[ad_1]

The vast majority of countries outside the United States should see an increase in the number of new wells drilled this year. By the same token, some analysts see global oil and gas exploration shrinking this year, as companies continue to struggle with the Covid-19 pandemic and international energy crises, including the Russian invasion of Ukraine.

Fig. 1. This is the latest rendering of the FPSO design for Equinor’s proposed Bay du Nord field development offshore Newfoundland and Labrador. Image: Equinor.

However, some industry professionals, like Schlumberger Chief Executive Officer Olivier Le Peuch, think the demand for reliable energy will accelerate the global oil exploration and production industry, Reuters reported. “The need for reliable energy supply and reinvestment in our industry remains very compelling, and will ultimately extend the growth cycle, both in terms of duration and magnitude,” Le Peuch said at the JP Morgan Energy Conference in New York, according to the Reuters report.

Indeed, Halliburton Chairman, President and CEO Jeff Miller shares Le Peuch’s enthusiasm. “I think the fundamentals today really support a multi-year energy up cycle,” Miller told World Oil. “I think we’re at a point in time, where the industry has suffered eight years of underinvestment, and that can only be overcome with some period of time of overinvestment, which I think is longer rather than shorter.” (For more of World Oil’s exclusive interview with Mr. Miller, please turn to page 48.)

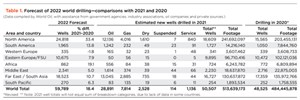

Drilling outside the U.S. during 2021 was barely higher than the 2020 level, gaining just 0.6%. However, World Oil projects the number of wells drilled outside the U.S. in 2022 will increase 12.4% during 2022, as the upstream industry continues to recover. Every region will experience higher drilling levels this year, save for Western Europe, and even that area will be down just 1.8%.

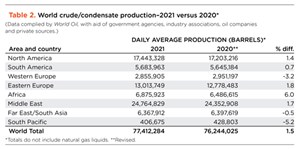

On the production front, worldwide output of crude and condensate staged a small recovery last year. After dropping to 76.244 MMbopd during 2020, global production gained 1.5% last year, to average 77.412 bopd. Improvement was noted in five of the eight regions that World Oil tracks.

Fig. 2. The Liza Destiny FPSO, which is now operating offshore Guyana for ExxonMobil and Hess. Image: Hess Corp./Stabroek News.

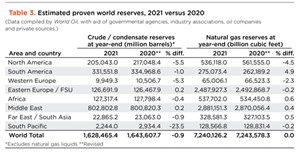

Given the reduced drilling levels experienced over much of the globe, it’s no surprise that worldwide crude and condensate reserves dropped nearly 1% to 1.628 trillion bbl, with six of eight regions sustaining declines. Meanwhile, natural gas reserves held up better, staying nearly even at 7,240 Tcf. Please read forward for discussions of activity in the eight global regions.

NORTH AMERICA

Outside the U.S., North American drilling is projected to increase 31.4% in 2022. Canadian growth continues strong, and Mexico is slowly gathering speed, despite production difficulties. Regional production averaged 17.443 bopd, up1.4%. Oil and gas reserves both declined.

Canada is poised to increase oil production by 900,000 bpd, according to Alberta Premier Jason Kenney, and Canadian gas is already moving ahead, with a 16-year production high of 17.7 Bcf during July 2022. However, Canada’s strengthening production faces bottlenecks, as existing pipelines to the U.S. limit additional exports to 300,000 bopd. The Trans-Mountain Pipeline, meanwhile, isn’t projected to finish construction until 2023. Pipeline woes also extend to natural gas, with maintenance shutting down major export pipelines in mid-2022, causing price drops in the wake of surging production. When compared to prices in January (C$4.00/GJ), July prices dropped to C$3.36/GJ.

Table 1. Forecast of 2022 world drilling—comparisons with 2021 and 2020

In a rare move, Canadian President Justin Trudeau’s administration approved the environmental permit for a potential $12 billion field development project in the Bay Du Nord area, offshore Newfoundland and Labrador, Fig. 1. With estimated, initial recoverable reserves of 300 MMboe, this project is set to be Canada’s first new major undertaking since 2018. World Oil projects drilling activity to increase 31.7% this year in Canada. For more on the Canadian upstream outlook, please turn to page 39.

Mexico continues to push a national-centric plan for its oil and gas sector, ranging from making the country an LNG export hub to nationalizing production for greater domestic supply. However, this push is costly: increasing favor toward state companies versus private operators—with little priority for ESG goals—threatens to invoke the wrath of both U.S. tariffs and global climate proponents.

