[ad_1]

CUHRIG

Background

Andrew Forrest – Twiggy – as insiders at Fortescue Metals know him, has had a colorful past. The visionary founder of Fortescue Metals is known for his approachable, affable manner.

One of Australia’s wealthiest entrepreneurs, the Perth born iron ore tycoon first knew a series of corporate failures in the late 90s. His resilience, drive, and pioneering approach to the mining industry has positioned Twiggy’s Fortescue Metals (OTCQX:FSUMF) as one of Australia’s lowest cost iron-ore producers. Since then, his fortune has expanded to A$27B.

With vast spanning tenements throughout the Pilbara and an armada of haul trucks, iron ore trains, and power stations, his 19-year-old iconic Australian iron-ore miner, the fourth largest in the world, now ships 180m tons of the commodity annually, fueling a Chinese industrial boom.

Under Twiggy’s strategic leadership, the company is now transitioning to a vertically integrated green energy and resources company. He has already pioneered the integration of fully automated Liebherr dump trucks to supply green mining technology with zero-emission power system technologies.

Fortescue Future Industries – his renewables venture is advancing initiatives in green hydrogen. All-in, Andrew’s Fortescue Metals provides not only strategic vision for the future with fledgling projects in sustainable energy, but he backs this with the rock-solid cash flows from a mature iron ore mining and distribution business. Hard not to be bullish.

Trading Economics

As the global economy rolled over mid-year, iron ore prices have declined, posting a -17% drop year to date.

My outlook for Fortescue Metals is bullish. The firm provides a compelling investment opportunity for any money manager looking to back ambitious projects in renewables & sustainable energy coupled with the predictability of base metal cash flows.

Notwithstanding, the company’s fortunes are very much married to China’s economic growth. Keep a close eye on spot prices for 62% fe iron ore or any sign of a post Covid Chinese reopening. Relaxing of Covid restrictions will be a likely boon not only for commodity prices but Fortescue Metals also.

Company Overview

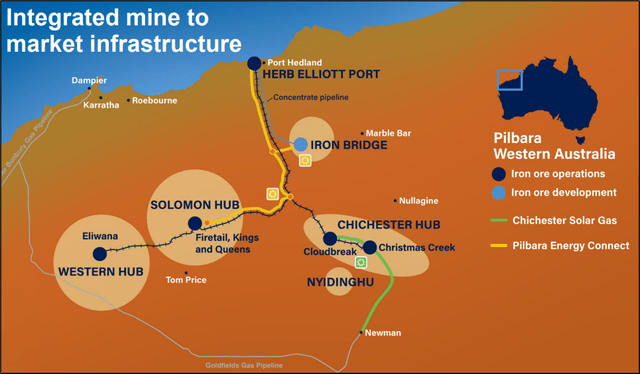

Fortescue Metals is one of Australia’s lowest cost iron-ore producers. Founded in 2003, the West Australian iron-ore staple ships ~190M tons annually from its Herb Elliot Port complex fed by Iron Bridge, Solomon Hub, Western Hub & Chichester Hub mines.

Its 189M tons shipped FY 2022 exceeded top-end guidance and posted a best-in-class cost position of US $15.91/ton. Its low-cost profile has allowed the firm to flourish even at lower price points in iron-ore spot prices.

Fortescue Metals

The company’s integrated mine infrastructure provides it with a competitive edge in terms of pricing.

Fortescue Metals occupies a strong foothold in the prolific mineral-rich Pilbara rich of Australia’s Northwest. Its mining leases are integrated via rail to a port complex for onward shipping to Asia.

Integrated logistics and clockwork like operational efficiency allows the company to maintain an ultra-competitive cost structure. The company boasts one of the largest autonomous fleet conversions in the industry with 190 remotely controlled haul trucks operating across Chichester and Solomon operations.

Fortescue Metals

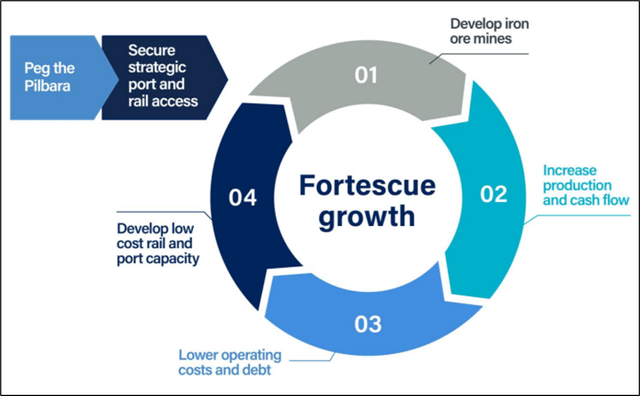

Fortescue’s strategy is underpinned by low-costs and world class operational efficiency.

Eliwana mine site construction is almost completed which will add another 30m tons per annum of dry ore processing and an additional 143km to the iron ore miner’s vast rail network.

First ore was achieved about 2 years ago – the project’s ramp-up is providing the firm additional output with low capital intensity. The Iron Bridge lease is a major iron ore growth project with JV partner Formosa.

First production is penned in for Q1 2023 with the strategic $3.6B complex delivering 67% Fe high grade magnetite concentrate. It is worth noting that Fortescue’s share of the project came is at around $2.7B.

Fortescue Metals

The company’s Iron Bridge Magnetite JV is likely to pay dividends once off the ground.

The company prides itself on its positive social change pedigree, attempting to distance itself from some of the PR horror stories the likes of Rio Tinto and BHP Billiton have navigated over the past years.

