[ad_1]

| A wind farm in Spain. Several renewables IPOs are planned in the country. Source: BayWa r.e. |

Spain’s Acciona SA is sticking to a plan to list its renewable energy subsidiary by the end of June despite a decidedly downbeat picture for recent renewables IPOs in the country.

José Ángel Tejero, Acciona’s CFO, confirmed the company’s intention to take its green energy business public during an earnings presentation May 7, two days after another Spanish renewables producer shelved its planned IPO due to share price volatility in the sector.

The company, Opdenergy Holding SA, said in a stock market filing on May 5 that it was postponing a listing, in which it was looking to raise around €375 million, because of “challenging market conditions,” in particular for renewable energy companies. Orders for the stock had been coming in slowly, according to Reuters, citing a source familiar with the matter.

Opdenergy’s announcement came after Grupo Ecoener SA, another renewables producer based in Spain, saw its share price slip 15% on its first day of trading May 4. Shares in the company have since recovered to slightly above the listing price.

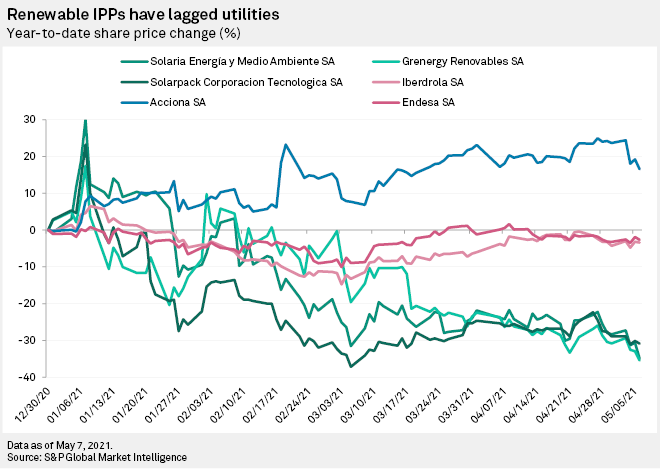

Investor appetite in specialized renewable energy producers has flagged this year after a rally in 2020 drove up prices across the industry. In Spain, pure-play solar developers like Solarpack Corporacion Tecnologica SA and Solaria Energía y Medio Ambiente SA have lost around 30% of their value so far in 2021, while diversified utilities that also own grid networks and other ventures, such as Endesa SA, have been more stable.

Acciona, which also has a broader infrastructure business, has outperformed both segments, seeing its share price climb about 17% so far this year. The company plans to spin off and list shares of Corporacion Acciona Energias Renovables SL, the parent company of its renewable energy subsidiary Acciona Energia SA, which is active in Spain, the U.S. and more than a dozen other countries.

“We remain committed and very excited about the opportunity to present to the market Acciona Energia as a stand-alone, pure-play renewable energy leader,” Tejero told analysts on the call. The new company, he said, is “determined to be one of the winners in this huge growth opportunity that lies ahead, driven by decarbonization.”

Shareholders approved the plan for the IPO in April, two months after it was first announced. Acciona intends to free float at least 25% of Acciona Energías Renovables’ capital and wants to maintain a stake of 70% following the transaction. A date for the IPO has not been set yet, although Acciona said the IPO is “on track for completion” in the first half of the year.

Tejero said Acciona already capitalized €1.8 billion of intragroup loans during the first quarter, which he said should allow Acciona Energia to hit its spending targets while maintaining an investment-grade credit profile.

The company’s energy business saw first-quarter sales grow by a fifth year over year, with EBITDA up by 22% to account for 82% of the wider group’s earnings. Acciona invested €760 million in the energy unit during the quarter, more than twice the prior-year volume, although Tejero said the following quarters should see lower investments.

Acciona Energia has 280 MW of wind and solar plants under construction and expects to break ground on another 1,600 MW this year, adding to an installed capacity that surpassed 11,000 MW in the first quarter. The company wants to almost double its renewables capacity to 20,000 MW by 2025, focusing on its largest markets: the U.S., Australia, Spain, Chile and Mexico.

Acciona Energia’s listing is set to be followed by additional renewables IPOs in Europe, as major companies seek to capture a growing volume of sustainability-linked investments and capitalize on enthusiasm around climate targets in many countries. Spanish oil and gas producer Repsol SA is considering a listing for its low-carbon business and the board of Eni SpA, another oil company, recently approved a similar plan for 2022.

[ad_2]

Source link