[ad_1]

The market action in August has been fast and furious, with the summer rally screeching to a halt over the past week. We’re seeing a resurgence of the theme that was present earlier in the year, with defensive sectors outperforming while technology and growth lead the downside. Bond yields have shot back up, while energy names are holding up well after retreating earlier in the summer.

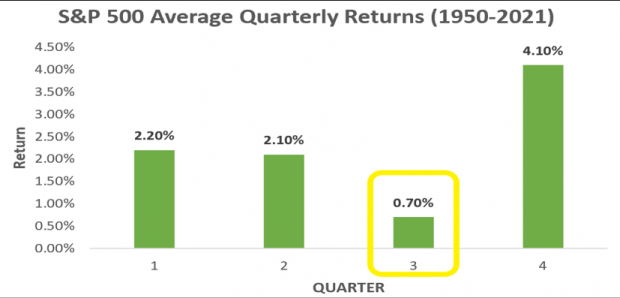

We’re also heading into the dreaded month of September, which has been the worst month in midterm years (down an average -1.14%) dating back to 1928. And as we can see below, the third quarter is historically the weakest time of the year, averaging a measly 0.7% dating back to 1950. The unfavorable seasonality combined with an overall volatile midterm year may spell trouble in the weeks and months that follow.

Image Source: Zacks Investment Research

That’s why it’s so important to be extremely selective with individual stock purchases, targeting only the strongest stocks that are in the most powerful uptrends. Identifying leading stocks can help us weather the volatility and include names with the best profit potential. Let’s take a look at a highly-rated stock that is defying the odds and making new 52-week highs in this treacherous market environment.

A Zacks Rank #1 (Strong Buy) Stock

World Wrestling Entertainment (WWE – Free Report) is an integrated media and entertainment company. WWE is engaged in the production and monetization of video content across various platforms, including the WWE network, broadcast and pay television, and digital and social media. Live events generate revenues through the sale of tickets as well as travel packages. World Wrestling Entertainment is also involved in the merchandising of branded products such as video games, toys, apparel, and books.

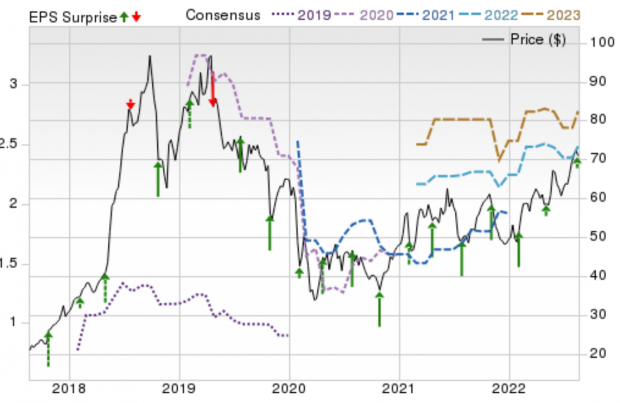

WWE has surpassed earnings estimates in each of the last four quarters. The global media giant most recently announced Q2 EPS last week of $0.59/share, a 5.36% beat over the $0.56 consensus estimate. WWE has delivered a trailing four-quarter average earnings surprise of 30.93%, pushing shares over 45% higher in the past year.

Image Source: Zacks Investment Research

Analysts are in agreement in terms of earnings revisions and have been raising estimates across the board. The full-year EPS estimate has been increased 4.18% in the past 60 days. The Zacks Consensus Estimate now stands at $2.49/share, reflecting potential growth of 17.45% versus last year. Sales are expected to climb 18.61% to $1.3 billion.

Employing a process that identifies leading stocks can help investors navigate this market. Make sure to keep an eye on WWE as we head further into a historically weak third quarter.

[ad_2]

Source link