Mexico’s lofty goals also have to contend with rising gas prices and declining production from Pemex. In May, private operators surpassed 100,000 bopd, while Pemex’s output dropped 6% from last year, to 1.52 MMbopd. Wintershall announced two new discoveries in the Sureste basin, with a prospective find of 48 MMboe, but cooperation between Pemex and private operators is dampened by the ongoing Zama field dispute. World Oil projects drilling will increase 21.9% this year.

Fig. 3. The Johan Castberg FPSO arrived in Norway in April 2022, where it has been undergoing installation of its topsides module and turret. Image: Equinor/ Photographer-Originator: Jan Arne Wold and Bo B. Randulff.

SOUTH AMERICA

Brazil, Guyana and Suriname are surging ahead in production, with continued exploration promising further growth in the years ahead. Brazil already has awarded 59 exploration blocks, both onshore and offshore. This is the largest number of awarded blocks this year, worldwide. Elsewhere in the region, various countries are struggling to overcome the constraints of limited and failing infrastructure. This, added to conflicted political agendas, suggests a continuation of the downward trend from earlier this year. Compared with 2021’s impressive show of drilling growth, South America is projected to increase drilling a “mere” 13.8% in 2022. Regional oil production was up 0.7% in 2021, while reserves were down 1.0%. Gas reserves posted an encouraging 4.9% gain.

Brazil. In the wake of early 2022’s favorable legislation, production in Brazil is surging ahead. Petrobras projects 2.6 MMboed for 2022, and there was a new discovery in the Campos basin during April. Petrobras’s FPSO count is also rising, with 14 projected to be online by 2026—with five scheduled to go onstream in 2023 alone.

Independent production is also increasing, following Petrobras’s shift to pre-salt formations, away from previous assets. 3R boasted a collective 2,600 bopd in production from two such assets, and Petroreconcavo may do the same. Drilling is expected to increase 15.1% this year.

Colombia. With the recent change in administrations, Colombia’s oil and gas sector may face a shaky future. President Gustavo Petro’s halt on new exploration permits casts a cloud over NOC Ecopetrol’s goal to boost production from the 2022 target of 700,000 boed to 800,000 boed or higher by 2030. However, Colombia’s weakening energy self-sufficiency may already be softening President Petro’s stance against the industry, with his concession to respect existing contracts—even in the instance of fracing. Meanwhile, a major offshore gas discovery in July could boost Colombia’s remaining gas reserves. World Oil projects drilling will increase 6.5% this year.

Venezuela. U.S. sanctions may show signs of easing, with legislation in May improving negotiating flexibility with Venezuela, while companies await a decision later this year on allowing production to resume. Meanwhile, Venezuelan production struggled to benefit from high oil prices, with power outages, a pipeline explosion, and shutdowns all slowing production. Despite a recent, 20-year cooperation deal with Iran, Venezuela’s production for 2022 is estimated at 700,000 bopd, compared to a former high of 3.0 MMbopd. In July, the country resumed its first export shipments to Europe in two years, but failing infrastructure threatens to suspend these shipments indefinitely. Drilling is expected to increase 5.6% this year.

Argentina. Despite the estimated 27 Bboe and 802 Tcfg of reserves to be found in the Vaca Muerta play, Argentina is still lacking the infrastructure to meet domestic demand. A new pipeline that would increase output 25% has been announced, and World Oil predicts drilling to increase 18% this year. However, the looming winter season is likely to see Argentina become a gas importer, competing with the UK and Asia for supplies, in 2022 and 2023.

Guyana and Suriname. While Guyana and Suriname remain open to outside development, Guyana is considering forming a state-owned oil company to net greater profits. Following three recent offshore discoveries in Guyana and two in Suriname, the region is projected to produce 800,000 bopd by 2025, with drilling to increase 71.4% in Guyana, alone, this year. Gas is booming similarly, with an offshore LNG plant promising production of 4 MMmt/yr from Guyana and Suriname’s estimated 35 Tcf of gas reserves.

WESTERN EUROPE

Focus may finally be shifting away from renewables and back to oil and gas, following Western Europe cutting ties with Russian oil. Norway is investing in major exploration, with 54 new licenses as of last year’s licensing round and major exploration drilling underway for 2022. Elsewhere, UK domestic production is gaining traction compared to last year, despite conflicting signals from government policy. Overall drilling is projected to decrease 1.8%, due paradoxically, and solely, to a reduction in Norwegian activity.

