF Q2-2022 Presentation

All in all, it looked like a splendid quarter.

Why We Did Not Like It

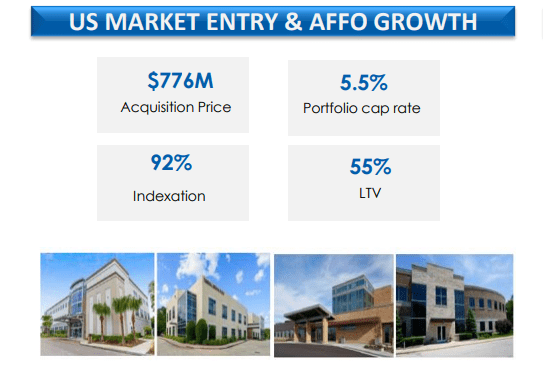

In our previous article, we had joked that NWHUF was aiming to buy every last piece of healthcare property that existed, and they were not interested in destroying that meme. They bought about $1.0 billion (in Canadian dollars) soon after that.

NWHUF Q2-2022 Presentation

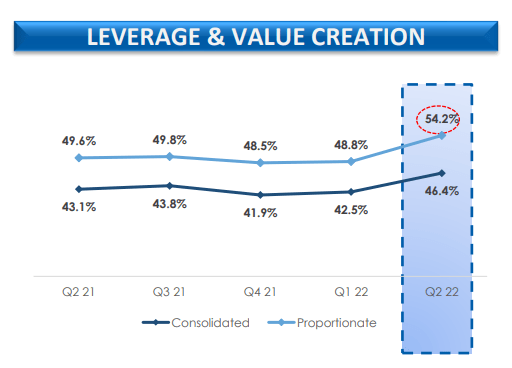

Oh yes, that AFFO growth was mentioned with that slide, just like with the management platform expansion comment. To get there, we saw a good expansion of leverage.

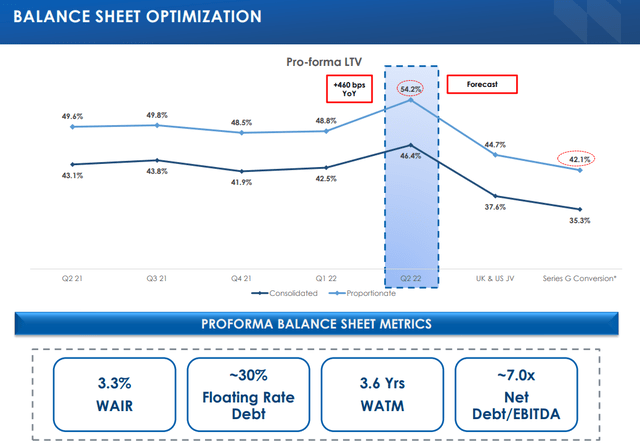

NWHUF Q2-2022 Presentation

To be fair, they did mention that they would once again work at bringing this back in line.

NWHUF Q2-2022 Presentation

We think that plan is feasible, but we are still not thrilled that NWHUF is going this route. We have three major issues here.

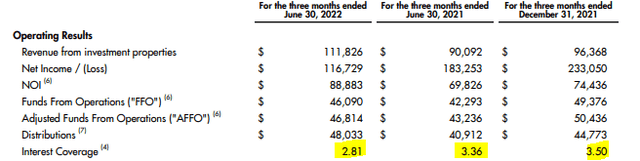

The first is that the weighted average debt term is 3.6 years. This was driven lower by the recent acquisition financed with a 1-year debt term. This is incredibly risk gamble, but the idea is that the JV will allow most of this to be paid back. The best laid plans get damaged by economic cycles, and we seriously doubt that management had envisioned these aggressive moves by central banks across the border late last year. Inability to offload those into a JV with far higher refinancing rates will crimp NWHUF in 2023. Interest coverage is now under 3.0x and bears watching.

NWHUF Q2-2022 Presentation

The second aspect here is that management puts a value on its management platform and gets it into the NAV calculation.

NWHUF Q2-2022 Financials

While those revenues and cash flows have value, we don’t remotely put them in the same category as the collateral hard assets provide.

The final aspect here is that despite claims of a nice NAV bump, we are now back to 20 cents in quarterly AFFO. A stunning 9% drop in AFFO per share looks totally out of place with the other 3 numbers there, as all 3 should be bumping AFFO up.

NWHUF Q2-2022 Presentation

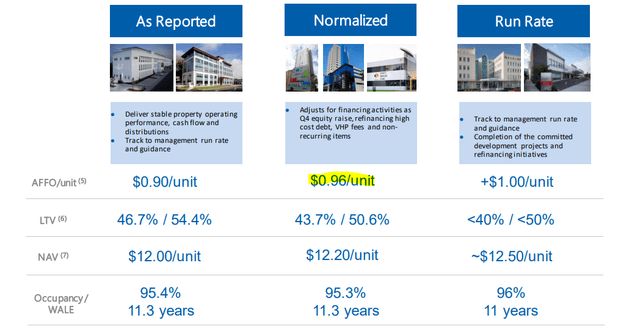

But here we are with yet another quarter and AFFO at 20 cents, aiming for 80 cents for the year. In 2017 with about half the assets and less leverage, before anything remotely resembling the management platform came about, NWHUF did 96 cents and promised $1.00 in AFFO soon.

NWHUF 2017 Presentation

5 years of brazen growth in assets and tons of secondary offerings later, we will now likely have a plus 100% payout ratio.

Verdict

Yes, the assets are good, so there are really no immediate risks to the dividend. The properties are very beautiful (we have visited a few) and it is easy to fall in love with the concept. But the risks are increasing, and this empire building has squashed returns versus where they could have been. Asset buying has costs and AFFO does not even capture that. Multiple equity issuances below NAV, also have costs. That is why we are sitting at $0.80 in AFFO versus a possible $1.20. We are not even fond of the AFFO quality today, as we view management fee AFFO as of lower value than property NOI derived AFFO. Overall, we have little faith in this strategy, but it is one that might not blow things up for a while. We also think they could sell this for a small premium even today. All of this gets us to a “hold”.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints

[ad_2]

Source link