[ad_1]

It’s common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like NVR (NYSE:NVR), which has not only revenues, but also profits. While profit isn’t the sole metric that should be considered when investing, it’s worth recognising businesses that can consistently produce it.

Check out our latest analysis for NVR

How Quickly Is NVR Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that NVR has managed to grow EPS by 27% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of NVR’s revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that NVR is growing revenues, and EBIT margins improved by 4.2 percentage points to 21%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

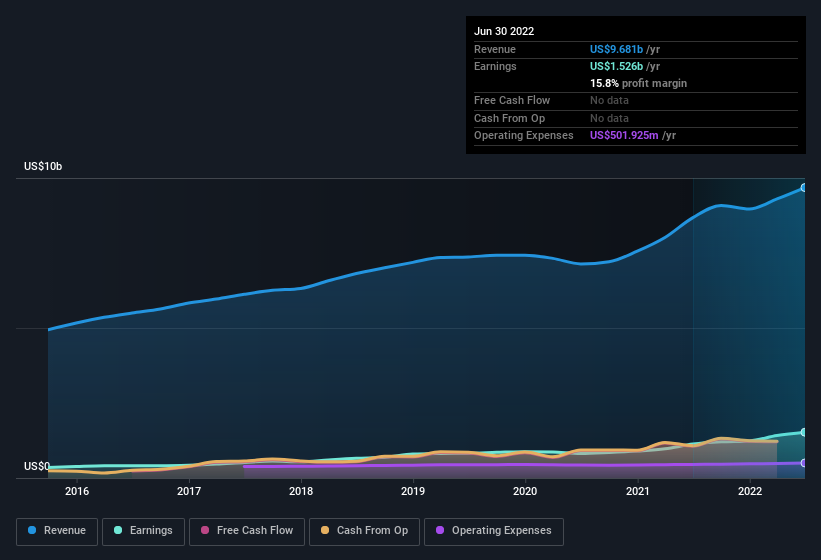

You can take a look at the company’s revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for NVR.

Are NVR Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no NVR insiders reported share sales in the last twelve months. But the important part is that VP, Chief Accounting Officer & Controller Matthew Kelpy spent US$486k buying stock, at an average price of US$4,860. Big buys like that may signal an opportunity; actions speak louder than words.

On top of the insider buying, it’s good to see that NVR insiders have a valuable investment in the business. We note that their impressive stake in the company is worth US$381m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company’s future.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That’s because NVR’s CEO, Eugene Bredow, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like NVR, with market caps over US$8.0b, is about US$13m.

The NVR CEO received total compensation of just US$1.1m in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it’s reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does NVR Deserve A Spot On Your Watchlist?

For growth investors, NVR’s raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. It’s still necessary to consider the ever-present spectre of investment risk. We’ve identified 1 warning sign with NVR , and understanding it should be part of your investment process.

The good news is that NVR is not the only growth stock with insider buying. Here’s a list of them… with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link