[ad_1]

The board of Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) has announced that it will pay a dividend on the 25th of June, with investors receiving US$0.10 per share. This means the annual payment is 4.1% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Solaris Oilfield Infrastructure

Solaris Oilfield Infrastructure Might Find It Hard To Continue The Dividend

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Even though Solaris Oilfield Infrastructure isn’t generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Looking forward, earnings per share could 13.1% over the next year if the trend of the last few years can’t be broken. This means that the company won’t turn a profit over the next year, but with healthy cash flows at the moment the dividend could still be okay to continue.

Solaris Oilfield Infrastructure Is Still Building Its Track Record

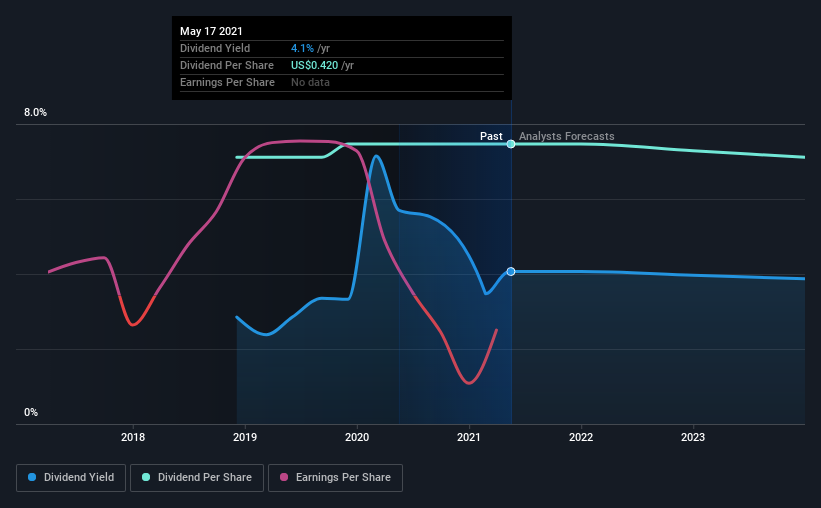

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The first annual payment during the last 2 years was US$0.40 in 2019, and the most recent fiscal year payment was US$0.42. This implies that the company grew its distributions at a yearly rate of about 2.5% over that duration. It’s good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn’t want to depend on this dividend too heavily.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company’s stock based on its dividend history. Let’s not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Solaris Oilfield Infrastructure’s EPS has declined at around 13% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Solaris Oilfield Infrastructure’s Dividend Doesn’t Look Sustainable

Overall, we don’t think this company makes a great dividend stock, even though the dividend wasn’t cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to it. We don’t think Solaris Oilfield Infrastructure is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we’ve picked out 3 warning signs for Solaris Oilfield Infrastructure that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

Promoted

If you decide to trade Solaris Oilfield Infrastructure, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

[ad_2]

Source link