Norway. In the wake of the Ukraine-Russia war, Norway continues to take the initiative in filling demand. Exploration drilling is forging ahead, with 17 wells having been drilled as of July and 35 to 40 total exploration wells estimated by the end of 2022, although World Oil projects drilling overall to decrease 15.9% this year. Exploration is likely spurred by multiple new discoveries made this year, totaling approximately 439 MMbbl of oil and 25 to 80 MMboe of gas so far. Oil and gas production in the first half of 2022 totaled 300 MMbbl of oil and 60.83 Bcfg, respectively. This represents a 3.6% drop from predicted oil production and an 8% increase for gas. However, Norway’s status as a major gas exporter, plus the government’s clashing desire to reduce emissions 55% by 2030, does not promise smooth sailing altogether.

United Kingdom. The UK aims to invest £20 billion to £25 billion into its energy system, following the cutting of ties with Russia and the threat of declining North Sea output. A refocusing on oil and gas, solidified by the Jackdaw field project approval in June, was shaken by July’s surcharge bill, which levied a tax jump from 40% to 65% on oil and gas producers. However, domestic production jumped 26% from last year’s level, and World Oil projects drilling to increase 29.2%, with at least 12 exploration wells planned. Cygnus field is already on track to add over 8 Bcfg to its yearly output of 81 Bcfg.

EASTERN EUROPE/FSU

Fig. 4. While the tally of new wells will rise in Eastern Europe and the FSU overall, drilling will hold steady with last year’s rate in Poland. Image: ORLEN Group.

Russia’s invasion of Ukraine in February had a profound impact on the global energy market, as the U.S., UK, and other countries almost immediately stopped importing Russian crude, natural gas and related products. Sanctions followed soon after. Already, high commodity prices surged, leading to record-breaking gasoline prices in the United States. Regional drilling will be up 7.9%, to 10,675 wells, Fig. 4. Production last year was up 1.8%, at 13.014 bopd. Oil reserves were up 0.2%, while gas reserves slipped 0.2%.

Russia. While numerous countries have halted importing Russian energy products, the International Energy Agency found that in August, Russian oil production had fallen by less than 3% since the invasion of Ukraine. The swathe of Western energy sanctions was having only a “limited effect,” said IEA. Exploration in Russia continues, and in July, Rosneft claimed to have made an 82-MMt oil discovery in the Pechora Sea. World Oil predicts that the number of new wells drilled in the Russian Federation will increase 8% this year.

Russia continues to find ways to sell and deliver its oil despite the sanctions. Asia has continued buying the cheap Russian oil that Europe doesn’t want. In August, Bloomberg reported that a cargo of about 700,000 bbl of Russian oil was delivered to Egypt’s El Hamra oil terminal, a relatively “tiny” port on its Mediterranean coast, early on July 24. Hours later, another vessel collected a consignment from the port —which may have included some or all of the Russian barrels—according to vessel-tracking data monitored by Bloomberg.

But the IEA expects production to slow down significantly next year. The European Union’s ban on seaborne imports of Russian petroleum will lead to an 18% drop in the country’s fuel output by the end of 2023, according to an IEA report.

Other FSU countries. Kazakhstan is in the middle of preparing a major oil and gas lease tender. The country plans to reallocate or sell 107 onshore and offshore oil and gas exploration blocks, hoping to attract new operators for discovered fields and prospective new discoveries, according to a government lease auction notice. Roughly two dozen blocks will be sold or reallocated only to state-owned oil and gas companies, according to the Kazakhstan government. The 107 blocks are located both onshore and offshore, the latter being in the shallow waters of the Caspian Sea.

Meanwhile, Azerbaijan said it is increasing natural gas exports to Europe this year by 30%, as the EU looks for alternate sources to lessen dependence on Russian energy after the Kremlin’s invasion of Ukraine. Azerbaijani Energy Minister Parviz Shahbazov said that over the first eight months of 2022, Baku has supplied 7.3 Bcm of natural gas to Europe. Expectations are that the total volume supplied to Europe in 2022 will be 12 Bcm of gas.

Drilling in the former Soviet republics outside Russia is predicted to rise 7.7%. The area’s oil production was up slightly, while oil reserves increased 1.1%. Gas reserves slipped 0.3%.

Fig. 5. Contributing to Angola’s offshore oil output is the N-Goma FPSO, operated by Eni. Image: Eni.

