[ad_1]

The Indian analytics market has seen considerable growth since Analytics India Magazine (AIM) began researching and studying the domain seven years ago. This report, which is now in its 7th year, provides insights into India’s state of the analytics industry across sectors and enterprises. The report analyses the direction in which the Indian analytics industry is headed.

The financial year of 2020-21 was not like any other since the world faced the Covid-19 pandemic, and India enforced one of the strictest lockdowns. Like every other industry, the analytics and data science industry was no exception and faced the brunt of the pandemic. Firms had to lay down their employees and freeze recruitments.

However, as the lockdown restrictions were slowly lifted, the post-pandemic world presented the analytics industry with favourable conditions that have ensured significant growth. The main factor was the increased digitisation that led to massive data resources among companies. As enterprises tracked digital transactions, consumer behaviour could be observed and analysed.

This analysis helped increase sales and improve customer satisfaction. Also, the need to avoid human intervention/contact amid the pandemic led to the accelerated adoption of intelligent automation or AI. This happened across every sector and for all business sizes. Suddenly, there was a surge in demand for an analytics workforce that could help enterprises grow in such difficult times.

The Indian analytics and data science industry will continue to grow and play a key role in decision-making across every sector and industry. The industry will also develop sophisticated and intelligent autonomous systems to help achieve tasks with greater precision, speed, and efficiency than their human counterparts.

All past reports:

2020 | 2019 | 2018 | 2017 | 2016 | 2015

OVERVIEW

As covered in our reports regarding the development of the data science domain in India, it is evident that the analytics and data science function has experienced significant growth over the last year, despite the pandemic. The rising trend in salaries across almost all parameters, the maturing of the analytics market in terms of experienced hiring and salaries offered, the significance of gender diversity in the Indian analytics function, and the $836.3 Mn investment in Indian AI and analytics start-ups in 2020, are self-explanatory in terms of the development and global standing of the Indian Analytics market.

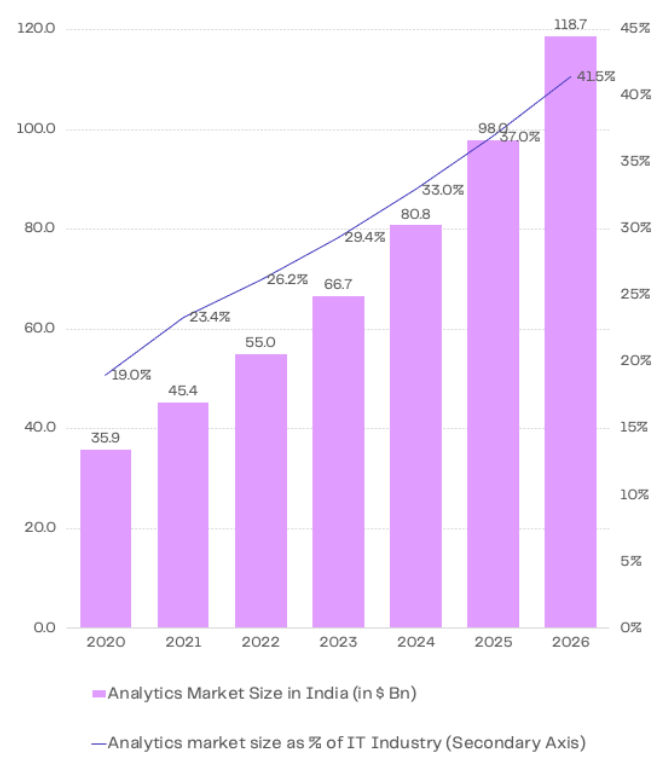

This development has facilitated the increase in the current market size of the Indian analytics industry to $45.4 Bn. This signifies a growth of 26.5% in the market size y-o-y. Last year, the analytics function garnered $35.9 Bn in size. The analytics function experienced growth across almost all companies, industry types, services rendered, and geographies.

The analytics industry will continue to grow in the coming years. However, the pandemic has impacted the scale and the scope of the analytics industry. Some of these impacts are short-term, while others have permanently changed the way analytics teams will operate. In this report, we have analysed the various characteristics of the Indian analytics industry, such as size, demographics, and employees and how they were impacted by the pandemic.

Key Highlights 2019-2020

- The market size for the analytics domain increased to $45.4 Bn in FY 2021 – a 26.5% growth in the market size over last year when it was $35.9 Bn.

