[ad_1]

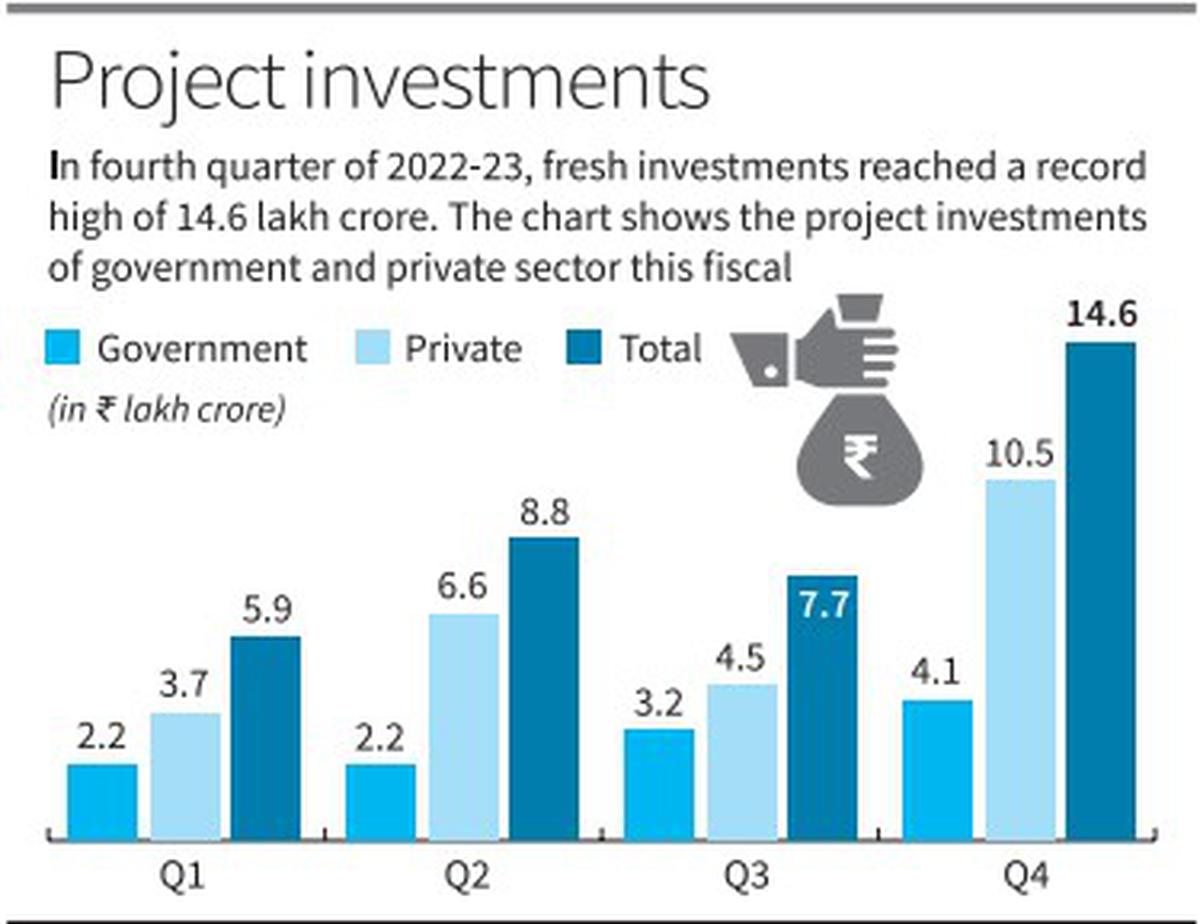

India’s investments narrative closed last year with a bang, as the January-to-March quarter recorded the highest-ever total fresh investments of ₹14.6 lakh crore, led by private sector outlays that also hit an all-time high of ₹10.5 lakh crore.

The fourth-quarter spurt, that was also driven by a record uptick in manufacturing investments, lifted the total new investment projects announced in India during a financial year to a fresh peak of ₹37 lakh crore in 2022-23.

This constituted a 92% surge over the ₹19.27 lakh crore of investments announced in 2021-22, as per data from investment monitoring firm Projects Today shared with The Hindu. Projects Today has been monitoring investment project announcements since the year 2000.

The record numbers apart, the fourth quarter of 2022-23 also saw a significant shift in the nature of investments, with private sector manufacturing investments resuming the lead role of capital formation from public sector-driven infrastructure-focused capex that had been propping up the metric in recent times.

