[ad_1]

A new western sanction on Russia for invading Ukraine that cuts off Russian banks from the main international payment system, Swift, would directly hurt South Korean exporters due to disruption in payment.

According to Korea International Trade Association on Sunday, Korean exporters and importers could be victimized from the latest move by the United States, European Union, and their allies to cut off Russian banks from the Society for Worldwide Interbank Financial Telecommunication (Swift) system that enables easy cross-border payments for international trade as a part of international sanction for Russian invasion of Ukraine.

Korean exporters may not be able to collect due payments for their shipments to Russia, and importers may not be able to keep trade with Russia as their credit letter are already being rejected by Korean lenders. Credit letters are generally used in international trade as they allow exporters to receive payments in advance from banks and importers can reduce risk of not being able to receive products.

KITA has received 35 complaints and inquiries from 30 companies as of Saturday, of which 15 were related to payment risk.

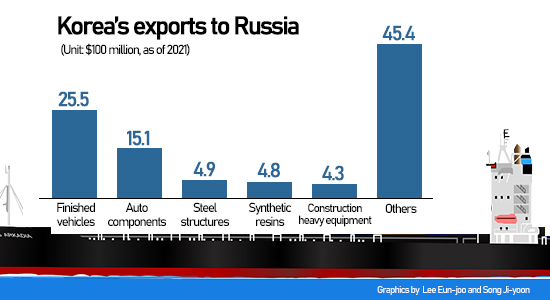

Korea’s exports to Russia reached $9.98 billion last year, taking up 1.6 percent of total outbound shipments. By item, finished vehicles and auto components accounted for more than 40 percent of exports to Russia, along with steel structures, synthetic resins, construction heavy equipment, cosmetics, and vessels.

Korean businesses are worried that exports would plunge as was the case in 2014 when Russia invaded and annexed Crimea.

At the time, Korea’s exports to Russia halved in the following year after western sanctions on the inter-continental country. Exports of finished cars dipped 62 percent on year in 2015, tires 55 percent, TVs 55 percent, galvanized steel sheets 47 percent, and auto components 39 percent.

Shipbuilders that have won large-scale orders in Russia are also closely monitoring developments. Korea Shipbuilding & Offshore Engineering, Daewoo Shipbuilding & Marine Engineering, and Samsung Heavy Industries are known to have struck shipbuilding deals worth 12 trillion won ($9.9 billion) with Russia.

Korean lenders including Shinhan Bank and Hana Bank have also launched a response team to monitor the Russo-Ukrainian War and are informing branches to restrain trade with the two countries.

Korean stock markets already weak from faster monetary tightening pace have been rattled by the Russia-Ukraine conflict.

The Kospi and Kosdaq lost more than 10 percent in the first two months of the year, or over 162 trillion won wiped out from their market cap. The benchmark Kospi was trading 0.22 percent higher at 2,682.7 on Monday morning and Kosdaq 0.56 percent at 877.84.

Kospi closed at 2,676.76 on Friday, down 10.1 percent from 2,977.65 in the end of December. Total market capitalization also fell 4.5 percent or 99.4 trillion won to 2,103.9 trillion won.

Tech-heavy Kosdaq also slipped 15.6 percent from 1,033.98 to 872.98 during the same period. Its market capitalization that reached 440 trillion won in December last year fell 14 percent to 383.2 trillion won.

Blue-chip stocks lost ground on weakened investor sentiment.

Shares of bellwether Samsung Electronics dropped 8.2 percent to 71,900 won during the cited period, SK hynix 6.1 percent, Hyundai Motor 16.7 percent, and Kia 10.2 percent.

Shares of Hyundai Motor and Kia, in particular, reached their 52-week low on Monday on concerns over its operations in Russia. Hyundai Motor stock was trading 1.44 percent lower at 171,500 won on Monday morning after touching 52-week low at 168,000 won. Kia stock was also trading 1.22 percent lower at 72,900 won, Hyundai Mobis 2 percent at 220,500 won, and Hyundai Wia 4.65 percent at 59,500 won.

Naver shares also plunged 16.9 percent to 314,500 won Friday, and Kakao 16.1 percent to below 100,000 won. Samsung Biologics dipped 14.8 percent, Samsung SDI 17.7 percent, and LG Chem 9.9 percent.

In Kosdaq, Celltrion Healthcare shares fell 22.2 percent, EcoPro BM 28.1 percent, Pearl Abyss 31.5 percent, L&F 14.1 percent, and Kakaogames 20.3 percent.

Daily turnover on the Kospi thinned 28.2 percent from over 15 trillion won to 11 trillion won and Kosdaq stocks 27.3 percent from 11 trillion won to 8 trillion won.

Analysts project the Kospi could test the bottom around 2,500 level.

By Han Woo-ram, Kim Hye-soon, Park Yun-gu, and Lee Eun-joo

[ⓒ Pulse by Maeil Business News Korea & mk.co.kr, All rights reserved]

[ad_2]

Source link