[ad_1]

The global oil and gas industry has recouped some losses incurred during the pandemic lockdowns, but there is still a way to go to ensure the profitability of the sector overall, according to NOV Inc. CEO Clay Williams.

Williams led a conference call to discuss the Houston-based oilfield services giant’s second quarter results. As he does in every quarterly call, the CEO discussed how the emerging recovery is expected to play out. It’s a “constructive” scenario for the exploration and production (E&P) sector, and in turn, the oilfield services (OFS) operators, he told investors.

“The world is facing a significant energy shortfall, and the oil and gas industry needs to increase activity in order to provide greater energy security to the global economy,” Williams said.

[Trend Alert: Higher commodity prices seem to have spurred an uptick in oil & gas deals. Tune in to NGI’s Hub & Flow podcast to learn more about the health of the E&P market.]

“That urgent activity will need to come at a time when the industry’s tools – its rigs, drill pipes and pumps – have been idled, depleted, cannibalized and come out through a pandemic shutdown that has produced the most withering downturn the industry has ever been in.”

The E&P customers are “benefiting in real time from sharply higher oil and gas prices and the lack of exploration and development investment in the oilfield through the pandemic in the several years preceding,” said the CEO. “It has reduced the productive capacity of the industry. In fact, some argue that spare capacity may be approaching historic lows.”

Prosperity Trickling Down

The balance sheets of E&P customers overall have been healed by higher commodity prices, but the OFS sector “still has a ways to go,” Williams said. “Many still labor under low or no margin contracts signed during the duress of the pandemic lockdown. They continue to execute against rapidly rising costs due to inflation and materials and labor…Many still strain under high debt loads and lack access to external capital. It takes a while for prosperity to trickle down the oilfield food chain.”

However, “the trickle down is underway,” he said. “Month by month, the older, low margin contracts expire and are replaced with better price contracts.”

Contracting dayrates for some equipment “are squarely north of $30,000/day now…One major deepwater driller announced a drillship dayrate well north of $400,000/day this quarter. The overhang of equipment and capacity is diminishing admittedly at different rates across different categories, but directionally these are all going the right way.”

Idled equipment that was cannibalized now requires capital to reactivate, Williams noted. OFS operators are now demanding contractually guaranteed payback on these incremental investments in order to bring additional capacity to the marketplace. These are all the first steps that one would expect toward healing the balance sheets and business models of oilfield service companies, and the body of evidence of healing continues to grow.”

Improved Pricing, Execution

Williams said the second quarter results reflected improving execution, customer demand and better pricing.

“Diminished global oil and gas inventories and productive capacity,” along with “rising energy security risks and higher commodity prices, are spurring increased oilfield activity.” However, the “urgent need to rebuild oilfield service capabilities remains constrained by the limited availability of certain critical components, freight and logistics challenges, tightness in many labor markets, inflationary pressures and higher costs-of-capital for oilfield enterprises.”

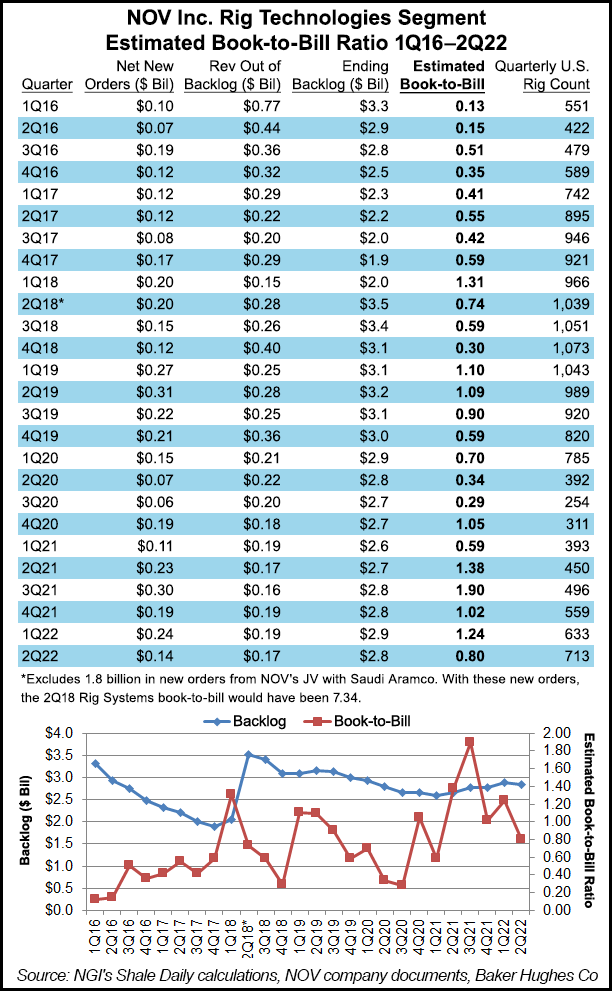

Still, NOV’s book-to-bill ratio during 2Q2022 “exceeded 100% for the fifth quarter in a row,” Williams said. Book-to-bill is the ratio of orders received to units shipped and billed.

The new orders are “a key indication that the industry is embracing its critical mission of restoring its capabilities to provide oil and gas supply to an energy-starved global economy. As the early phase of this upcycle advances, the people of NOV are diligently working to assist our vital industry…to alleviate challenges in meeting the world’s need for affordable, secure and clean energy supplies.”

In NOV’s Wellbore Technologies segment, revenue totaled $666 million, up 10% sequentially and 44% year/year. Operating profit was $81 million, or 12.2% of sales. Completion & Production Solutions (CPS) revenue climbed to $639 million, up 21% sequentially and 29% from 2Q2021.

“Growing demand for oil and gas equipment and improving execution against ongoing supply chain challenges and operational disruptions in shipyards drove improved results for the segment,” management noted.

New orders booked in CPS during the quarter totaled $530 million, representing a book-to-bill of 132% when compared to $401 million of orders shipped from backlog. Backlog for capital equipment orders was $1.44 billion at the end of June, up 6% from 1Q2022 and 44% from a year ago.

The Rig Technologies segment generated revenue of $462 million, which was 5% higher sequentially but down 5% year/year. Operating profit was $31 million, or 6.7% of sales.

“Growing demand for the segment’s aftermarket products and services as a result of increased global drilling activity levels, and the rising number of offshore wind power installation vessel projects, drove the sequential improvement in results,” management noted.

New orders booked totaled $140 million, representing a book-to-bill of 80% when compared to the $174 million of orders shipped from backlog. At the end of June, the backlog for capital equipment orders for Rig Technologies was $2.84 billion.

NOV’s profits in 2Q2022 increased to $69 million (18 cents/share), reversing year-ago losses of $26 million (minus 7 cents). Revenue rose to $1.7 billion from year-ago revenue of $1.4 billion.

[ad_2]

Source link