[ad_1]

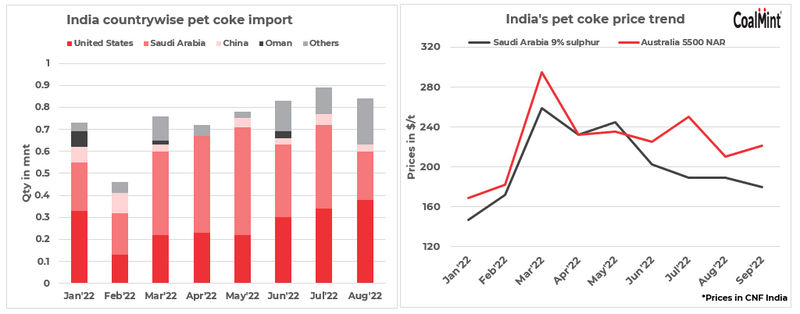

India’s pet coke imports in August 2022 stood at 850,000 tonnes (t), down 4% m-o-m. But imports were quite high compared to 160,000 t in August 2021, as per CoalMint vessel data. Also, imports in January-August this year surged 142% compared to the same period last year.

The m-o-m fall in imports can be attributed to reduced demand from the construction sector during the monsoon season. But the y-o-y increase was majorly due to improved construction activities this year, as last year the country was reeling under the impact of COVID-induced lockdowns.

Moreover, amid elevated thermal coal prices this year due to the Russia-Ukraine conflict, cement manufacturers shifted back to pet coke. Imported pet coke prices fell by 40% from the March peak this year, while thermal coal prices (across origins) corrected 30-33% during this period.

Venezuelan pet coke imports plunge

Qty in mnt

Around 70% of total imports were from the US and Saudi Arabia. Imports from the US were the highest in August. Shipments from Venezuela decreased by 48% m-o-m to 520,000 t. Although of good quality, delay in Venezuelan vessel arrivals due to limited berthing facilities at the country’s ports impacted shipment volumes.

The vessel turnaround time for Venezuelan pet coke is around three months, whereas for Saudi Arabia it is around 20 days.

Company-wise imports largely stable

Qty in mnt

Ambuja Cement imported 80,000 t, up by 33%, in August. Meanwhile, other cement buyers booked the same quantity last month on subdued demand.

Outlook

Construction activities in India are expected to pick up with the monsoon season nearing its end in September, thereby boosting demand for cement and pet coke. Additionally, with Indian refineries like BPCL (Kochi) going on maintenance for a month till October, the demand for imported material is likely to remain high.

[ad_2]

Source link