[ad_1]

bymuratdeniz

The oil and gas sector has been experiencing a cash flow bonanza in the last year and a half, reaping the benefits of years of underinvestment, strong rebound in demand after the COVID-19 lockdowns and geopolitical turmoil. However, high energy prices are not good for the rest of the economy, as operating costs are rising, pushing inflation upwards. In light of that many politicians, instead of adopting policies to incentivize more supply, decided to reach deeper into the pockets of oil and gas companies by introducing windfall taxes. In this article I’ll discuss the chances of that happening in the US and the opportunity of investing in the US oil and gas sector through a single instrument – the Energy Select Sector SPDR ETF (NYSEARCA:XLE).

High oil prices are here to stay

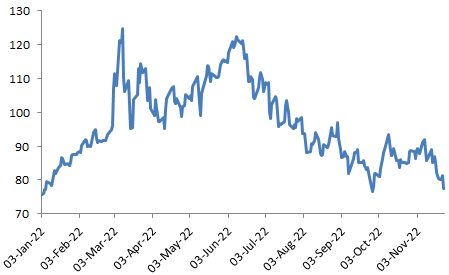

WTI crude oil prices began 2022 in the mid-US$70 range, but quickly jumped well within the triple digit area on the back of continued demand recovery as well as the Russian invasion in Ukraine. In order to counterbalance those effects, the US government took the decision to release an unprecedented amount of oil from its Strategic Petroleum Reserve (SPR). The drawdown of the SPR inventory for the period March-November was more than 180M barrels, which equates to around 0.75Mboe/day of additional supply for the 8 month period. In addition, China, which is the biggest importer of oil, still maintains its COVID-zero policy by strict lockdowns, which supress energy demand. These factors have led to gradual fall of oil prices to nearly the levels from the beginning of the year as WTI closed on 23 November around US$78/barrel.

WTI price (US$/barrel) (prepared by the author with data from Investing.com)

However, now the SPR is out of the equation as part of the supply side and even may enter the demand side at some point in order to replenish its depleted reserves. The Chinese lockdowns couldn’t continue forever and as the country is trying to spur its slowing economy, ending the restrictions will became more of a possibility. These and other reasons why I expect oil prices to move soon to the upside again were discussed in my recent article – The Downside In Oil Looks Limited, Triple Digits May Be Hit Again.

So how investors or a speculators, who believes in the bullish thesis for oil could position themselves? One option could be long positions in instruments aiming to replicate the price of oil itself like The United States Oil ETF (USO). Another approach could be to invest in equities of oil and gas companies. The problem with that approach is that the cash flow bonanza that these companies are enjoying lately have not remained under the radar of power hungry politicians, who slapped the oil and gas sector with windfall taxes. That has already happened already in the EU and the UK as well as some LATAM countries like Colombia. So what are the chances of that happening in the US?

Windfall taxes in the US are not likely

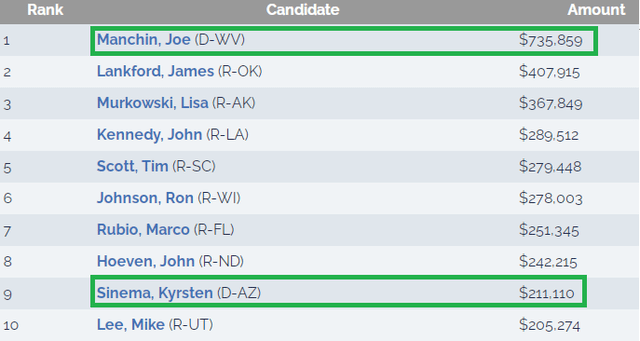

The US government is yet to follow the footsteps of its European colleagues, however the President – Joe Biden had already accused oil and gas companies of war profiteering and threatened them with windfall taxes. Nonetheless, such proposal has to pass through Congress, as the legislative body sets the tax rules. Following the mid-term elections, the Democrats have lost control of the House, but seems that control of the Senate will be maintained with a very slight 51-49 majority if the upcoming Georgia runoff is won by their candidate. However, probably not even all Democrats in the Senate would support windfall taxes on energy. It appears that in 2022, the biggest recipient of contributions from oil and gas companies amongst Senators is a Democrat, while there’s one more member of the President’s party in the top 10 beneficiaries. Therefore the oil and gas sector has some leverage with at least two Democrats from the Senate.

