[ad_1]

Walmart-owned Flipkart has begun a workforce reduction exercise that could see its total team size decrease by 5-7%, according to people in the know. This will be completed by March-April as part of performance reviews being conducted currently, they said.

Flipkart has been implementing these performance-based job reductions annually for the past two years. It has also frozen fresh hiring in the past year to control costs, these people said. Currently, the firm is closing $1-billion financing from Walmart and others, first reported by ET on December 21.

India’s largest ecommerce company has 22,000 employees, excluding fashion portal Myntra. “Better utilisation of resources is being planned… across businesses — existing and new,” said a person aware of the matter. The restructuring as well as the roadmap for 2024 will be discussed and crystallised at a gathering of senior executives due next month.

However, there are no plans to revisit its decision to put off its public offering for 2024, said those in the know.

Flipkart had considered launching an IPO during 2022-23, but those plans have been put on hold, at least for this year.

An email sent to Flipkart did not elicit a response on the matter.

Large Indian internet firms have been rationalising teams after they aggressively hired in 2021, aided by record fundraising amid the pandemic-induced demand for technology services.

ET reported on December 25 that Paytm laid off more than 1,000 to cut costs and realign its businesses, and would downsize workforce by 10-15%. Flipkart’s US rival, Amazon, and SoftBank-backed Meesho have also slashed jobs and restructured businesses.

Industry experts said similar moves were likely at other venture-funded Indian organisations through 2024.

Road ahead

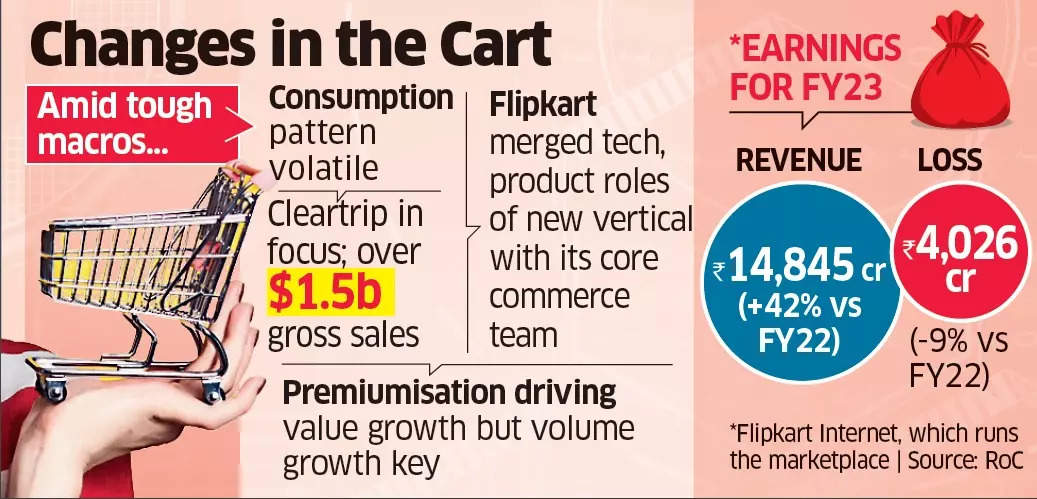

The proposed restructuring at Flipkart comes at a time when it is reassessing existing and new lines of business.

Cleartrip — in which Adani Group holds 20% — has hit about $1.5-1.7 billion in gross merchandise value, or GMV, and is expected to be one of the key areas for Flipkart. People aware of the matter said Flipkart will invest further in its hotels business. The travel portal, acquired by the group in 2021, has largely focused on airline bookings but will double down on this — adding hotels and other travel-related verticals.

Flipkart’s efforts to drive various synergies internally have been in the works for months now, people aware of the changes said.

“This has become an annual practice now. As part of the appraisal cycle, they (Flipkart) are restructuring teams. Overall business in 2023 had its ups and downs for the ecommerce industry, including Flipkart. So, corrections are being done now,” said one of the people mentioned above.

Last September, Flipkart merged key technology and product roles of its new businesses, Cleartrip (travel) and Flipkart Health Plus (epharmacy), into the core commerce team to streamline operations.

Flipkart-owned Myntra cut at least 50 jobs in July, as it wanted to focus on its top private labels.

While $600 million in new capital has come into the company from parent Walmart, as part of the ongoing $1 billion round, the senior management is looking to reduce its burn in various categories.

In February last year, chief people officer Krishna Raghavan told Flipkart’s top 30% executives that they won’t be handed out any appraisals as the ecommerce firm wanted “prudent” management of resources. Raghavan quit in October.

Old & new

Grocery will continue to be in focus and will have the group’s backing. Shopsy, the so-called social commerce business, will also be further scaled, said people versed with the strategy.

“They (Flipkart) have gained market share in the pharmacy business, but it may not see equal allocation of resources or capital,” said one person cited above. Flipkart Health Plus had 16-17% market share between October 2022 to September 2023, ET reported in November, citing Redseer internal data.

Tata 1mg had gained share during the same period, while Pharmeasy had lost share, the data reviewed by ET had shown.

Flipkart is also venturing into the fintech space through Super.money, a venture set up by senior executive Prakash Sikaria, where the etailer currently holds a majority stake and has invested $15-20 million.

Smartphones, large appliances and fashion continue to be the core of Flipkart’s business in India, but group chief executive Kalyan Krishnamurthy focused on scaling new businesses from 2022, in a bid to widen its total user base as well as diversify offerings.

[ad_2]

Source link