[ad_1]

Dream Finders Homes, Inc. (NYSE:DFH) shareholders should be happy to see the share price up 13% in the last month. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 39% in the last year, significantly under-performing the market.

While the last year has been tough for Dream Finders Homes shareholders, this past week has shown signs of promise. So let’s look at the longer term fundamentals and see if they’ve been the driver of the negative returns.

View our latest analysis for Dream Finders Homes

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Dream Finders Homes share price fell, it actually saw its earnings per share (EPS) improve by 60%. It’s quite possible that growth expectations may have been unreasonable in the past.

It’s fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

Dream Finders Homes’ revenue is actually up 102% over the last year. Since we can’t easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

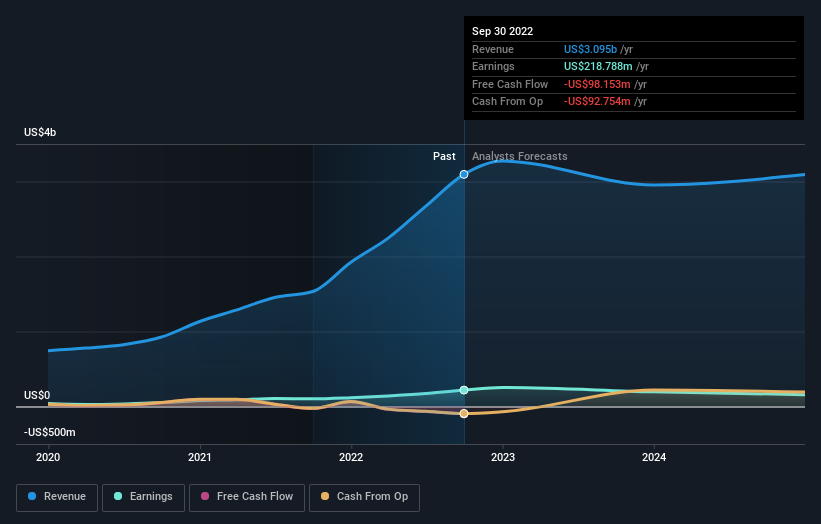

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Dream Finders Homes has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Dream Finders Homes will earn in the future (free profit forecasts).

A Different Perspective

We doubt Dream Finders Homes shareholders are happy with the loss of 39% over twelve months. That falls short of the market, which lost 10%. There’s no doubt that’s a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it’s good to see the share price has rebounded by 8.6%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it’s the start of a new trend. It’s always interesting to track share price performance over the longer term. But to understand Dream Finders Homes better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We’ve identified 3 warning signs with Dream Finders Homes , and understanding them should be part of your investment process.

Of course Dream Finders Homes may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we’re helping make it simple.

Find out whether Dream Finders Homes is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link