[ad_1]

Also in this letter:

■ PhonePe raises $350 million in first tranche of $1 billion fundraise

■ Tech salary expectations down 40% YoY as demand cools

■ Supreme Court rejects Google’s plea seeking stay on CCI order

Pricewaterhouse flagged discrepancies in GoMechanic’s FY20 audit: filings

Pricewaterhouse, the auditor of troubled car servicing startup GoMechanic in the financial year ended March 2020 (FY20), had flagged discrepancies in how the Sequoia Capital-backed startup had reported its business activities and assets, regulatory filings reviewed by ET showed.

Details: Pricewaterhouse audited financial statements of GoMechanic only for the 2020 fiscal year, following which it was replaced by BSR & Co, an audit network member of KPMG, in FY21 and FY22.

Catch up with quick: The ‘qualified opinion’ by Pricewaterhouse comes to light a day after GoMechanic founder Amit Bhasin confessed on LinkedIn about inflating business numbers and getting ‘carried away’ while chasing growth.

What’s new? Multiple people aware of the company’s accounting practices confirmed to ET about the ‘qualifications’ by Pricewaterhouse and said the company was told to fix those issues.

A senior executive at one of the ‘Big Four’ audit firms said qualifications are always a negative for a company and it means the company being audited hasn’t followed the requisite accounting practices and that the firm needs to fix it.

“Look, qualifications are negative in general. What matters after that is what the company does with that information flagged by the auditor. Sometimes, at an early-stage, investors feel founders will fix these processes over the long-term once they grow bigger,” the executive said.

Qualified opinion: Matters listed under the Tiger Global-backed company’s FY20 audited financial report’s ‘qualified opinion’ included not holding that period’s annual general meeting within a stipulated period, not maintaining inventory records for receipts and issuance of goods directly received by customers, not maintaining formal documentation to map services rendered by the automobile workshops to end customers, among other non-compliances.

A qualified opinion, in accounting parlance, is a written statement by an auditor in an audit report that states that the financial statements of a client are fairly presented, except for specified issues.