The Fortescue organization spent more than A $63M in social investment in communities with a focus on empowering Aboriginal businesses and fostering indigenous employment.

Unlike the other large Australian miners, Fortescue Metal’s brand remains somewhat unscathed from the damning reports regarding verbal and sexual abuse on mine sites and general workplace culture.

Another distinguishing factor regarding the organization is its ambitious carbon neutral goals. Under Twiggy’s stewardship the enterprise has pledged carbon neutrality by 2030, net zero scope 3 emissions by 2040 and many renewables in the company’s energy mix powering the future. The organization is working actively with vendors to decarbonize its supply chain and make operations net zero.

Fortescue Metals

Fortescue’s heavy-duty hydrogen powered dump truck prototype could be an industry game changer.

Fortescue Future Industries

Fortescue Future Industries is Forrest’s sustainable energy brainchild. The green energy and green technology company underpins the organization’s strategy to decarbonize its iron-ore mine sites and develop new green energy business lines.

Fortescue focuses on high performance battery and electrification technologies through its partnership with Williams Advanced Engineering. Hydrogen powered haul trucks are being prototyped as are renewable battery developments. The organization’s rail network has procured two new battery electric locomotives from Progress Rail Australia.

Approximately 10% of Fortescue’s net profit after tax (~US $400M-$600M) is allocated for this strategic venture. The brand manages to generate a net positive by distancing itself from the dirty old mining cachet blighting several prominent mining corporations presently.

Trading View

It has been choppy trading for the Aussie miner YTD, with price returns of only +4.6%. The firm has paid 10.37% in dividends during 2022.

Financials

The commodity behemoth has guided around 185-188m tons iron ore for FY 2022, representing circa A$25B in annual sales. The mining giant prides itself on direct engagement with customers, building long-term relationships.

Its disciplined cost structure ($15.75-$16.00 per ton) hedges the company somewhat from iron ore price volatility. Gross profit for FY2022 tallied A$14B, posting 56% gross margins. Net income was lower at A$8.97B (A$13.72B in FY 2021) The company continues to deploy capital in growth projects and strategic initiatives, to the order of A$4B annually.

Fortescue posts a market cap of A$61B, prudently holding $7.5B in cash on hand for capital expenditure, while maintaining $8B of debt. The company is a cash machine, delivering $9.6B in operating cash flow even if this is significantly lower than the year (A$16.7B FY 2021) before following the decline in iron ore commodity prices.

Not only has the company been a serial distributor of dividends, returning close to A$10B in dividends to equity holders over the past 2 years, but it has also deployed capital for stock repurchases. Those repurchases have been in the range of A$160M – A$200M annually. Liquidity is not a problem for the mining giant, even despite some economic headwinds.

The company trades at almost 10x forward earnings, with next 12 months EV to EBITDA weighing in around 5.4x. The company posts sizable returns on assets (~20%), equity (~35%) and total capital (25%).

Pricing power and a competitive cost structure furnish the company with a considerable economic moat and provide shelter from macro-economic jitters. The company has a cash conversion cycle of about 17 days – to put that into perspective, Rio Tinto (RIO) converts cash in roughly 31. Twiggy runs a tight ship.

Koyfin

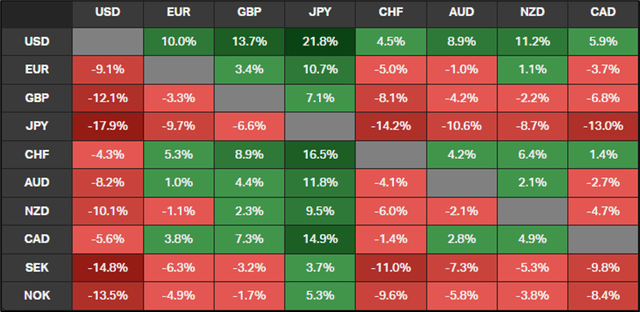

The Aussie Dollar has lost considerable ground on the Greenback during 2022 despite an economy that has not signaled tell-tale recession jitters via an inverted yield curve, unlike both the US and Canada.

Australian Dollar

For foreign investors taking a position in the Australian equity, a likely additional benefit is perhaps the Australian dollar. The Aussie took China lockdowns, an economic softening, and a relentless Fed monetary tightening regime squarely on the chin with the local currency losing about -8% against the greenback.

Expect any Chinese reopening to provide the Australian dollar with some upside, perhaps providing additional gains to US investors in the long run. The Australian economy has withstood economic woes comparably well.

Risks

The biggest risk for Fortescue Mining remains its positioning at the crossroads of Australian industry and Sino-Australian geopolitics. Mounting tensions between Australia and China have resulted in dampened trade, a trade tariff war, blocked Chinese foreign direct investment and diplomatic jostling with Pacific Island neighbours in the region.

Any continued souring of diplomatic relations is likely to weigh on Chinese imports of iron ore. A soft Chinese economy or even wholesale implosion of the Chinese real estate market would also be an extremely bearish signal.

Granted, Fortescue Metals is hedged by its appealing cost structure, but trade tensions represent not only the biggest storm cloud for the firm but also for the Australian dollar and the Australian economy.

Key Takeaways

Fortescue Mining is a standout iron ore miner, cash rich and visionary in its approach to using technology to build a world class cost structure while meeting self-imposed sustainability prerogatives.

Given the possibility of a Chinese industrial reopening, an Australian dollar perhaps primed for upside, and an upside to iron ore prices, this firm merits scrutiny for any money manager looking for positive commodities exposure. Bullish.

[ad_2]

Source link