This trend should be music to the ears of the government that has outlined a ₹10 lakh crore capital investment plan for 2023-24, but has been repeatedly exhorting the private sector to invest more to boost economic growth amidst a slowing world economy. Indian industry had been citing high inflation, uneven consumption demand and rising interest rates as factors for the reluctance to raise production capacities.

New manufacturing investments in Q4 of 2022-23 were almost three times the average in the previous three quarters at almost ₹9.6 lakh crore, with the share of planned manufacturing outlays jumping from an average of 45% of total investments announced in the first three quarters to almost 66%. The overall share of private investments averaged 65% between Q1 to Q3, but jumped to 72% in Q4.

“The manufacturing sector has emerged as the dominant sector in terms of investment, with its share in total fresh investment increasing from 41.93% in 2021-22 to 53.66% in 2022-23, with new projects outlay in the sector more than doubling from ₹8.08 lakh crore in 2021-22 to over ₹19.85 lakh crore in 2022-23,” Projects Today’s 90th Survey of project investments noted. “On the flip side, the number of new manufacturing projects declined from 2,759 in 2021-22 to 1,912 in 2022-23,” it added.

For the full year, Central and State governments’ investment projects grew 95% to ₹11.68 lakh crore from just a shade under ₹6 lakh crore in 2021-22. Private sector investments, on the other hand, jumped 90.7% to ₹25.32 lakh crore in 2022-23 from ₹13.27 lakh crore a year earlier. Foreign investments grew at a faster clip, albeit on a smaller base, to touch ₹4.73 lakh crore compared to ₹2.17 lakh crore in 2021-22.

“We expect the buoyancy in the announcement of fresh investment to continue in FY2024 too unless domestic inflation increases further and international issues like crude oil prices, financial uncertainties, and geopolitical issues puncture the animal spirit of the Indian investors,” reckoned Shashikant Hegde, director and CEO of Projects Today.

With the number of mega investments that entail an outlay of over ₹1,000 crore, jumping from 98 projects worth ₹6 lakh crore in 2021-22 to 132 projects worth ₹18.05 lakh crore in the year gone by, Mr. Hegde, however, stressed the need to push their execution to trigger a virtuous investment cycle.

“In India, mega projects are delayed due to several issues including the availability of land and environmental clearances in time. A quicker grounding of mega projects would instil confidence in the private promoters to commit more fresh investment,” he told The Hindu.

A.P. pips Gujarat

While several major States held Global Investors’ meets to attract fresh investment intentions and signed scores of Memoranda of Understandings (MoUs) during these summits, the State that gained the most was Andhra Pradesh which emerged from outside the top 10 States for fresh investments in 2021-22 to the top State in 2022-23.

A.P. attracted 306 projects worth ₹7.65 lakh crore last year, which included 57 mega projects with investments of ₹7.28 lakh crore. This included seven Green Hydrogen projects and 18 Hydel-based power projects.

Gujarat, which topped investment plans in 2021-22, ended up a distant second last year with 1,008 new projects worth ₹4.44 lakh crore. The State is host to three of the mega superconductor fabrication projects announced in the country last year, including Vedanta’s ₹94,500-crore facility which chose the western State over its traditional rival and neighbour Maharashtra.

Maharashtra which had recorded the second highest investment intent in 2021-22, slipped to fourth place in 2022-23 but secured the highest number of new projects across States at 1,639. In terms of investments, however, it slipped behind Karnataka which sealed investment projects worth ₹4.33 lakh crore, compared to Maharashtra’s ₹3.71 lakh crore.

Odisha, with investments of ₹3.65 lakh crore was close behind Maharashtra, followed by Uttar Pradesh (₹2.4 lakh crore), Rajasthan (₹2.13 lakh crore), Tamil Nadu (₹1.73 lakh crore) and Telangana (₹1.58 lakh crore). West Bengal completed the list of top 10 States, with ₹1.22 lakh crore of investment projects, with the 10 States cornering 90% of the total fresh investments announced in the country in 2022-23.

Mining outlays drop

While manufacturing was the headline growth driver, investments in irrigation projects also recorded an almost five-fold increase in 2022-23 to hit nearly ₹62,000 crore and infrastructure projects saw a 32.4% uptick to cross ₹11.76 lakh crore from ₹8.88 lakh crore in 2021-22.

Electricity sector investments surged 175% to ₹4.11 lakh crore from less than ₹1.5 lakh crore in 2021-22. Mining was the only sector to record a contraction in investment plans last year, slipping 4.2% to ₹65,252 crore. However, the number of new mining projects on the drawing board went up from 135 to 174.

[ad_2]

Source link