[ad_1]

Regional banks that lend into the oil and natural gas sector say they are increasingly active as producers borrow to invest in growth amid enduring strong demand for fossil fuels.

To be sure, national banks such as JPMorgan Chase and Well Fargo & Co. have pulled back on oil and gas lending amid pressure from investors to combat climate change. At the same time, some large publicly traded exploration and production (E&P) companies, under similar pressure, have only nudged up oil and gas output this year.

[Client Collaboration: What type of additional content / information / data would you like to see more of in NGI? Tell us now.]

But others, including private E&Ps, are ramping up production this year – oil output reached a pandemic-era high in early August as a result – and regional banks in states such as Texas and Oklahoma say they are committed to supporting the industry this year and beyond.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

Oklahoma City-based Bank7 Corp., for example, said its energy loans – predominantly oil and gas – made up more than 11% of its total portfolio in the second quarter, up from 9.5% at the start of the year.

“The opportunities in the energy space are really great,” CEO Thomas Travis said during Bank7’s recent earnings call.

He said the bank is both meeting strong loan demand and gobbling market share left for the taking by the megabanks.

“And at the same time, the underwriting requirements are really strong. I’m not sure they’ve ever been stronger,” Travis said, noting that energy borrowers are in solid financial health. “The energy loan quality today is probably the best it’s been since I can remember, and the terms are really favorable for the banks. And that’s why we haven’t left the space. That’s why we’re going to continue to extend energy commitments, and we think it’s a really good strength of the company.”

He and other bankers say that, while the United States and other leading countries gradually shift to increased use of renewable energy, oil and natural gas will be needed for years to come.

What’s more, producing these fuels in the heavily regulated and technologically advanced United States is far better for the climate than shifting such work to other countries with weaker standards and capabilities, observers say.

“We can’t simply flip a switch and one day suddenly rely only on things like wind and solar,” Jacob Thompson, managing director at Samco Capital Markets, told NGI. “It’s going to be a long transition, and in the meantime, you have banks that see a need and support the idea of meeting that need here rather than betting on other parts of the world that are not as reliable.”

BOK Financial in Tulsa said its 2Q2022 energy loans grew 6% quarter/quarter, and the bank is poised for continued steady lending expansion in the oil and gas sector. CEO Stacy Kymes noted the pullback by national banks just as E&P activity is increasing.

“This has been a really historic opportunity for BOK Financial to take market share,” Kymes told analysts during a recent earnings call.

He said that, with lofty inflation and rising interest rates to combat it, much of the country is vulnerable to possible recession this year. But he thinks energy-heavy states are poised to navigate a downturn better than most, given strong commodity prices. BOK Financial lends across Oklahoma, Texas and Colorado.

The “likelihood that you could have a better regional outcome in this footprint that we are in than other parts of the country is very high with commodity prices at the level that they are today,” Kymes said.

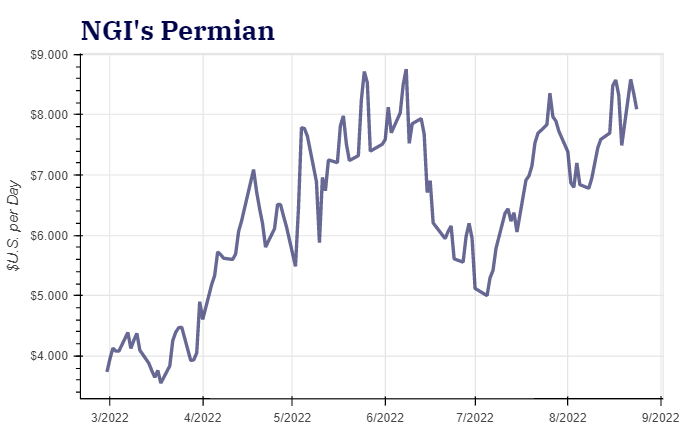

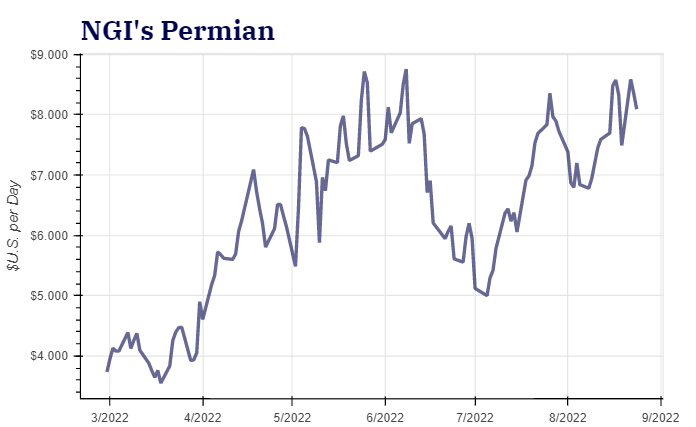

U.S. natural gas futures prices in August jumped past $9.00/MMBtu, near the highest level in more than a decade, propelled by robust global demand and supply weakness across Europe and parts of Asia. Benchmark West Texas Intermediate crude, meanwhile, declined late in the summer from its 2022 high, but it is still up more than 15% on the year.

Odessa, TX-based SouthWest Bank said the opportunity is so pronounced that it launched an oil and gas division this year. It, too, sees both solid loan demand and a void left by national banks.

SouthWest CEO Dewey Bryant said the bank hired a team of lenders that will focus on fossil fuel lending. “I am confident they will make a positive impact in our markets that will position us well in the years to come,” he said.

[ad_2]

Source link