- The analytics domain accounts for 23.4% of the Indian IT/ITES market size in 2021. This proportion has increased from the 19.0% share last year. With the current expected CAGRs (21.2% for analytics; 8.1% for IT), the analytics industry will contribute to 41.5% of the IT/ITES market by 2026

- The Indian analytics industry is predicted to grow to a market size of $98.0 billion by 2025 and $118.7 billion by 2026

- While the revenues generated through analytics are not published separately by most IT firms, news reports in 2020 suggest that Infosys’ analytics unit has grown into a nearly $3 billion business. and TCS said in 2018 that the firm earns $2 billion dollars per year through its analytics business

- The Banking, Financial Services, and Insurance (BFSI) sector contributes to approximately 13.9% of the total analytics market – the total includes the market share of IT/ITES and consultancy firms.

- Excluding the market share of IT/ITES and consultancy firms, the enterprises across the BFSI sector contribute 34.0% of the market size – the maximum market share.

- Bengaluru again led the way to the largest contribution to the analytics market among the major cities at 30.3%, followed by Delhi and Mumbai at 26.2% and 23.4%, respectively.

- More than half (51.6%) of the market share of analytics services to foreign countries was garnered from the US.

- The median work experience of analytics professionals in India marginally increased from 7.5 years in 2020 to 7.6 years in 2021. In 2019, the median was at 8.0.

- Mumbai has the highest median employee experience at 8.4 years in 2021, followed by Bangalore at 8.2 years. The median employee experience for Chennai increased significantly to 8.2 in 2021 from 7.2 in 2020.

- More than one in three (34.2%) analytics professionals in India are engineering graduates, and more than one in five (21.0%) are MBA post-graduates.

- 28.1% of analytics professionals in 2021 are women.

ANALYTICS INDIA MARKET PROJECTIONS

- The Analytics industry is expected to grow at a CAGR of 21.2% till 2026 – the Indian analytics market in 2026 would touch $118

- The analytics market accounts for 23.4% (increasing from 19.0% last year in 2020) of the entire IT/ITES industry in 2021. This share is expected to increase and would account for 41.5% of the Indian IT industry by 2026.

SECTION 1: SECTOR-WISE MARKET DISTRIBUTION

The IT sector remains the top contributor (43.0%) to the analytics industry market in 2021. However, this is a considerable drop from the contribution in 2020. This drop can be mainly attributed to the increase in the analytics market share of other sectors. As domain-specific enterprises realise the significance of AI and data science, they have increased their investments to hire analytics talent.

Within the IT sector, Tata Consultancy Services is the leading contributor to the analytics market in 2021, as it was the year before. This is followed by Accenture, Infosys, Cognizant, Wipro, IBM, Capgemini, Oracle, Microsoft, and Fractal. Together, these ten firms contribute to 41.3% of the analytics market share generated by the IT sector. The analytics industry’s market share is seeing a rising shift towards Indian start-ups or stand-alone firms that provide analytics-as-a-service.

After IT, the BFSI sector had the second-highest analytics market share at 13.9%, highlighting the continued investment in analytics capability, personnel, and technology in this sector. This was followed by the Engineering & Manufacturing sector at 6.9% and Retail & E-commerce at 5.9%.

- Excluding the IT and consulting sectors, the BFSI sector contributed to 34.0% to the analytics market size in 2021. This is the largest contribution when the IT and Consulting sectors are excluded. The BFSI sector is followed by Engineering & Manufacturing at 16.9% and Retail & E-commerce at 14.4%.

- Enterprises in the BFSI and the E-commerce sector have heavily invested in analytics in the past couple of years. While the number of analytics professionals working in the sector increased considerably, the two sectors observed a marginal change in their analytics market share. This is mainly because both of them adopt analytics at an early stage of operations set-up.

- The Engineering & Manufacturing sector came to a complete halt due to the lockdown enforced amid the pandemic. As the industry realised its heavy dependence on its labour, it felt the need for establishing digital continuity in its value chains. Apart from that, Industry 4.0 has also made significant progress in recent years with IoT, cyber-physical systems, and cloud technologies enabling data collection in various ways. Hence, an increase in analytics adoption coupled with the latest technological advancements made the Engineering & Manufacturing sector the second-highest contributor to the analytics market.

