[ad_1]

bjdlzx

(Note: This article was in the newsletter November 12, 2022.)

The oil and gas industry has long caught a lot of unwanted attention because of perceived carbon emissions. Then came a major surprise short speech from the CEO of Occidental Petroleum (NYSE:OXY):

Vicki Hollub

And I would add that, my view is that the world cannot afford a climate transition without — by cutting out completely oil and gas production. Oil production is going to be needed from decades — for decades to come and using CO2 in enhanced oil recovery is a way to produce a net 0 emission oil. And to have that as the fuel source, it’s low cost, lower cost than other options, it would help with the transition, it would help to fund the transition. So I think that oil is needed for us, for our company, in particular, we have 2 billion barrels of resources available for further development in our enhanced oil recovery assets.

And we’d like to use either antibigenic or atmospheric CO2 for the — to develop those resources. In addition, we do know that we can technically use CO2 in the shale reservoir, so we can increase the 10% recovery that we have today to something much higher than that. So it’s — there is a use for CO2 in enhanced oil recovery. It’s not as well recognized yet. But when the world realizes how much the transition will cost, I do believe that this will become the preferred option to ensure that we can continue the production of low-carbon fuel for those that need it.

The first admission was probably one that the Green Revolution advocates never wanted to hear. Oil and gas production will play a key part in the green revolution whether or not they want it to happen. Natural gas in particular supplies the raw material ethane, which is used to make ethylene (which is a prime material used in plastic). There is a whole lot more that oil and gas supplies. This business about doing away with oil and gas in 10 years has zero basis in fact.

But the larger surprise was that the CEO talked about enhanced oil recovery (EOR). Occidental has one of the biggest and lowest cost EOR operations in the United States. Almost half of its Permian production is EOR and EOR can use carbon dioxide to recover oil after the usual upstream methods got the “easy oil”.

The result of this is Occidental has the potential to use a lot of carbon dioxide for EOR recovery in its rather sizable operations. Time will tell where it is economical for carbon dioxide to be used. Shale or unconventional is another part of the industry that is about to discover the uses of carbon dioxide. The industry catches a lot of flack for emissions. But it very seldom gets credit for the carbon dioxide that it uses in secondary recovery and the potential to use a whole lot more if that use was encouraged.

Carbon Dioxide Business

Kinder Morgan (KMI) has had a major carbon dioxide business with a long list of customers. The company actually gets the carbon dioxide from the ground just like oil and gas (which are secondary products produced in this situation). The only real difference that is now proposed is to get the carbon dioxide either from the air or before it gets released into the atmosphere.

As far as storing the natural gas in the ground goes, the oil and gas industry forces the natural gas into the ground to get the remaining products to the surface. If any carbon dioxide is produced with the oil, then that carbon dioxide gets reused when possible because it lowers the need to purchase more carbon dioxide for this process.

From this experience the industry very much knows how to store carbon dioxide permanently if that is what is needed. Even with production uses, the main idea of carbon dioxide is to push the oil into production. The industry does not want it to come back out of the ground.

Occidental Carbon Capture Plans

Occidental management wants to build the first plant to capture carbon dioxide from the air to either store the gas underground or use it for EOR (which is about the same as storing it).

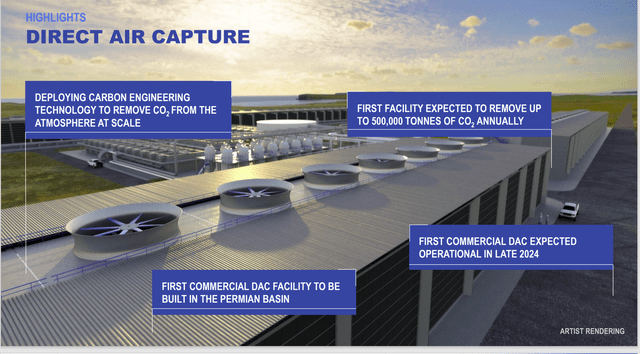

Occidental Petroleum Carbon Capture Plant Planned (Occidental Petroleum Earnings Conference Call Slides Third Quarter 2022)

The company has a first plant planned for this new idea of capturing carbon dioxide from the air. Management stated during the conference call that they would either build it themselves or (preferred) get partners to reduce their exposure. So, this is something that will definitely happen in the future.