AFRICA

Nigeria, traditionally the continent’s largest oil producer, is seeing political changes that could lead to more oil production, reflected in our prediction that its number of wells is expected to increase 36.5% this year. Lately, the country’s output has been decreasing, falling to 1.43 MMbopd in the three months through June, Bloomberg reported. All major African countries, excepting Libya, should see an increase in the number of wells this year. Overall, the region’s new wells drilled is forecast to increase 19.1%, to 862. Regional oil output rose 6% to 6.876 MMbpd. Oil reserves were marginally lower, while gas reserves were up slightly.

Libya. Political turmoil led to major fluctuations in Libya’s oil production during first-half 2022, until the government, National Oil Corp. and protesters reached an agreement in July to reopen oil fields and export terminals. The clash had led the country’s oil production to decrease by more than half in a matter of months, but it was back up to more than 1.0 MMbpd by late July. World Oil predicts that Libya’s number of new wells will decline 45% this year, compared to the 2021 level.

Table 2. World crude/condensate production–2021 versus 2020*

Angola. An offshore licensing round last year is helping Angola challenge Nigeria’s oil production level. The country’s output reached 1.16 MMbopd in May, according to OPEC’s Monthly Oil Market Report, Fig. 5. World Oil predicts the number of new wells drilled in Angola this year will increase 38.2%. TotalEnergies announced in July that it would develop Begonia, the first development of Block 17/06, 150 km (93 mi) offshore Angola. This will consist of five wells tied back to the Pazflor FPSO and add 30,000 bopd to the vessel’s production after commissioning which is expected in late 2024.

Nigeria. Nigerian oil production has declined steadily in recent years because of consistent theft from onshore oil pipelines, but the country’s sweeping Petroleum Industry Act gives producers hope that they will soon boost output. State-owned Nigerian National Petroleum Company (NNPC) recently became NNPC Limited, a commercial venture, as mandated by the Petroleum Industry Act. NJ Ayuk, executive chairman of the African Energy Chamber, believes this will give the company an opportunity to focus on productivity and profits without the red tape and inefficiencies that came with operating as a government entity.

ExxonMobil was one of the first operators to get permits under the country’s new oil and gas law, and it renewed two deepwater leases, OMLs 133 (Erha) and 138 (Usan), for a 20-year period. Three other licenses were extended at the same time, with interests held by Chevron, Equinor, TotalEnergies, Shell and CNOOC Ltd. In late July, TotalEnergies announced that it and NNPC Limited had started production from Ikike field, about 20 km (12 miles) offshore Nigeria. The companies expect peak production of 50,000 boed by the end of the year.

Fig. 6. In May 2022, State firm ADNOC Drilling Company signed a sale-and-purchase agreement to acquire an additional two premium offshore jack-up drilling units as part of its fast-tracked fleet expansion program. Image: ADNOC Drilling Company.

Egypt is predicted to have the largest number of new wells drilled in Africa during 2022, which would reflect a 23.2% increase compared to 2021. In January, Tarek El Molla, the Egyptian Minister of Petroleum and Mineral Resources, signed agreements with Canada’s Transglobe and Pharos Energy to explore and develop several regions in the eastern and western deserts. The $506 million in investments include a signature grant of $67 million to drill 12 wells, the Ministry of Petroleum said. Also in January, Italy’s Eni was awarded five new exploration licenses offshore Egypt.

MIDDLE EAST

Saudi Aramco surpassed Apple Inc. as the world’s most valuable company in May, showing how the region’s oil production became extremely important during an energy-short first half of the year. While a decline was predicted in 2021, due to a focus on renewable and alternative forms of energy, multiple circumstances this year showed the importance of reliable oil and natural gas supplies. Accordingly, World Oil predicts that the number of new wells drilled in the Middle East will increase 5.0% this year. Regional oil production was up 1.7% in 2021, and both oil and gas reserves were up marginally.

Saudi Arabia. Saudi Aramco posted record profits in August, which is attributed to high crude prices and high production rates. Net incomes rose to $48.4 billion in the second quarter, up from $25.5 billion in second-quarter 2021. In May, Saudi Arabia was reported to be earning $1 billion from oil exports every day. March oil exports reached $30 billion, a six-year high.

U.S. President Joe Biden visited the Kingdom during the summer to request that the country produce more oil, but many were skeptical that OPEC+ would agree. In early August, OPEC+ announced it would increase production 100,000 bpd, which amounts to one of the smallest oil production increases in its history. More recently, OPEC+ agreed to make a token oil supply cut for October to help stabilize global markets, reducing production by 100,000 bpd. Saudi Arabia recently told OPEC that its oil output hit 11 MMbpd in August. World Oil predicts the number of new wells drilled this year will increase 15.3%.

