[ad_1]

Kotak said it reads the revision in valuation formula for the balance Max-Axis deal as a realignment with regulatory guidance and the stamp of certainty on the partnership. The focus now shifts to the next leg, i.e. merger of Max Financial Services and Max Life in which the bank will likely need to play a crucial role. Valuations remain inexpensive, still factoring some risk/uncertainty on the eventual entity.

Axis Bank will buy balance stake in Max Life with a revised formula

In a release, Axis Bank has announced that it will buy the balance 7% stake in Max Life from Max FS at a revised formula. The current agreement prescribes valuation of the deal as per Rule 11UA of IT ( i.e. book value). As per revised terms, the insurance business will be valued on DCF. The release does not disclose the revised valuation. We expect the revised valuation to be higher than current transfer price and likely closer to FV. Kotak reads this as a stamp of approval by the bank to the revised (higher) formula. The bank has likely worked our revised economics/feasibility at a higher price – with removal of commission caps, the bank is in a position to earn higher commissions from Max Life and other insurance companies. More importantly, we believe that this rests any uncertainty around the Max-Axis transaction, providing comfort to investors.

Axis Bank to play an important role

Also read: Sebi pitches for PE firms as MF sponsor

Axis Bank is now set to own 20% stake in Max Life as envisaged earlier, reducing any uncertainty on the transaction. Interestingly, the promoter recently reduced stake in Max FS, down to 13% from 14.7% as compared to 20% stake of Axis Bank. We expect the bank to play an important role in the entity the way forward. The key task that lies ahead is to merge Max FS in Max Life, with a resultant listing of Max Life.

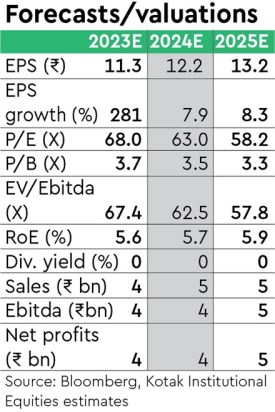

Valuations inexpensive, ‘Buy’

Also read: Gold bonds losing their shine, demand at three-year low

Max FS trades at 9X EVOP and 1.6X EV FY2025E, discount to listed private peers. Uncertainty on partnership with Axis Bank and lack of clarity on the economics of the partnership have marred the stock performance. The imponderables include eventual counter share at Axis Bank and likely commissions post removal of commission.

[ad_2]

Source link