[ad_1]

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Skyline Champion Corporation (NYSE:SKY), which is up 62%, over three years, soundly beating the market return of 17% (not including dividends).

After a strong gain in the past week, it’s worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Skyline Champion

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

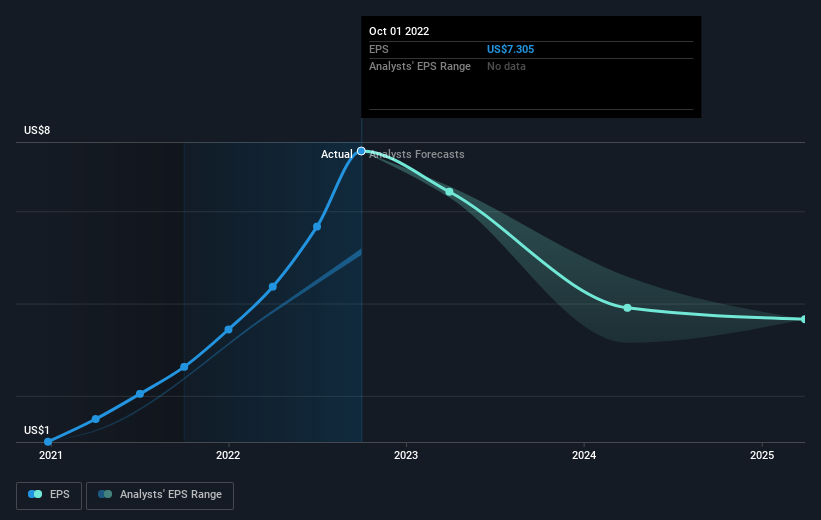

During three years of share price growth, Skyline Champion achieved compound earnings per share growth of 96% per year. This EPS growth is higher than the 17% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock. We’d venture the lowish P/E ratio of 7.87 also reflects the negative sentiment around the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Skyline Champion has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Skyline Champion’s financial health with this free report on its balance sheet.

A Different Perspective

The last twelve months weren’t great for Skyline Champion shares, which performed worse than the market, costing holders 18%. Meanwhile, the broader market slid about 16%, likely weighing on the stock. Fortunately the longer term story is brighter, with total returns averaging about 17% per year over three years. Sometimes when a good quality long term winner has a weak period, it’s turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we’ve discovered 2 warning signs for Skyline Champion (1 is a bit concerning!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

What are the risks and opportunities for Skyline Champion?

Skyline Champion Corporation produces and sells factory-built housing in North America.

View Full Analysis

Rewards

-

Price-To-Earnings ratio (7.9x) is below the US market (14.6x)

-

Earnings grew by 179.5% over the past year

Risks

-

Earnings are forecast to decline by an average of 33.9% per year for the next 3 years

-

Significant insider selling over the past 3 months

View all Risks and Rewards

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link