[ad_1]

Jerod Harris

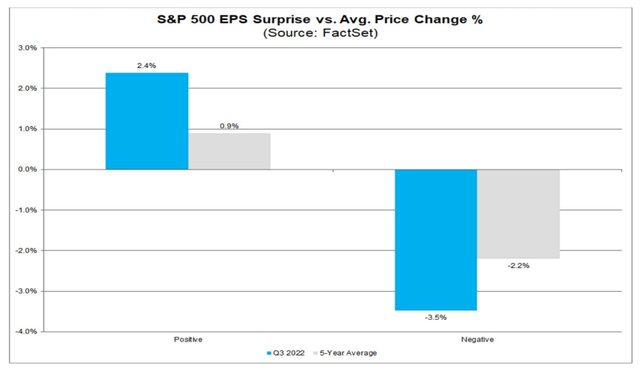

You better not miss on earnings this season. According to FactSet, companies issuing negative EPS numbers versus consensus estimates have fallen much more than usual this reporting period. Retail earnings are on the hot seat this week.

One domestic audio electronics company has results Wednesday night. After a drubbing in the last year, is the stock a buy now? Let’s run through the risks.

Earnings Misses Punished in the Q3 Reporting Season

FactSet

According to Bank of America Global Research, as the inventor of multi-room wireless audio products, Sonos (NASDAQ:SONO) offers smart speakers for use inside and outside of the home that are easy to set up, provide a premium sound experience, and can stream content from approximately 100 providers including Pandora, Apple Music, and Spotify, among others. In fiscal-year 2021, it generated 57% of its $1.7bn in revenues from the Americas, 36% from EMEA, and 7% from Asia-Pacific.

The California-based $2.3 billion market cap Household Durables industry company within the Consumer Discretionary sector trades at a high 20.5 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. The stock has an 8.2% short interest ahead of earnings Wednesday night.

Sonos is an interesting consumer play right now given its valuation reset and an ongoing litigation process against Google – there’s the chance that shareholders might benefit from the outcome.

Comparable consumer device stocks trade with EV/EBITDA multiples about where Sonos is. The risk, however, is that the macro environment continues to worsen, leading to a weaker consumer and a double whammy of a lower valuation and reduced earnings.

Digging deeper, the competitive landscape in the retail audio market could pressure the firm’s margins. Making things more uncertain is what’s going on in China – further lockdowns could hamper the company’s supply chain.

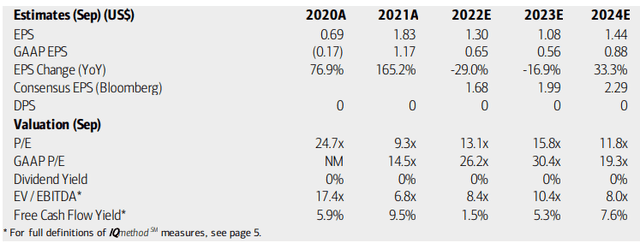

With so many question marks, how does the valuation look today? Analysts at BofA see earnings dropping sharply this year and next amid a less resilient consumer. The Bloomberg consensus forecast has more upbeat bottom-line numbers through 2024, though. A sound balance sheet should eventually help bring about shareholder accretive activities – notice how Sonos’ free cash flow yield remains positive through this tough patch. Overall, the GAAP P/E is high while the operating multiple is not as bad. Given heightened risks right now, I’m cautious about the valuation.