Iraq should have a significant boost in the number of new wells drilled this year, as World Oil forecasts a 29.5% increase. In April, Iraq’s Oil Ministry announced that it had begun drilling 20 oil wells in Nasiriyah oil field in southern Dhi Qar province. From January to February, Iraq’s oil exports rose from 3.2 MMbpd to 3.314 MMbpd, said the oil ministry. In July, an executive of Basra Oil Co. said the country could increase its production by 200,000 bopd this year.

UAE-Abu Dhabi. Abu Dhabi National Oil Co. (ADNOC) has held steady its oil production while continuing to invest in new equipment and projects, which should result in a 6.3% increase in new wells drilled, Fig. 6. In July, ADNOC Drilling secured $2 billion worth of contracts from ADNOC for its Ghasha offshore mega gas project, which ADNOC says is the world’s largest sour gas development. Production from the concession is expected to start around 2025, ramping up to produce more than 1.5 Bcfd before the end of the decade.

Fig. 7. The Trunojoy 01 FPSO will handle production from the Madura satellite fields, also known as the M satellite fields, offshore Indonesia. Image: Husky Energy (Cenovus Energy).

In May, ADNOC said it discovered 650 MMbbl of onshore crude reserves in Abu Dhabi, within a new formation at Bu Hasa field. Bu Hasa is Abu Dhabi’s biggest onshore field, with a production capacity of 650,000 bopd, and is operated by Adnoc Onshore. In August, ADNOC announced a $1.17 billion contract to hire 13 self-propelled jackup barges, to drive offshore operational efficiencies and support expansion of its crude oil production capacity to 5.0 MMbpd by 2030.

Oman continues to represent the largest proportion of drilling in the Middle East, and that number should increase 6.9% this year. The country’s government has reported steps that it is taking to boost production, along with its success in consistently increasing output this year.

In March, the government said it is planning to award three oil and gas blocks this year to increase upstream work, and that it is in negotiations with Shell and TotalEnergies to sign a commercial agreement that will see the development of Block 11.

The government’s plans to boost E&P activity seemed to be successful, as shortly after, Searcher entered into a strategic partnership with the Ministry of Energy and Minerals of Oman to acquire several new seismic surveys and reprocess legacy seismic data, both offshore and onshore Oman. Around the same time, Sweden’s Maha Energy said it was preparing to drill the first of six wells targeting a promising heavy oil field named ‘Mafraq’ in its Block 70 license in central Oman. This summer, Oman boosted its oil production 12.9%, compared to last year, increased its oil reserves to 4.9 Bbbl, and saw new oil discoveries that could raise its production by 50,000 to 100,000 bopd in the coming two to three years.

Table 3. Estimated proven world reserves, 2021 versus 2020

Iran’s oil producing capability has been in focus much more than previous years, due to energy shortages. However, there has yet to be an official revival of the 2015 nuclear deal with the U.S., which eased sanctions in exchange for Iran dismantling its nuclear stockpile. If an agreement materialized, Iran could ramp up sales within months, raising supply by hundreds of thousands of barrels per day before the end of the year, predicted the International Energy Agency. However, the International Atomic Energy Agency recently said that there is a large “information gap” regarding the country, leading European countries’ hopes to dwindle that a deal could be struck in the near future.

FAR EAST/SOUTH ASIA

The Far East region should see a 10.7% increase in new wells drilled this year, to 18,523. That number is influenced by some significant increases in certain countries, such as Thailand, which World Oil predicts will boost drilling 20%. Regional oil production was off less than 1% last year, as were oil reserves, but gas reserves posted a small gain.

China. China continues to have the region’s largest proportion of wells by far, and the number of new wells drilled this year should increase by about 10.5%, aligning with the region overall.

China National Offshore Oil Corporation announced that its oil and gas production increased 8.5% to 573 MMboe. The corporation plans to invest $14 billion to $15.8 billion, to reach a production target of up to 610 MMboe in 2022, then increase up to 650 MMboe in 2023. About 65% of that production should be achieved in China, CNOOC said.

PetroChina said that it is exploring shale oil in four horizontal wells in Yingxiongling, in Qinghai oil field, part of the Qaidam basin in the western province of Qinghai, where oil exploration began in the 1950s, and aims to build a pilot zone to pump about 20,000 bpd by 2025.

