[ad_1]

bjdlzx

Thesis

The BMO MicroSectors U.S. Big Oil Index 3X Leveraged ETN (NYSEARCA:NRGU) is an exchange traded note that has an objective of giving an investor three times the daily performance of the Solactive MicroSectors U.S. Big Oil Index. Similarly, to other leveraged products, this vehicle caters to short-term horizon investors, not to buy and hold individuals.

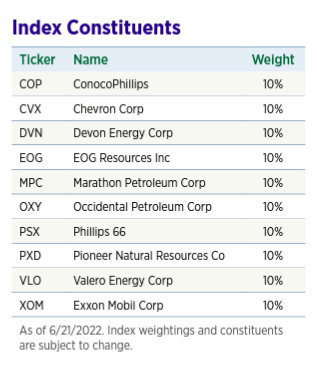

The fund provides leveraged exposure to an equal weight Oil & Gas equities index, namely the Solactive MicroSectors U.S. Big Oil Index. The difference between this index and say the Energy Select Sector SPDR Fund (XLE) is the fact that Solactive has an equal weight of roughly 10% on its components while XLE is overweight Exxon (XOM) and Chevron (CVX), which account for over 44% of the ETF. To that end for example, the recent announcement by Berkshire Hathaway (BRK.B) that it obtained permission to buy as much as 50% of Occidental Petroleum (OXY) only marginally affected XLE which only has a 4.42% weighting to OXY while the Solactive index and implicitly NRGU got a much bigger boost. Expect more of the same with an outperformance for the equal weight Solactive Index over XLE. We feel that in the energy space the balance sheet mend and longer-term performance is a two-horse race, where some of the better managed companies having already reached extremely robust valuations, while some of the laggards will catch up via performance as oil prices stay at elevated levels.

The portfolio is currently composed of the largest North American Oil & Gas majors, with both integrated operations as well as more specialized players. Note that no European Oil & Gas majors are present in this portfolio, meaning that the returns for the product have been insulated from the Ukraine/Russia conflict and the significant write-downs we have seen for the likes of Shell (SHEL) and BP (BP) on the back of their Russia business.

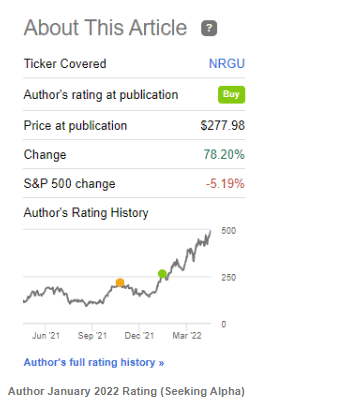

We have covered in our articles NRGU before, and have made some nice calls on the name:

Prior Rating (Author)

We feel we have seen a resurgence of investor interest in short term trading ideas as witnessed in the recent rally for meme stock Bed, Bath & Beyond (BBBY). We are of the opinion that sophisticated investors looking for quick trading ideas can also make a profit by trading fundamentally sound companies that generate substantial amounts of cash-flows and are leveraged up via vehicles such as NRGU. Below we outline our view on how to best trade NRGU now and potentially double an investor’s capital.

How to trade NRGU

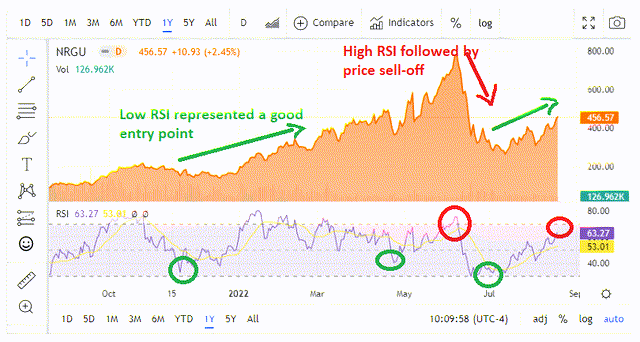

In our view the best way to trade NRGU is to form a macro take on the current market rally (we view it as a bear market rally which is ending) and use technical analysis to trade this leveraged vehicle. We can see that in 2022 an investor following momentum trading and respecting RSI over-sold / over-bought signals could have doubled their capital a number of times:

Technical Analysis (Seeking Alpha)

We can see from the above chart that an RSI below 40 this year was always followed by a significant rally and price gain. Conversely, selling when the RSI was close to the 70 band would have crystalized significant profits.

We are now in a set-up where the RSI is yet again approaching the upper 70 band. This is not an ideal entry point. Moreover, from a macro standpoint, we feel we are witnessing a bear market rally which is about to sputter.

The best way to trade NRGU now is to wait for a normalization of the RSI, with the indicator falling below 40 representing a buy signal. We are of the opinion that while fundamentally sound, energy companies are going to be caught up in the pessimism of the next wave down in this bear market and there is going to be a good entry point in NRGU in the upcoming month.

Performance

Firstly, let us reiterate that this vehicle is NOT for buy-and-hold investors and let us have a look at how destructive 3-times leverage can be in an adverse scenario:

3Y Return (Seeking Alpha)

We can see above the benchmarked performance of NRGU versus the Energy Sector ETF since 2019. We can see how XLE suffered a tremendous drawdown of -65% during the Covid crisis, while NRGU had a -95% loss. An investor in the leveraged vehicle would have been nearly wiped out.

That being said a savvy investor can also double their capital during very short periods of time:

YTD Return (Seeking Alpha)

We can see from the year-to-date price return chart that there have been several opportunities to double or even triple the existing capital via NRGU.

When compared to XLE, NRGU outperforms:

YTD Return (Seeking Alpha)

We can see from the above table that the year-to-date performance is higher than simply 3x the XLE performance and that is due to the composition as we outlined above (in fact in 2022 NRGU’s performance is 4x XLE’s return). XLE is extremely overweight XOM and CVX and in our view an equal weight index is going to produce better results for the rest of the year.

Holdings

The fund mirrors the Solactive MicroSectors U.S. Big Oil Index which has the following composition:

Composition (fact sheet)

The portfolio is currently composed of the largest North American Oil & Gas majors, with both integrated operations as well as more specialized players.

Conclusion

NRGU is a leveraged ETN from BMO. The vehicle has proven to be on the right side of the energy trade this year, providing for a performance so far that is 4x the Energy Select Sector SPDR Fund return. NRGU outperformed due to its equal weight composition versus the energy ETF which is now extremely overweight XOM and CVX. To that end for example, the recent announcement by Berkshire Hathaway that it obtained permission to buy as much as 50% of Occidental Petroleum only marginally affected XLE which only has a 4.42% weighting to OXY while the Solactive index and implicitly NRGU got a much bigger boost. The article outlines our “house view” regarding how to trade NRGU, namely, to wait for a move in the RSI closer to a 40 level during the next leg down in this bear market.

[ad_2]

Source link