[ad_1]

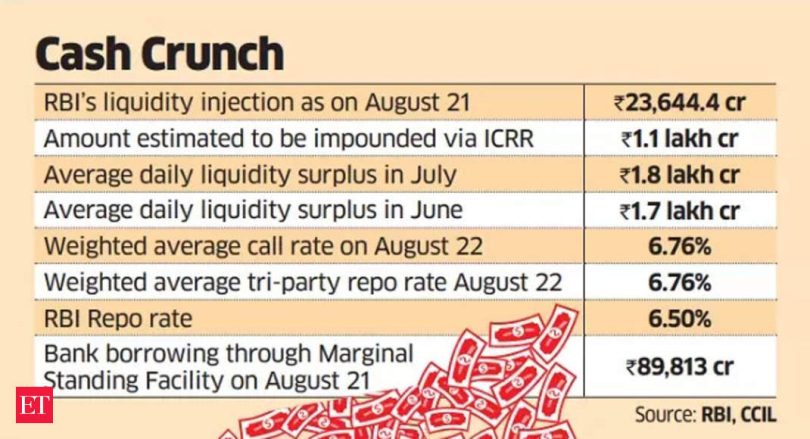

Daily central bank data showed that the RBI injected funds worth ₹23,644.4 crore into the banking system on August 21, marking the first infusion of cash since March 27. An injection of funds by the RBI reflects deficit liquidity conditions in the banking system.

In its last policy statement on August 10, the RBI announced an incremental cash reserve ratio (ICRR) of 10% that banks must maintain on the rise in their deposits from May 19 to July 28. The ICRR, which came into effect from the fortnight beginning August 12, is expected to impound around ₹1.1 lakh crore worth of funds from banks. The RBI said that it will review the ICRR on September 8 or earlier.

With the central bank having drained out a large portion of extra funds, money market rates have risen, pushing up banks’ cost of funds. Goods and services tax outflows on the 20th of the month have exacerbated the cash crunch for banks.

“When we look at the Marginal Standing Facility section under Liquidity Adjustment Facility operations in the RBI data, we see that it has gone up to ₹90,000 crore on an overnight basis,” said Achala Jethmalani, economist at RBL Bank.

“The weighted average call and triparty repo rates have gone up to the 6.75% mark, which is the upper end of the borrowing corridor. It is likely that the RBI would prefer money market rates at the higher end of the corridor because that in a way helps to curtail the rupee’s slide too and is also in line with the aim of tackling inflation,” she said.

The weighted average call rate is the operating target of the RBI’s monetary policy.

RBI Governor Shaktikanta Das said earlier this month that the decision on the ICRR was taken in light of the sharp rise in excess banking system liquidity following deposits of ₹2,000 notes with banks, foreign exchange inflows and a large surplus transfer from the central bank to the government. In June and July, the RBI absorbed close to ₹2 lakh crore worth of funds from banks on a daily basis.

“Excessive liquidity, on the other hand, can pose risks to price stability and also to financial stability,” Das said on August 10. India’s inflation surged to a 15-month high in July.

Surplus liquidity conditions typically push down the cost of funds for banks, running counter to the RBI’s aim of withdrawing monetary accommodation.

Another factor that has likely added to the tightness in liquidity is dollar sales by the RBI in the currency market in order to prevent excessive volatility in the exchange rate. The rupee touched an all-time closing low of 83.15 to the US dollar last week on August 17 amid higher US bond yields.

A foreign bank treasury executive said that the RBI may have sold around $6 billion in the spot market over the last couple of weeks. Dollar sales by the RBI drain out rupee liquidity from the banking system.

[ad_2]

Source link