Donations from oil and gas companies to Senators in 2022 (OpenSecrets.org)

Turning to the economic reality and consequences of a windfall tax, the US has experience from the 1980s with such extra levies. Research papers of the effects have shown that these policies have led to decrease in domestic oil production and increased reliance on oil exports. So given the political situation and the previous experience of the US, I think it’s unlikely windfall taxes to be implemented again.

A sober look on XLE

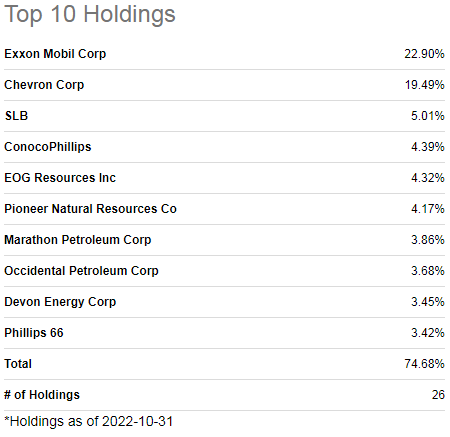

Following the implementation of windfall taxes in UK and the EU, it appears that the US and Canada are pretty much the only places with political stability where property rights are relatively strong and oil and gas companies are unlikely to be exposed to extra levies. In that regard, XLE offers investors exposure to the energy component of the S&P500 index. As of the end of Oct’22, it has 26 components, with Exxon Mobil (XOM) and Chevron (CVX) accounting for more than 42% of the holdings.

XLE top 10 holdings (Seeking Alpha)

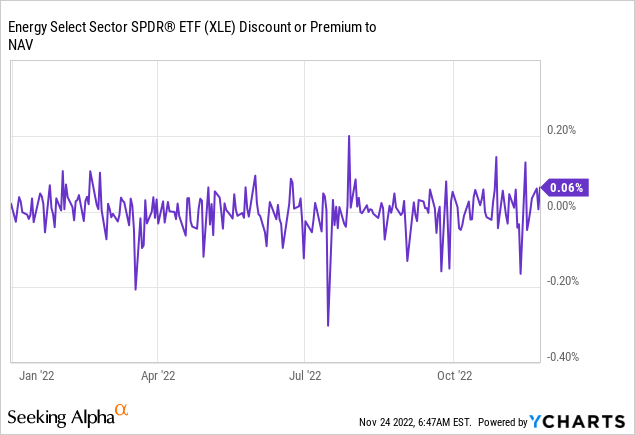

While such weighting may seem a bit too much, this is due to the fact that the index, tracked by the ETF is market-cap weighted. On the bright side, this allows for a very lean cost structure with expense ratio of just 0.11%. AUM of the ETF are about US$42.8B and due to its size and liquidity, it trades at hardly any difference to NAV.