CNOOC successfully tapped oil and gas from the country’s first offshore shale well in July. While this discovery came from the Weiye-1 well, which tested a daily production of 126 bbl of crude oil, CNOOC estimates that the shale oil resources in the entire Beibuwan basin are equivalent to 8.8 Bbbl.

Sinopec, China’s state-run petrochemical group that also participates in E&P, said it discovered an oil field in the Tarim basin containing 1.7 billion tons of oil reserves. This is part of a 117-well exploration program in Shunbei oil and gas field. According to the Global Times and the director of China’s Center for Energy Economics Research at Xiamen University, the new discovery could supply the country’s oil demand for two years.

India. Oil & Natural Gas Corp.’s profits soared to 152.1 billion rupees ($1.9 billion) in the quarter ended June from 43.35 billion rupees in the same period a year ago, according to an exchange filing, Bloomberg reported. Bloomberg credited Russia’s invasion of Ukraine and an increase in local gas prices for the unexpected profit surge. The country imposed a $40/bbl tax on domestic oil production from July 1 to take away windfall gains being reaped by producers, which was later reduced after prices softened. World Oil predicts the number of wells drilled in India will increase 3.6% this year.

Fig. 8. The Prelude FLNG facility, operated by Shell, produces natural gas off the coast of Australia. Image: Shell plc.

Malaysia. Malaysia should see a significant increase in its drilling this year, and its “Coming Home Strategy” may be partially responsible, according to the Bangkok Post. The publication reported that PTT Exploration and Production Plc (PTTEP) is preparing to explore a new offshore oil block in Malaysia. Malaysian state firm Petronas awarded the exploration rights at Block SB412, off the northwestern coast of Sabah, to PTTEP through its subsidiary PTTEP HKO and its partner SapuraOMV, the Bangkok Post said.

“We are delighted to expand our growth in Malayzia through this new PSC. The investment follows through with our Coming Home Strategy, which earmarks investments for Southeast Asia,” said Montri Rawanchaikul, chief executive of PTTEP. The firm’s portfolio in Malaysia comprises several other exploration blocks. Sarawak Shell Berhad, a subsidiary of Shell plc, together with Petronas, decided to develop the Rosmari-Marjoram gas project. Gas production is expected to start in 2026. World Oil predicts that Malaysia’s new wells drilled will increase 38.6% this year.

Indonesia. In August 2022, China’s Jiangsu Strong Wind Offshore Shipyard (JSSW) completed construction of a floating production unit (FPU) for the development of a cluster of satellite fields offshore Indonesia Fig. 7. The FPU has since been christened “Trunojoy 01.” JSSW had been contracted to build and deliver the FPU for the Madura satellite fields, also known as the M satellite fields. These fields are operated by Husky CNOOC Madura Limited, a joint operating company between China National Offshore Oil Corporation (CNOOC) and Husky Energy (Cenovus Energy). Indonesian drilling should increase 10.5% this year.

SOUTH PACIFIC

For 2022, the South Pacific region expects to increase drilling 6.3%, with major discoveries in Australia, plus a gas boom, driving interest in developing production. In Papua New Guinea, meanwhile, development is well underway for projects delayed by the pandemic. Regional oil output was off about 5%, while both oil and gas reserves declined.

Australia. Two major discoveries, Santos and Sasanof, added 219 MMbbl to 492 MMbbl of oil and 7.2 Tcf to 17.8 Tcf of gas, combined, to Australia’s reserves. However, severe financial blows like July’s clean-up levy on the entire oil and gas industry suggest an uncertain tenure for the current gas production boom, Fig. 8. World Oil projects drilling will increase 7.7% this year.

Papua New Guinea continues to gradually increase drilling, with a 50% gain expected this year, albeit to just several wells. The PNG LNG project also has begun to gain speed, with TotalEnergies awarding a contract for the FEED stage of development in August. Elsewhere, development and seismic exploration are also underway. Angore field is expected to produce first gas in 2024, and development of P’nyang field’s estimated 4.36 Tcfg is set to follow the PNG LNG project’s completion.

About the Authors

Maddy McCarty

World Oil

Maddy McCarty is the Senior Digital Editor, Upstream & Midstream, for World Oil.

Olivia Kabell

World Oil

Olivia Kabell is an editorial assistant for World Oil.

Related Articles

FROM THE ARCHIVE

[ad_2]

Source link