PhonePe raises $350 million in first tranche of $1 billion fundraise

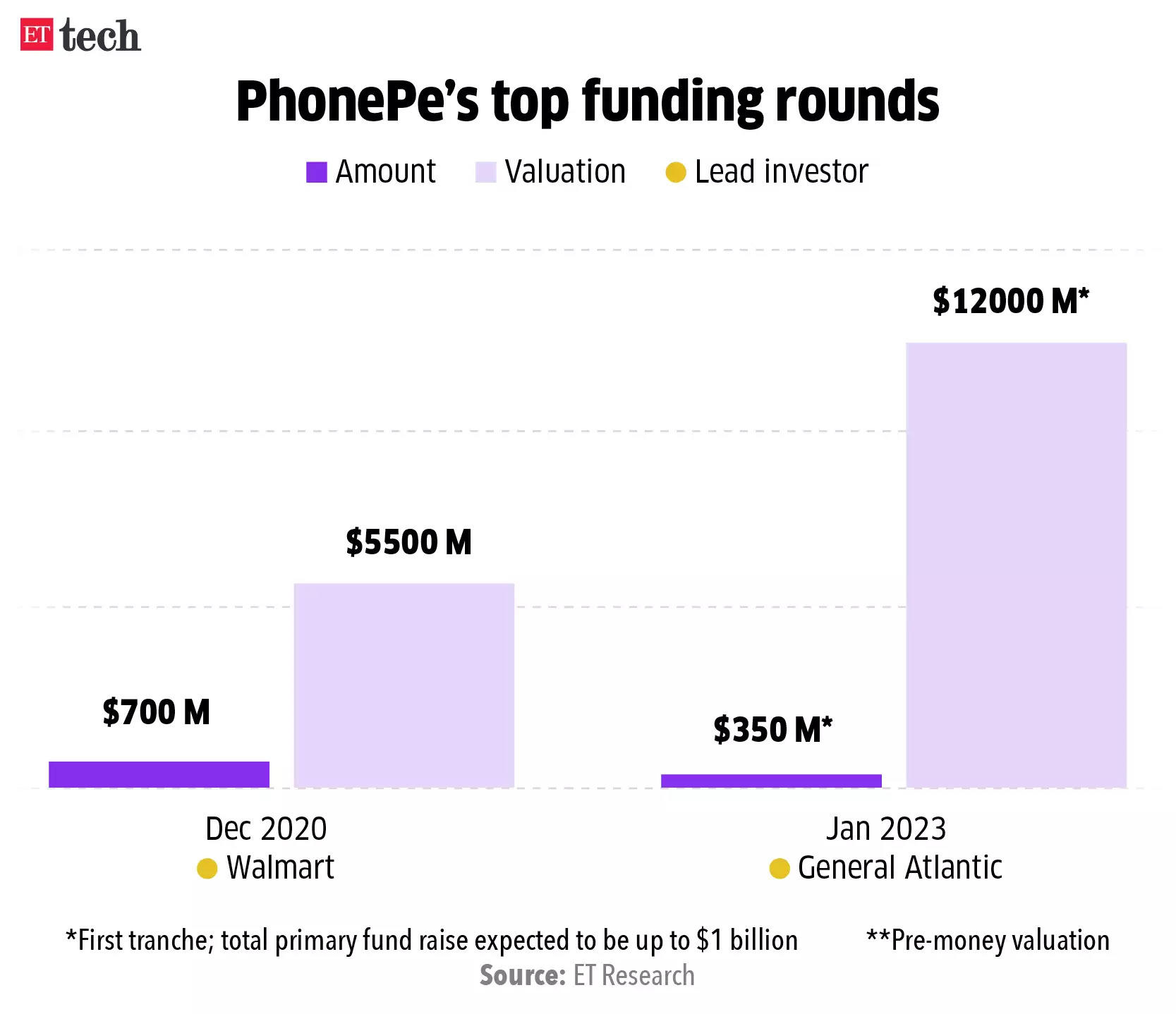

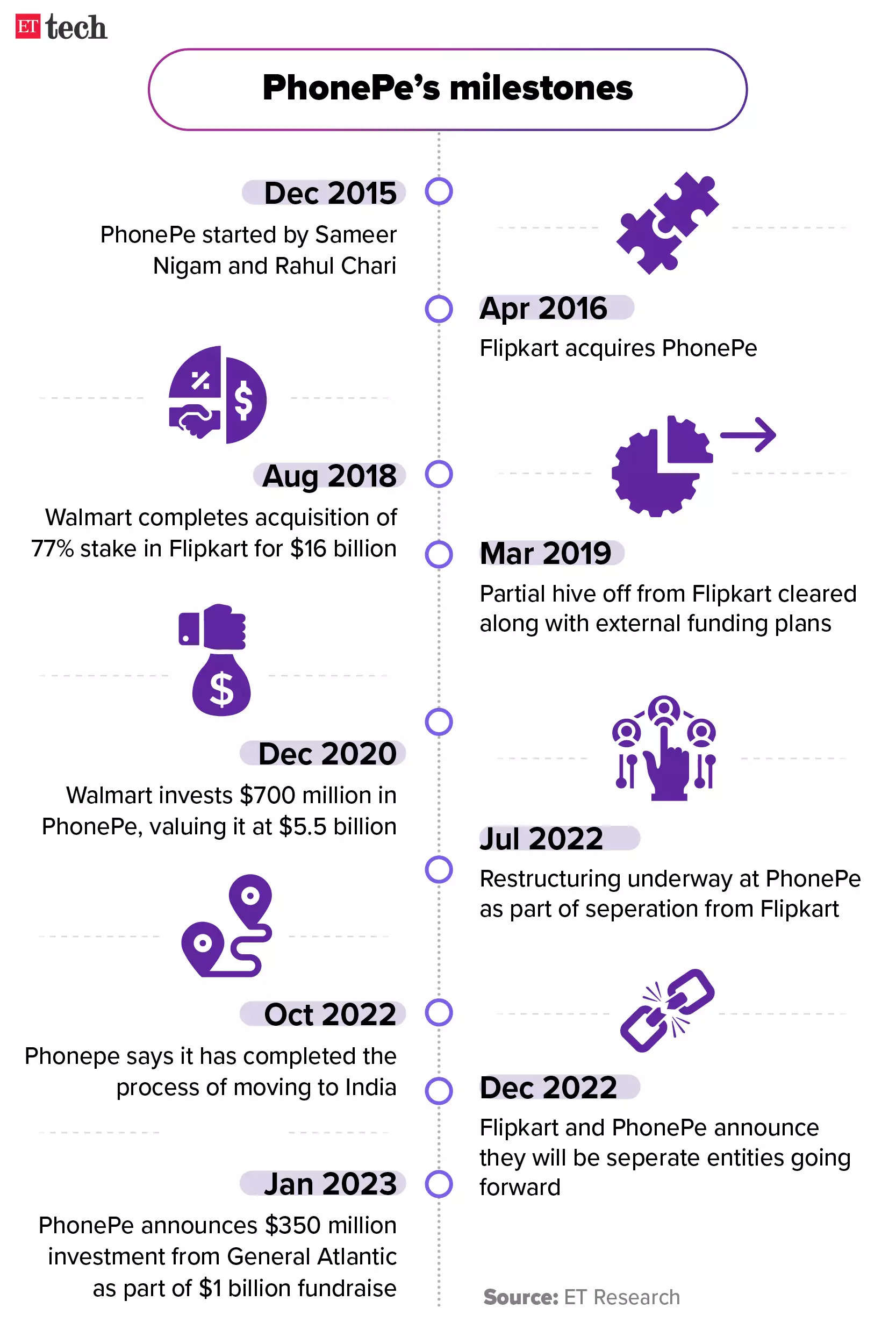

Digital payments major PhonePe on Thursday said it has raised $350 million in funding from global private equity firm General Atlantic at a pre-money valuation of $12 billion.

The investment marks the first tranche of an up to $1 billion total fundraise that commenced in January 2023, the company said in a statement. It said other global and Indian investors are also participating in the round.

PhonePe, owned by Walmart, was last valued at $5.5 billion in December 2020 after raising $700 million from the US retail major.

Landmark: With this transaction, PhonePe has become the highest-valued privately held Indian fintech firm, surpassing digital payments provider Razorpay, which was last valued at $7.5 billion.

We reported on December 23 that PhonePe was looking to close a funding round of $1.5-$2 billion in total where both Walmart and private equity major General Atlantic are expected to pump in capital at a pre-money valuation of $12 billion.

While the primary fund raise was estimated to be $1 billion in size, it will include a secondary share sale, taking the total financing to a range of $1.5–$2 billion.

In a secondary share sale, existing investors sell their shares to new investors and the money doesn’t go to company coffers.

PhonePe’s India shift: The fundraise also follows PhonePe’s recently announced change of domicile to India and full separation from the Flipkart group.

With the company shifting to India, the government is likely to gain as much as $1 billion in taxes from Walmart and other shareholders, we reported earlier this month, citing sources.

Tech salary expectations down 40% YoY as demand cools

Salary expectations of IT employees have dampened due to recession and geopolitical concerns. Techies reported a drop of around 40% as of December compared to the same period last year as the demand environment cooled amid mass layoffs by big tech firms.

Attrition drops: Attrition has tapered from peak levels of 25-30% last year to about 20% in the December quarter and the consequent lag in salary hikes is likely to help companies improve operating margins, which have been under pressure due to the high cost of talent.

Quote: TeamLease Digital CEO Sunil C said with the general tightening of talent requirements, layoffs and global market concerns, employees have become more cautious about switching jobs.

“It is fair to state that the hike when someone changes jobs has dropped from 70% to 30%,” Sunil added.

“The salary expectation for candidates with 3–7 years’ experience was averaging at more than 75% (hike) a year ago for a job switch and now it has tempered down to realistic levels of 30% plus,” said AR Ramesh, director, managed services and professional staffing, Adecco India.