Sonos: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

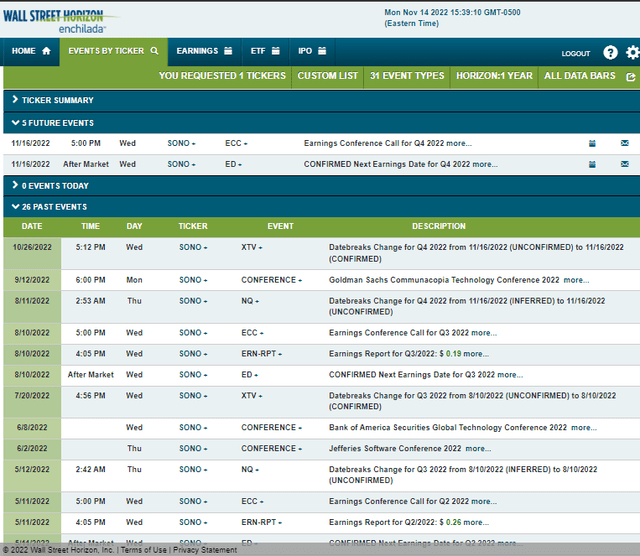

Looking ahead, Sonos reports its Q4 results Wednesday, November 16 AMC with a conference call immediately after results cross the wires. You can listen live here. The calendar is light aside from the earnings event.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

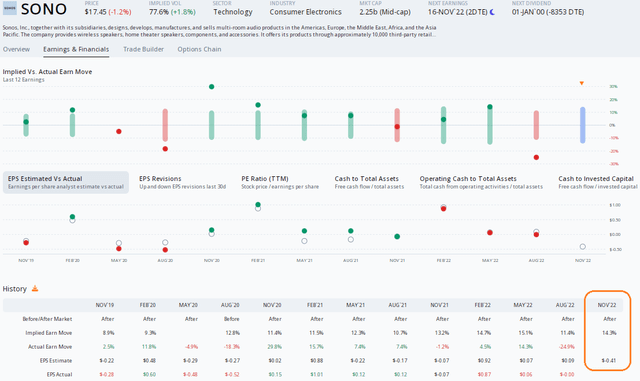

Options Research & Technology Services (ORATS) show a consensus EPS figure of -$0.41 which would be a steep decline from just -$0.07 of per-share losses seen in the same period a year ago. The bears point to Sonos missing estimates in the last three quarters, though the bulls can look at a generally positive trend in how the stock price moves post-earnings – higher in six of the last eight reports.

Catching my eye is the exceedingly high implied volatility. ORATS options data show a 14.2% implied stock price swing post-earnings using the nearest-dated at-the-money straddle – that seems fair given two major moves in the previous pair of quarterly reports. Traders should take caution with aggressive bets given the stock’s high volatility.

SONO: Big Implied Volatility, Strong Post-Earnings Stock Price History

ORATS

The Technical Take

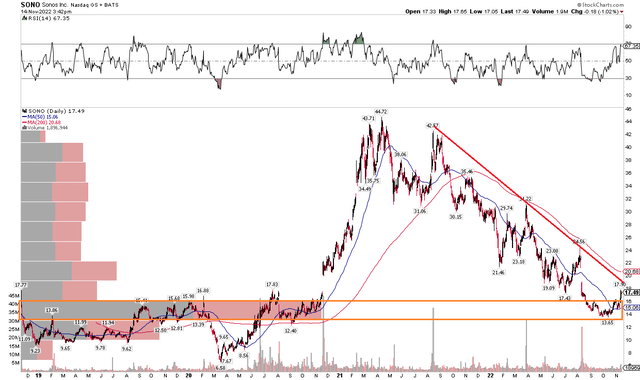

SONO has fallen sharply back to key support in the $13 to $15 range. Notice how the volume-by-price indicator on the left shows a tremendous number of shares traded in that range. Sure enough, the stock found its footing in that zone. I see resistance, though, in the $20 to $21.50 area – the early 2022 lows and where the falling 200-day moving average lies. After a big move lately, the chart might be suggesting caution as well.

I would hold off technically on the stock until a move above $21. Traders can also buy on a dip to $14-$15 with a stop under the October low.

SONO: Shares Find Support Within A Downtrend

Stockcharts.com

The Bottom Line

Sonos’ valuation is not overly compelling given the very weak growth seen next year. I think the stock will be a legitimate value case soon, but we are not there yet. Traders can play a few levels, but long-term investors should hold off for now.

[ad_2]

Source link