[ad_1]

It’s been a soft week for Azorim-Investment, Development & Construction Co. Ltd (TLV:AZRM) shares, which are down 13%. But that scarcely detracts from the really solid long term returns generated by the company over five years. It’s fair to say most would be happy with 157% the gain in that time. We think it’s more important to dwell on the long term returns than the short term returns. Of course, that doesn’t necessarily mean it’s cheap now. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 43% decline over the last twelve months.

Although Azorim-Investment Development & Construction has shed ₪341m from its market cap this week, let’s take a look at its longer term fundamental trends and see if they’ve driven returns.

View our latest analysis for Azorim-Investment Development & Construction

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

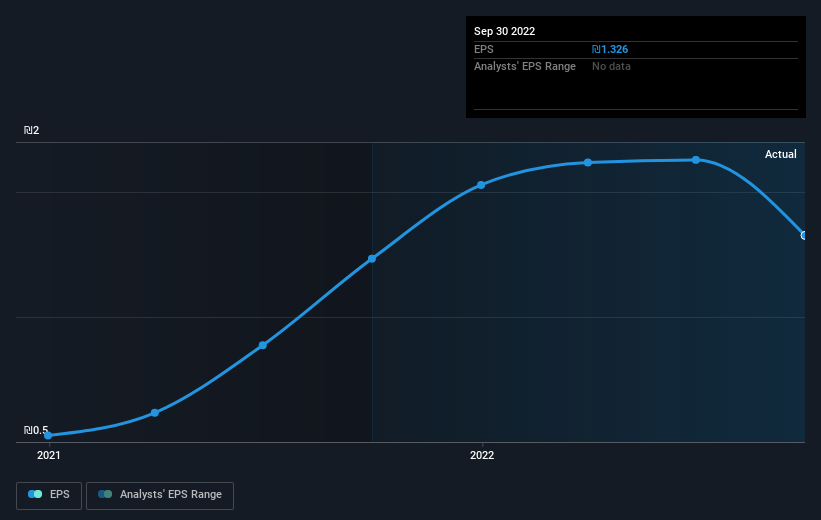

Over half a decade, Azorim-Investment Development & Construction managed to grow its earnings per share at 31% a year. The EPS growth is more impressive than the yearly share price gain of 21% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. The reasonably low P/E ratio of 8.16 also suggests market apprehension.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Azorim-Investment Development & Construction’s earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Azorim-Investment Development & Construction’s TSR for the last 5 years was 159%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 17% in the twelve months, Azorim-Investment Development & Construction shareholders did even worse, losing 42% (even including dividends). Having said that, it’s inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn’t be so upset, since they would have made 21%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example – Azorim-Investment Development & Construction has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

We will like Azorim-Investment Development & Construction better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

Valuation is complex, but we’re helping make it simple.

Find out whether Azorim-Investment Development & Construction is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link