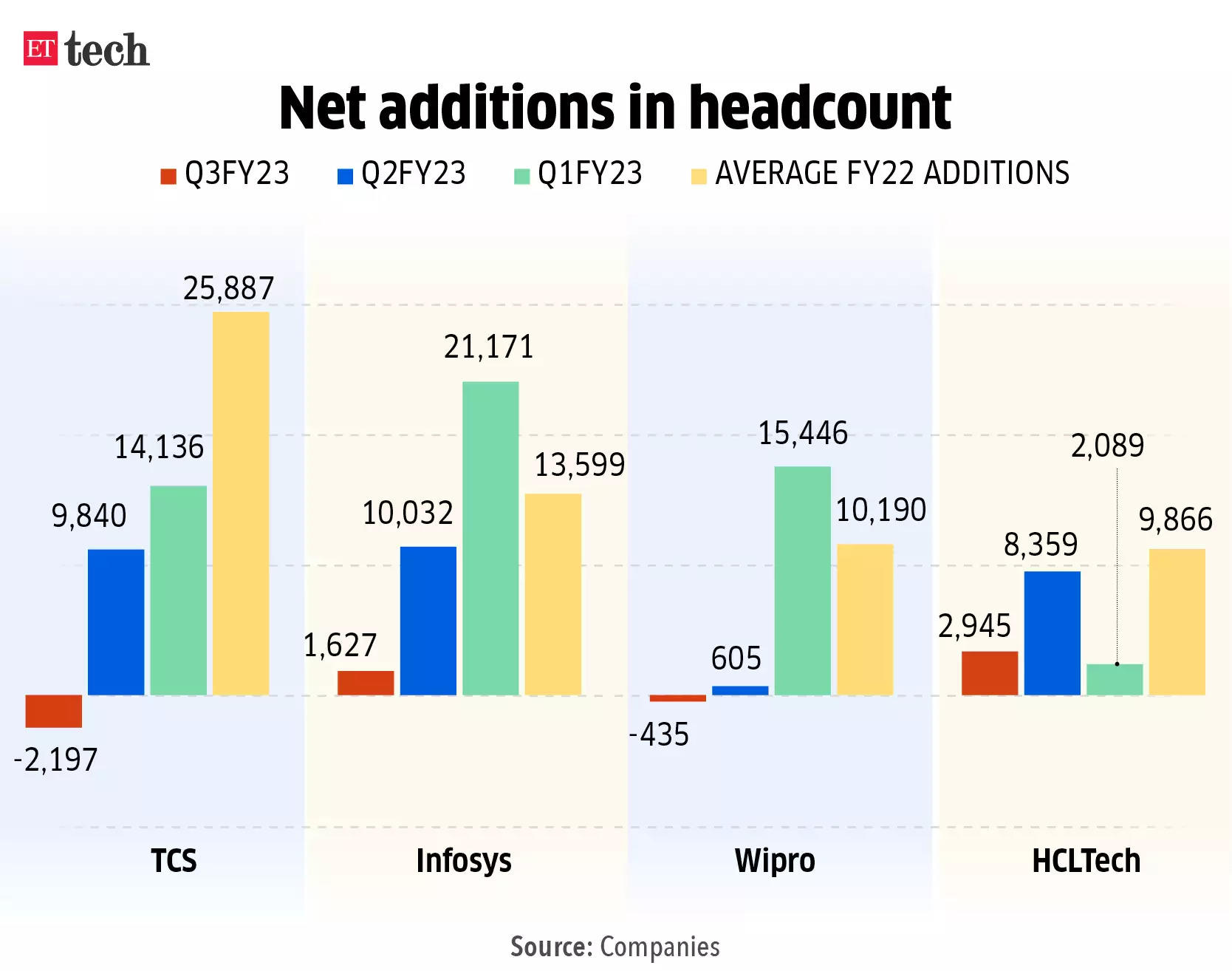

Demand tapers: We reported on January 18 that India’s top four software exporters — Tata Consultancy Services, Infosys, HCL Tech and Wipro — together recorded a net addition of just 1,940 employees in the quarter ended December 2022.