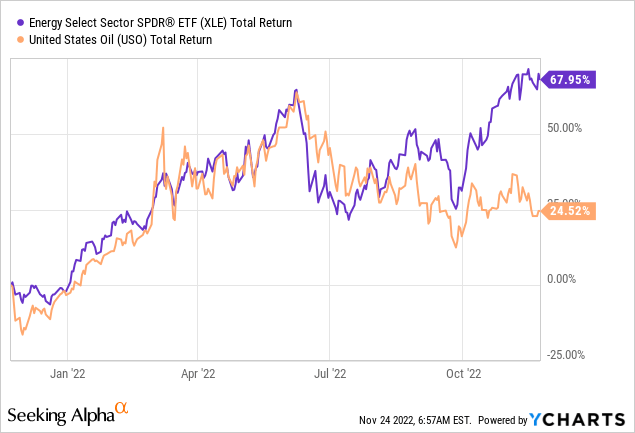

While through its holdings, the ETF provides some exposure to midstream and downstream segments, the upstream segment has the largest share, therefore should have the most influence on the pricing of XLE, through its components. In that regard, to get a grasp on the price level of XLE through a comparison with oil prices seems like a no-brainer. For the purposes of the comparison I’ll look at the performance of XLE and that of USO, which is tracking oil prices.

It appears that while XLE and USO were trading with very significant symmetry in the first half of the year, recently US oil and gas companies have decoupled and didn’t follow the recent down moves in oil prices. What’s more, while oil prices are far away from their highs from the summer of 2022, XLE is nearly at its peak. I don’t think that such divergence will persist and there are too possible ways for convergence to return. One is for the XLE to fall with a similar magnitude towards the levels of USO, while the other is for oil prices to catch up and advance to their highs, while US oil and gas equities remain mostly unchanged. Based on my bullish thesis for oil, the second option seems more likely to me, therefore I won’t rate XLE a “Sell”. That being said, I’ll refrain from rating it a “Buy”, due to the recent divergence from oil.

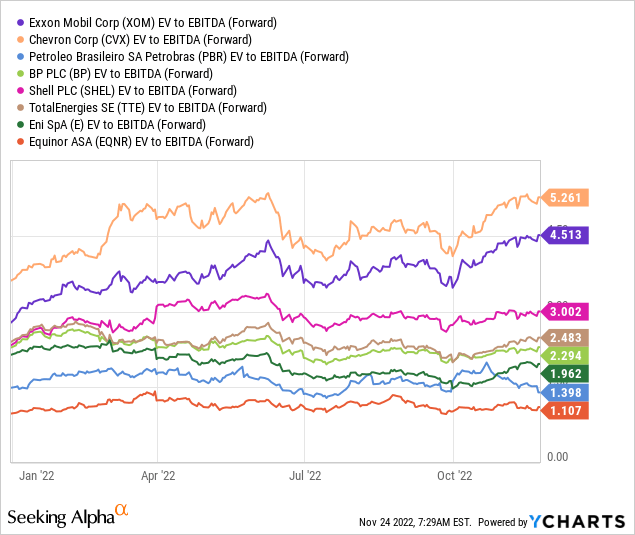

Besides, XOM and CVX, which have the largest weight in XLE are already trading at significant premium to other oil and gas majors.

Risks to the thesis

The main risks to the thesis could be twofold. On one bearish side, the bullish oil thesis for oil may not become a reality, due to for example deep recession, persistent lockdowns in China, rapid supply response or some combination of them. Furthermore even if oil prices stay at current or even slightly higher than present levels, the divergence with US oil and gas equities may disappear by the latter falling in price. On top of that, while windfall taxes don’t seem likely to be implemented in the US, that possibility couldn’t be crossed out completely. If extra levies are imposed, I’ll expect considerable contraction in the US oil and gas sector equities.

The risk to the upside is that the divergence between US oil and gas equities and the commodities themselves continues or even exacerbates, which would allow the XLE to expand the magnitude of its move to the upside, compared to USO. In such a scenario it would make sense to be long XLE.

Conclusion

XLE offers investors exposure to the US energy sector through a single, low-cost instrument. Based on the recent elections and the lobbying positions of US oil and gas companies with some Senators from the Democratic party, the implementation of windfall taxes seems unlikely. That being said, US energy equities appear to have decoupled from the recent downward move of oil prices and have remained elevated at almost their YTD peak values. On top of that, Exxon Mobil and Chevron, while having more than 42% weight in XLE, are trading at significant premium to other oil and gas majors. For these reasons, while bullish on oil, I’m not so bullish on XLE.

[ad_2]

Source link