- Pharma & Healthcare stood fourth with an 8.0% contribution to the analytics market. Many firms within the sector ramped up their hiring to build applications that could automate narrow AI tasks or develop AI chatbot consultants to assist the healthcare staff that were already stretched for resources due to the pandemic. Pharma companies hired analytics professionals for data analysis in clinical trials or drug repurposing for Covid treatment.

SECTION 2: CITY-WISE MARKET DISTRIBUTION

- Bengaluru continues to lead as the centre of analytics – enterprises in this city contributed to 30.3% of the analytics market in 2021, up from 29.4% last year.

- Bengaluru’s reign as the analytics hub for MNC and Domestic IT enterprises continues this year. Moreover, the city has emerged as a start-up hub after seeing significant investments in start-up ventures in the last few years. The combined funding of the startups based in Bangalore was $535.1 Mn or 64% of the cumulative funding in 2020 – more than the start-up funding of all the other cities combined.

- Bengaluru is followed by Delhi, hosting enterprises that make up 26.2% of the analytics market share, slightly up from 25.3% last year.

- Mumbai remains third in terms of its analytics market share. It has seen a significant increase of almost six percentage points to contribute 23.4% in 2021 (up from 17.6% in 2020)

- The sector-location niche of Mumbai continues to remain as many of the analytics functions of the BFSI captives, Investment Banks, Domestic consumer firms, and Consulting enterprises are based in this city.

- Hyderabad and Chennai contribute 9.7% and 8.1% of the analytics market, respectively.

- Pune’s market share fell significantly to 2.4% in 2021, down from 10.2% in 2020

SECTION 3: GLOBAL GEOGRAPHY-WISE MARKET DISTRIBUTION

While outsourced analytics market sizes were not reported by many IT firms, the market share by geography was determined through other secondary research sources, including whitepapers and case studies.

- The share of analytics services by geography indicates services to the USA garnered 51.6% of the market size in 2021, down by 5.0 percentage points compared to last year.

- The share from the UK focused services garnered 13.2% of the analytics market size, up from 9.7% last year.

- Market share from Australia and Canada comes in third and fourth at 8.3% and 6.4%. Analytics services to the European countries of Netherlands and Germany garnered 3.4% and 3.0% of the market share.

- The rest of the world contributed 14.1% market share in 2021, slightly higher than the 13.1% in 2020

SECTION 4: COMPANY SIZE AND EMPLOYEE DISTRIBUTION

The distribution of employees across company size brackets indicates a concentration of personnel across two main categories – the startup or niche analytics category (1-200 employees) and the large-scale enterprise category (10000+ employees).

- A greater percentage of employees are joining enterprises that provide stand-alone analytics-as-a-service to their clients. This includes Indian startups and enterprises that are approaching unicorn status (unicorns – privately held startup enterprises that are valued more than $1 Bn)

- This rising trend has resulted in the highest percentage (35.5%) of employees working for enterprises with 1-200 personnel in 2021, up from 30.1% in 2020

- The percentage of employees working for enterprises in the 10000+ employee category was the highest in 2020 at 39.9%. This figure has dropped by more than 10 percentage points to 29.8% in 2021

SECTION 5: DEMOGRAPHICS OF ANALYTICS PROFESSIONALS IN INDIA

- The median work experience of analytics professionals in India marginally increased from 7.5 years in 2020 to 7.6 years in 2021. In 2019, this median was at 8.0.

- The drop in the median age from 2019 to 2021 implies a greater attraction of the analytics domain to the IT workforce, who are choosing analytics over other IT professions/functions. Nonetheless, this does not imply that experienced people are not joining the analytics workforce from other domains.

- The percentage of freshers or analytics professionals with less than one year of experience dropped to 3.9% in 2021 from 4.6% in 2020. This was a result of tech firms freezing their recruitment drives due to the budget cuts amid the pandemic. Almost two in five (39.2%) of analytics professionals in India have work experience of fewer than 5 years.

- Mid-career professionals with work experience between 5 to 10 years make up 36.7% of the analytics workforce in 2021. Most of these professionals have worked in the analytics domain, since the start of their careers, and are now working as managers to head analytics teams.

- Experienced professionals with more than 10 years of work experience constitute 24.1% of the analytics workforce, many joining from sector-specific domains including FMCG, Telecom, and Industrials. Many of these are science and technology professionals upskilled to work as senior managers/head of analytics divisions.

City-wise Median of Years of Experience

- Mumbai, same as last year, has the highest level of median employee experience. It increased slightly from 8.1 years in 2020 to 8.4 years in 2021

- Since these firms need domain expertise, enterprises in Mumbai observe a relatively lower influx of freshers in their analytics function.