The number is lowest in 11 quarters and marks a sharp drop of nearly 97% from the net addition of 61,137 employees by the big four IT firms in the third quarter of FY22. This is also a nearly 94% drop from a net addition of 28,836 in the second quarter of FY23.

Supreme Court rejects Google’s plea seeking stay on CCI order

The Supreme Court on Thursday refused to stay the National Company Law Appellate Tribunal’s (NCLAT) order refusing to stay a Rs 1,337 crore penalty imposed on Google by the Competition Commission of India’s (CCI) last October.

The CCI’s order of October 20, 2022, also required Google to make changes to its Android ecosystem by January 19. However, the court extended the deadline for Google to comply with the order by a week.

Catch up quick: On October 20, 2022, the CCI fined Google Rs 1,337.76 crore for allegedly exploiting its dominant position in mobile operating systems with Android, which powers 97% of smartphones in India. It also asked the company to make changes in its licensing deals with Android phone makers.

On January 4, the NCLAT refused to stay the CCI’s order and directed the search giant to deposit 10% of the Rs 1,337.76 crore fine. It posted the matter for further hearing in April.

Google’s defence: Google has said implementing the CCI order would require wide-ranging changes to the Android ecosystem that would “undermine public interest, user safety and privacy for the Indian Android users”.

It has also said these changes would “open new back doors to foreign actors looking to compromise the security of Indian Android device users”.

Startups cheer: “We strongly believe that this decision will usher in a cataclysmic change in the Indian smartphone ecosystem and further improve and enhance digital penetration in our country,” Rakesh Deshmukh, cofounder and CEO, Indus OS said in a statement.

MapmyIndia too said they were ‘elated’ and ‘extremely grateful’ to the Supreme Court. “MapmyIndia was mentioned and spoken of multiple times in the Supreme court by multiple parties, who said that MapmyIndia pioneered digital mapping in India since 1995, far before the birth of Google,” Rohan Verma, CEO & ED of MapmyIndia said.

Event management startup Hubilo lays off 35% of staff

Virtual and hybrid events platform Hubilo has laid off around 120 people, or about 35% of its workforce, after witnessing “de-growth” in 2022.

Driving the news: The Bengaluru- and San Francisco-headquartered startup’s CEO and cofounder Vaibhav Jain wrote an email to its employees earlier this week announcing the layoffs. Jain said that due to the current macroeconomic conditions, most companies are spending less on marketing and events.

Earlier this week, we reported that pink slips are being handed out to several hundred employees of venture-backed startups such as ShareChat, Dunzo, Rebel Foods, GoMechanic and others.

This is Hubilo’s second such exercise in less than a year after it reduced 12% of its overall employee count in July 2022.

More Twitter layoffs: Twitter is planning to lay off 50 more employees in the coming weeks, particularly in the product division, according to a report by online publication Insider. The report said the fresh round of layoffs may cut Twitter’s headcount to below 2,000 – its lowest in over a decade.

Other Top Stories by Our Reporters

Data localisation was never a mandate in India, says IT min: Data localisation was never a mandate in India, cross-border data flow is happening even today, and investments in data centres continue to be significant, Union Minister of State for Electronics and IT Rajeev Chandrasekhar told ET.

B Capital closes third growth fund at $2.1 billion to ramp up India bets: Global investment firm B Capital, which has backed Byju’s, Meesho and Pharmeasy in India, said on Thursday that it has closed its third venture growth fund (Growth Fund III) at $2.1 billion, as it looks to continue backing opportunities across growth-stage startups.

Global Picks We are Reading

■ Crypto Lender Genesis Is Preparing to File for Bankruptcy Within Days (WSJ)

■ Tech workers had their pick of jobs for years. That era is over for now. (The Washington Post)

■ US arrests Russian crypto exchange owner for allegedly laundering over $700 million (The Verge)

[ad_2]

Source link