The company has an advantage in that as this method for obtaining carbon dioxide becomes cost competitive, the gas itself that is produced can be used in the EOR operations (and potentially sold to other secondary recovery operations). That would be in addition to the usual benefits management talked about on the conference call.

Finances

Management discussed that, in November, more long-term debt was paid so that total debt is now below $20 billion. When one considers that, at the end of fiscal year 2021, the long-term debt was roughly $30 billion, this has truly been an amazing year in terms of balance sheet repair.

Cash flows before working capital for the fiscal year-to-date have been roughly $14 billion. So, the debt ratio is heading towards one and is now comfortably below 2. That means that management should be capable of achieving the goal of again becoming investment grade.

Profitability Improvement

Management has long had a position of not growing the production. But there were some high return projects that will increase company profitability.

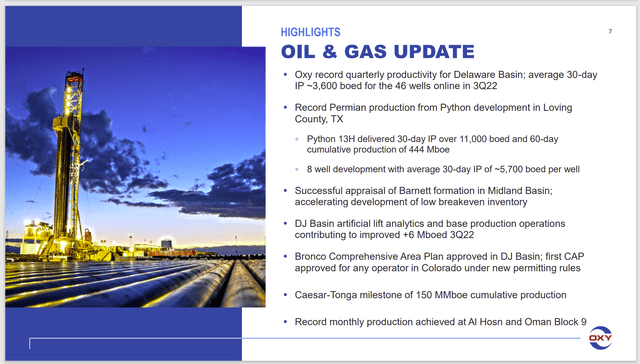

Occidental Petroleum Summary Of Operational Improvements (Occidental Petroleum Third Quarter 2022 Conference Call Slides)

Management has reported some production advances as the industry in general continues to lower the costs of production. The record 30-day IP shown above for a group of wells would be the main as would be the record initial production of one well.

Most likely as technology continues to advance lower costs will be the norm. This kind of advances contributes to lowering the corporate breakeven. It actually makes operations more efficient because it is far easier to deal with a few large production wells than a bunch of wells pumping (for example) 100 BOED.

Another surprise was they successfully tested the Barnett formation. For many years that I have written about the Barnett when it came up, the formation was considered high cost with only existing production. So, if technology has advanced to bring yet another basin back, then investors will know the country has more commercially productive reserves.

There is a lot of talk about the unconventional business maturing. But much of the industry is really very young with a lot more recovery methods yet to be discovered. As much as the talk about maturing happens, just as fast another basin gets revitalized. It has been happening probably since before I was born and is likely to continue long after I am gone.

The Future

The company is investing in carbon dioxide with the initial idea of taking advantage of the recent law passed and signed by the president. But there is so much more that can happen if the plant and the technology become cost competitive.

Currently, the industry takes natural gas from one place in the ground and gets it to an EOR operation. (Note that not all EOR operations can use carbon dioxide. But enough definitely can). That is expensive and time consuming. If the day ever comes when this technology becomes cheap, then the cost of EOR drops like a brick as carbon dioxide can be a fairly significant cost in secondary recovery.

There are other things like soda and some manufacturing processes that use the gas. This technology is liable to attract a fair amount of interest in the future.

In the meantime, management is at work with a lot of “add-on” or “debottlenecking” type projects (along with some expansions) that should improve profitability. This includes the advance of technology in the oil and gas business. Therefore, profitability is likely to improve more in the current business cycle.

Debt repayments will continue, but they will continue at a reduced pace. Share repurchases and dividends are on course to trigger mandatory repurchases of the preferred. How management handles that whole situation will be interesting to see. But it does appear that the balance sheet will simplify over the next few years.

The warrants are converting because warrants do not receive dividends, but the stock does. That adds more cash that management can use to retire the preferred stock and the debt.

All of this means that the company is in a cash flow building stage. Production may grow from technology improvements. But such growth is likely to prove insignificant right now. The emphasis appears to be upon regaining investment grade debt ratings and simplifying the balance sheet.

The financial progress combined with the operational improvements point to improved profitability as a way to grow earnings for the foreseeable future. Once that is accomplished, then management may grow the business more.

[ad_2]

Source link