[ad_1]

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. For example, the Madison Square Garden Entertainment Corp. (NYSE:MSGE), share price is up over the last year, but its gain of 13% trails the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Madison Square Garden Entertainment

Madison Square Garden Entertainment isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Madison Square Garden Entertainment actually shrunk its revenue over the last year, with a reduction of 91%. Given the revenue reduction the modest 13% share price rise over the year seems pretty decent. Generally we’re pretty unenthusiastic about loss making stocks that are not growing revenue.

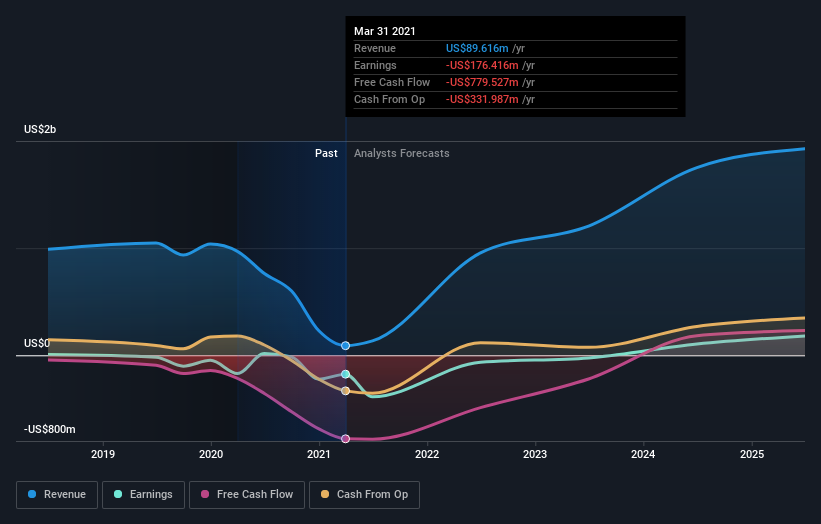

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Madison Square Garden Entertainment’s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We’re happy to report that Madison Square Garden Entertainment are up 13% over the year. The bad news is that’s no better than the average market return, which was roughly 53%. The last three months haven’t been great for shareholder returns, since the share price has trailed the market by 8.7% in the last three months. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example – Madison Square Garden Entertainment has 1 warning sign we think you should be aware of.

We will like Madison Square Garden Entertainment better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Promoted

When trading Madison Square Garden Entertainment or any other investment, use the platform considered by many to be the Professional’s Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

[ad_2]

Source link