[ad_1]

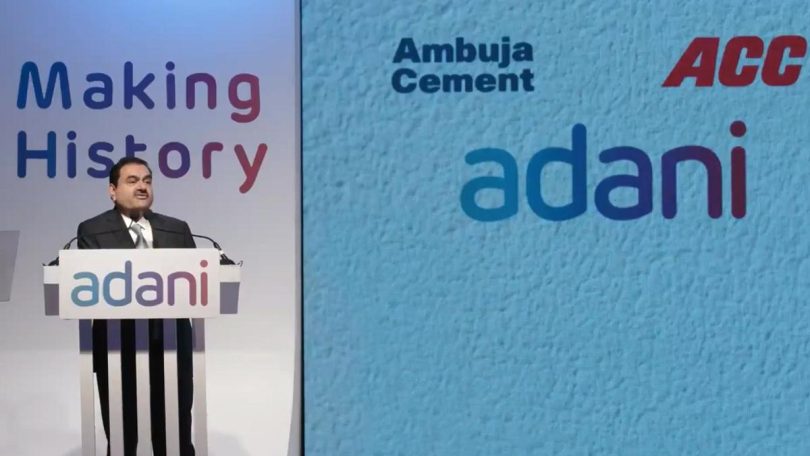

Gautam Adani’s intent to have a big play in cement business is obvious with the conclusion of Adani Group’s deal to acquire Ambuja-ACC. The more interesting announcement was the board of Ambuja Cements approving an infusion of Rs 20,000 crore into the company by a preferential allotment of warrants. Industry trackers see this is a clear intention to acquire more cement assets, especially the relatively smaller ones, whose cost structure and market share could now come under stress.

In terms of pecking order, the leadership position continues to be held by UltraTech at 120 million tonnes per annum (mtpa), with the Ambuja-ACC combine at 67 mtpa. For a while, the latter’s strategy in India, under the ownership of the Swiss major, Holcim, was marked by a lack of aggression either to increase capacity on its own or to acquire any assets. That could well change under the Adani Group, its new owner, with the intention to put in more money.

“This is a clear message that the group is ready with a war chest for more acquisitions in the cement sector,” says Mahesh Singhi, Founder & MD, Singhi Advisors, an M&A advisory firm. To elaborate on the point, he explains that the planned infusion of Rs 20,000 crore is merely equity. “They can easily have a debt equity ratio of 1:2 and that means a total sum of Rs 60,000 crore at their disposal. When you have access to that kind of cash, there are many options available.”

Analysts tracking the sector say the Adani Group is well-positioned with a presence in logistics, power and ports, with cement now bolstering the overall infrastructure play. “They now have the opportunity to offer an integrated services offering and that can be done in a cost-efficient manner,” says one at a domestic brokerage and a long-time cement industry tracker. To him, it is logical for the group to now look at smaller players such as Nuvoco Vistas (capacity of 25 mtpa), India Cements (15 mtpa) and Sanghi Cement (6 mtpa). “Over time, smaller players will find it hard to beat the cost structure of the biggies like UltraTech and Ambuja-ACC.”

In terms of capex, a greenfield cement plant with a capacity of 1 mtpa involves an outgo of Rs 700-800 crore and if it is only a grinding facility, the investment will be Rs 200-250 crore. Understandably, acquiring an existing asset will be more expensive but gives the Adani group immediate access to a market and brand.

Singhi says the Adani group has made it clear that increasing capacity in cement is the objective. “To that extent, it is only natural that inorganic growth is the way to go about it,” is his view, given the time taken for a greenfield cement project in India. Deven Choksey, MD, K R Choksey Securities, points out the strategy could involve looking at the transition from just construction to a larger opportunity in building materials. “This includes pre-construction slabs and with the government’s huge outlay on infrastructure, there is a serious opportunity. There is no doubt that the preferred route for Adani group’s cement expansion will be through acquisitions,” he says.

Also read: Karan Adani gets two key posts in the Adani Group’s newly acquired cement business

Also read: Own Adani Enterprises in your portfolio? Here’s how much inflow it may see after addition in Nifty 50

[ad_2]

Source link