[ad_1]

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn’t suit, you might be more interested in profitable, growing companies, like Thejo Engineering (NSE:THEJO). While this doesn’t necessarily speak to whether it’s undervalued, the profitability of the business is enough to warrant some appreciation – especially if its growing.

View our latest analysis for Thejo Engineering

How Quickly Is Thejo Engineering Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Thejo Engineering has managed to grow EPS by 21% per year over three years. If the company can sustain that sort of growth, we’d expect shareholders to come away satisfied.

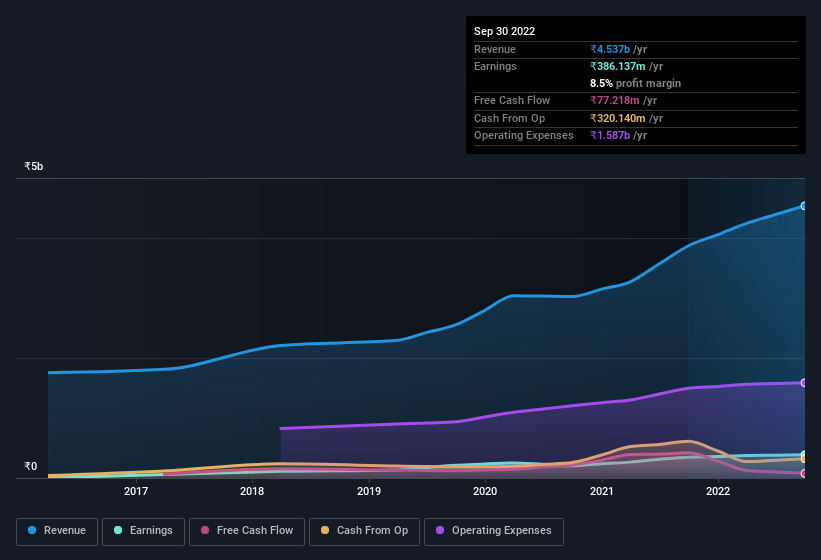

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Thejo Engineering maintained stable EBIT margins over the last year, all while growing revenue 17% to ₹4.5b. That’s a real positive.

The chart below shows how the company’s bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Thejo Engineering is no giant, with a market capitalisation of ₹11b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Thejo Engineering Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we’re pleased to report that Thejo Engineering insiders own a meaningful share of the business. To be exact, company insiders hold 64% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about ₹7.1b riding on the stock, at current prices. That’s nothing to sneeze at!

Does Thejo Engineering Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Thejo Engineering’s strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Thejo Engineering’s continuing strength. The growth and insider confidence is looked upon well and so it’s worthwhile to investigate further with a view to discern the stock’s true value. It’s still necessary to consider the ever-present spectre of investment risk. We’ve identified 1 warning sign with Thejo Engineering , and understanding this should be part of your investment process.

There’s always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we’re helping make it simple.

Find out whether Thejo Engineering is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link