- Bangalore maintained 2nd place with the median employee experience at 8.2 years in 2021, a considerable increase from 7.5 years in 2020.

- Numerous niche Analytics firms, start-ups, and MNC & Domestic IT firms have their operations centres in Bengaluru. This has resulted in personnel with considerable experience managing the analytics functions for global and local clients – this has pushed the average experience of Bengaluru to the 2nd spot.

- Chennai saw the highest increase in its median employee experience. The median increased from 7.2 years in 2020 to 8.2 years in 2021. Pune also saw an increase of 0.5 years, with median employee experience at 7.6 years in 2021.

- The increase in the median employee experience in these two cities results from experienced professionals moving back to their hometowns amid the pandemic. The younger demographic stayed back in the cities they are working in. The lack of fresh hires further adds to the median figure.

Percentage of Women in Analytics

- The participation of women in Analytics stands at 28.1% in 2021, slightly higher than the participation recorded last year (27.8%). This is the highest proportion recorded ever since AIM began researching the domain. Nonetheless, there is significant room for growth and improvement.

- Women Analytics employees are still new in the workforce in India, with a median employee experience of 6.3 years compared to 7.6 years for the entire Analytics workforce in India.

- Similarly, as of 2021, the median salary for women in Analytics is 24.7% lower than the entire analytics pool (10.1 Lakhs v/s 13.4 Lakhs).

- Here, the bias of lower salaries offered to women employees for a given set of experience and skillset needs to be addressed by Labour Department at the Centre and State levels and industry organisations, including NASSCOM and FICCI.

Distribution of Analytics Professionals by Education Level

The professionals in the Analytics industry come from diverse educational backgrounds. As the pool of professionals has significantly grown over the last few years, the diversity of educational backgrounds has also widened.

- Engineering graduates make up more than a third (34.2%) of the analytics professionals working in Indian firms in 2021 – highest amongst all educational qualifications. Of these engineering graduates, 6.5% have graduated from top-tier institutes like the IITs, NITs, BITs, etc.

- Postgraduates with a Master’s in Business Administration (MBA) make up 21.0% of the professionals working in analytics. More than one in five (21.3%) of these MBA post-graduates are from top-tier universities like IIMs, XLRI, NMIMS, SP Jain, etc.

- As a percentage of the total analytics professionals, only 5.8% are engineering graduates or MBA post-graduates from the top-tier universities.

- Non-engineering graduates make up 30.4% of the analytics professionals. Non-MBA postgraduates make up 12.2% of the analytics professionals.

- 2.1% of the analytics professionals have completed their PhDs/PPGs

CONCLUSION

The market size for the analytics domain increased to $45.4 Bn in FY 2021 – an increase of 26.5% from FY 2020. This indicates the strength of the Indian analytics domain as a whole and its talent pool. Despite the lay-offs amid the pandemic, the net demand for the analytics workforce in India continued to grow through 2020 and 21 and will continue to grow in the coming years.

An increase in digitisation amid the pandemic has amassed significant volumes of data resources. Firms are using these resources to analyse consumer behaviour to improve sales, production, and customer satisfaction. AI/ML further strengthens the analytics function. With the growing importance of automation to reduce human intervention/contact in the post-pandemic world, AI/ML is being leveraged by many firms across the industry.

Excluding the IT and Consulting sectors, the BFSI sector continues to have the highest market share at 34.0%. This was followed by the Engineering & Manufacturing sector that observed a considerable increase in its contribution (6.9% in 2020 to 16.9% in 2021) to the analytics market. In terms of cities, Bengaluru again emerged as the destination with the highest market share at 30.3%, indicating the location’s appeal in terms of analytics talent and ecosystem. With fresher recruitment drives halted by companies, amid the pandemic, the median years of experience among analytics professionals increased across cities. The highest increase was seen in Chennai from 7.2 in 2020 to 8.2 in 2021.

Finally, given the growth in Digital and Online segments across not just the Indian IT industry but also other sectors, including Media & Entertainment, Retail & E-commerce, FMCG, and Telecom, the Indian analytics market is expected to grow at 21.2% CAGR till 2026. This will see the analytics market account for 41.5% of the IT/ITES industry.

Please find the full 46-Page Report attached below:

To know more about our research capabilities, visit AIMResearch.

[ad_2]

Source link