[ad_1]

Ladislav Kubeš/iStock via Getty Images

By Alex Rosen

Summary

Get in your car, look at your cellphone, check your email. Chances are you are looking at a rare earth metal. In fact, they are so prevalent, it almost seems a misnomer to call them rare. Everything from screens to batteries to magnets all require rare earth metals, and the demand and extraction of them has gone through the roof, or through the earth’s core as the case may be.

Rare earth metal mining makes up a tiny fraction of the overall mining sector. As a result, the fund invests in many companies that derive revenue from other sources as well.

Due to the scarcity of companies that meet these criteria, the VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) has holdings around the world in both emerging and emerged markets.

Because of the potential for high returns, we rate REMX a Hold as we would like to see how the market for rare earth metals shapes out.

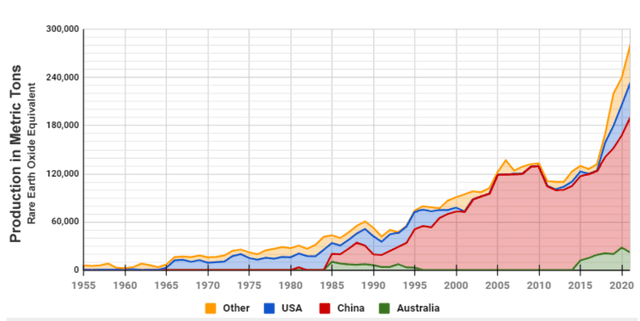

Rare earth metals are getting less rare (Geology.com)

Strategy

The ETF seeks to invest in companies that have at least 50% of their revenue derived from rare earth metals. The fund is rebalanced quarterly. The fund holds just a few stocks, chosen and weighted by market cap, with an upper limit of 8% per company for diversification purposes.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Non-U.S. Equity

- Sub-Segment: Rare Earth Metals

- Correlation (vs. S&P 500): Low

- Expected Volatility (vs. S&P 500): Very High

Holding Analysis

REMX holds a small collection of assets that best approximate the global rare earth mineral exploration market. Due to the requirement that every holding must generate at least 50% of its revenues from rare earth metals, the field is very narrow. To meet that requirement, REMX must search far and wide for holdings. Some of its main holdings include Pilbara Minerals Ltd (PLB AU) (OTCPK:PILBF) the world’s leading pure-play lithium company based in Australia, Allkem Ltd (AKE AU) (OTCPK:OROCF) (AKE:CA) another Australian Lithium mining company, Zhejiang Huayou Cobalt Co Ltd ( 603799 C1), a Chinese cobalt mining firm, working in the Democratic Republic of Congo, China Northern Rare Earth (Group) High-Tech Co., Ltd (600111 C1) operating in Inner Mongolia, and Livent Corp (LTHM) a U.S. based extraction company also operating in the U.S. For a complete list of the fund’s holdings, click here. An unintended consequence of this is that REMX’s portfolio is extremely broad from a regional perspective.

Strengths

The chart above shows just how quickly the rare earth metal demand has exploded. In the last forty years, demand has increased tenfold, and it has doubled since 2005 alone. The trend is only going to get bigger. Virtually every technological item we use today requires, to some degree, rare earth metals.

The green sector, and its ever-increasing need for stronger and longer lasting batteries, is consuming rare earth metals like a thanksgiving buffet. The energy sector is becoming increasingly reliant on rare earth elements including lithium and cobalt. Basically all technological breakthroughs in the 21st century are due to the understanding and exploitation of rare earth metals.

As technology continues to develop, the need for these metals will only increase, driving up price and investment.

Another appealing aspect of the fund though not a priority is its annual dividend yield. In 2021, the fund paid out a 5.9% dividend, and has paid out as much as 11% in 2011, but typically it ranges between 1 and 2%.

Weaknesses

Geologically speaking, rare earth elements are not lacking in abundance, but t are never found in abundance and are often mixed together with radioactive elements, such as uranium and thorium. The cost of extraction is high, and questions remain about whether the increasing demand can be met. For many extraction industries where the challenge is not finding the mineral but figuring out how to extract it, the cost of extraction has continued to drop. Fracking has become so cheap that the market at one point had an overabundance of supply. For rare earth elements, the real challenge is separating them from other more volatile elements.

Currently only a handful of companies are dedicating even 50% of their resources to this endeavor, and the names keep changing. The fund has a high turnover rate for a reason.

Additionally, as mentioned above, it is curious that the fund doesn’t have holdings in Africa and virtually none in South America, as that is where much of the rare earth metals are found. One of the greatest rare earth metal deposits can be found in the Democratic Republic of Congo, and that country is a hot mess, to say the least. Extraction is extremely difficult, and as I once told a client who wanted to invest in a gold mine there, you will need a private army to protect your investment. Similar arguments can be made about Bolivia, though there it is the government that is preventing the extraction.

Until these countries can create a safe and stable environment for extraction, the cost will continue to be high regardless of the advancements in extraction technology.

Opportunities

Almost no rational person will argue that the demand for rare earth metals is not going to increase, and as a result investment in exploration will continue to increase, especially in more politically stable regions of the world where it is determined that the potential is there. Right now the market is limited to only a handful of mining companies dedicating resources to the endeavor, but where there’s opportunity, money will follow.

The sector is still really in its infancy, and will only continue to grow. In the next decade, it is very reasonable to expect that more and more big time extraction companies will turn to the sector in an effort to capitalize on a rare opportunity. When that happens, funds like REMX will really stand to capitalize.

Threats

There are several potential red flags facing this sector. One, technology will improve to the point where alternative less risky elements will be just as effective, eliminating the need for continued exploration and extraction.

Two, the price of extraction will become so high that it isn’t worth the investment. This also is unlikely because of the constant increase in demand, though it may drive companies toward greater investment in alternatives.

Three, the supply of rare earth metals in stable locations dries up, and companies will be forced to invest in less savory parts of the world. For a deeper dive in to that read here about Zhejiang Huayou Cobalt Co Ltd , and child labor issues.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

REMX is swimming in a very shallow pool, and it has captured all the upside that exists for the moment. The transient nature of the industry is reflected in the extremely high turnover ratio. Companies that meet the 50% threshold today may fall below it tomorrow. One thing that has not been mentioned previously is that REMX also pays an annual dividend, though that is not the main focus of the fund.

This is a highly speculative sector, though unlike other speculative sectors (See Bitcoin), it is rooted in a tangible good with a clear purpose and need, and that is always something to feel good about.

ETF Investment Opinion

Infant industries always have the potential to hit home runs, and sometimes they do, and sometimes they don’t. This is a pure speculative play, but with a lot to like on the upside gain. The demand is there, it is just a question of how quickly the supply can meet it.

REMX is investing in an industry rife with concerns and issues, including child labor, government involvement, environmental concerns, and health issues. For every one ton of rare earth minerals extracted, 20,000 tons of toxic waste is created. These issues need to be resolved before we can recommend REMX as a buy. For now we rate it a Hold with the express understanding that the rare earth metal market is very fluid and conditions on the ground and in the ground are subject to change on a moment’s notice.

[ad_2]

Source link