[ad_1]

In a reversal of trend, almost 50% of home buyers prefer buying 3BHK homes and 38% favor 2BHKs. As many as 75% of property seekers now want balconies. That’s not all, as many as 58% millennials and 39% Gen-X potential buyers intend using their gains from other investments to purchase homes, a FICCI-Anarock Consumer Sentiment Survey (H2 2023) has said.

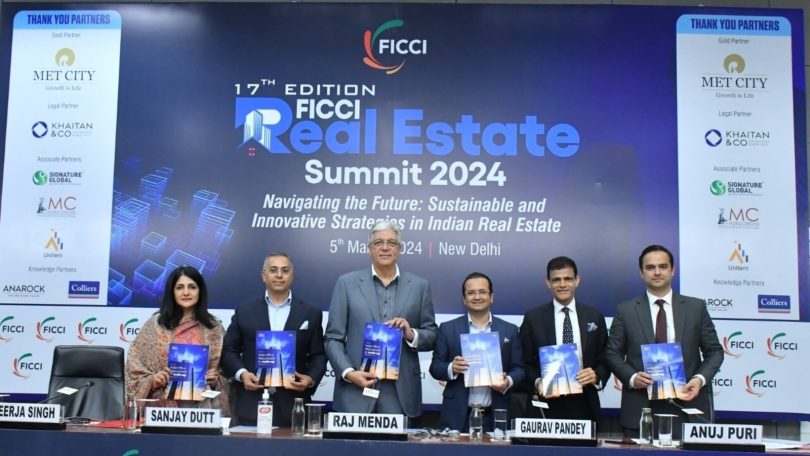

The survey that was unveiled at the FICCI Real Estate Summit held in the Capital on March 5 found that demand for 3BHKs stood at 42% in H2 2022 edition of the survey. The survey was conducted by ANAROCK Research between July to December 2023 with approximately 5,510 online respondents from across Indian geographies and age groups.

Bigger apartments in demand

Despite increasing property prices, the demand for bigger apartments continues unabated and is, in fact, increasing. 3BHKs are particularly in vogue in Bengaluru, Chennai, Hyderabad, and Delhi-NCR. In hyper-pricey MMR, 44% of respondents preferred 2BHKs. The demand for 1BHK units is being primarily evident in the western markets of MMR (17%) and Pune (10%), it said.

Also Read: Relief for homebuyers: Allotted flats will not be part of liquidation process, says insolvency and bankruptcy board

Aligned to the growing preference for bigger apartments, the demand for luxury homes priced more than ₹1.5 crore has also gained traction. At least 20% of the H2 2023 survey respondents prefer to buy homes in this price bracket, against 12% in H2 2021. The ₹45-90 lakh budget range remains the most popular, with over 33% prospective homebuyers favoring it, the survey observed.

Affordable housing demand shrinks

Affordable housing demand has shrunk further, to 21%20. in H2 2023 from 25% in H2 2021, and 40% in H2 20

Also Read: Signature Global aims high with more than ₹12,000 crore project pipeline in Gurugram amid demand for premium housing

“The supply of bigger homes is seamlessly following the demand for them. ANAROCK data indicates that average flat sizes in the top 7 cities grew by 11% annually last year – from 1,175 sq. ft. in 2022 to 1,300 sq. ft. in 2023. The survey also finds that for the first time, the demand for ready-to-move homes is lower than new launches. The survey highlights that in H2 2023, the ratio of ready homes to new launches is 23:24 against 32:24 in H2 2021. Interestingly, it stood at 46:18 back in H1 2020,” said Anuj Puri, chairman, ANAROCK Group.

Also Read: Delhi-NCR’s real estate market: Here’s why rich Indians are lapping up luxury properties

The survey further highlights the growing inclination of homebuyers towards suburban areas and city centers, in line with the return to office (RTO) dynamic being witnessed post the COVID-19 pandemic. 30% of respondents in the current survey (H2 2023) chose suburban areas as their first choice for buying a home, against the 25% who preferred suburban areas in H2 2021.

The survey also found that 75% property seekers want balconies. The desire for more open spaces within homes is a significant change from earlier years when the focus was more on dedicating almost every square inch for indoor utilization.

Investors back in the market

More investors are now backing residential real estate – in H2 2023, about 36% prospective buyers will purchase properties as investment.

Over 73% survey respondents state that their home buying decision will not be impacted if home loan rates stay below 8.5%. Inflation is not impacting disposable income as much as it did in the previous year’s survey – in H2 2023, 55% participants felt a notable impact of inflation, down from 61% in the H2 2022 edition, the survey found.

Over 57% respondents now consider real estate as the best investment option, followed by the stock market which is favored by 29% in the current situation. In contrast, preference for gold witnessed a meagre rise, although ranking at the bottom of respondents’ investment options despite the surging gold rates. Currently, only 6% respondents view gold as their preferred choice for investment, the survey found.

Millennials wish to cash out from the stock market to buy their first home

“As many as 57% of consumers prefer investing in real estate. It’s interesting to note that 58% of millennials wish to cash out from the stock market to buy their first home. They would prefer taking a house on rent earlier. Another takeaway from the survey is that 25% buyers wish to buy a home at the time of launch, 25% at the time completion and 50% during the duration of the project. This is now evenly spread,” Puri said at the FICCI event.

Office leasing expected to cross 50 mn sq ft market in 2024

Another report on the office market titled ‘India Office – Repurposed to Scale Up’ by FICCI-Colliers was released at the event. It noted that office leasing is expected to cross 50 mn sq ft in 2024 yet again, a new normal for India office leasing. Domestic enterprises are expected to account for over half of the office demand during 2024 and that global capability centers are expected to gain further ground accounting for over 40% of the total office demand.

Flexible office space are expected to drive about 15-20% of the overall leasing in 2024. Also, large-sized deals of 100,000 sq ft or more are projected to account for 50-55% of 2024 leasing activity, the report said.

“The government’s increased spending on the infrastructure sector, stable policy regime, and commitment to providing housing for all are not only helping the real estate sector’s growth but also accelerating the growth momentum,” said Raj Menda, Chairman of the FICCI Committee on Urban Development and Real Estate and Chairman of Supervisory Board, RMZ Corporation.

Also Read: NBCC sells 2 lakh sq ft commercial space in South Delhi’s World Trade Centre for ₹828 crore

“With the growth in infrastructure, the real estate sector will find new avenues for expansion. The office market in 2023 witnessed gross absorption of 58. 2 bn sq ft across leading six cities and supply is likely to increase to bn sq ft by 2030. Co-working segment has witnessed 53.4 mn sq ft inventory distributed over a 1000 centers across the country. This number is expected to surpass 81 mn sq ft within the next two years. The luxury retail segment is attracting foreign investment in the sector. Despite the slowdown in commercial real estate in many parts of the world, global capability centers are witnessing exponential growth in the country and this opportunity is expected to grow year-on-year. Retail malls have also experienced a significant increase in rents,” he said.

Gaurav Pandey, co-chairman, FICCI Committee on Urban Development and Real Estate and Managing Director and CEO, Godrej Properties noted that there has been an explosive growth of Indian wealth, particularly in equities and gold, and pointed out that this has had an impact on the residential real estate sector.

[ad_2]

Source link