[ad_1]

- LULU stock jumped for the third time following its earnings

- The company raised its FY guidance, but some institutions deem it overly aggressive

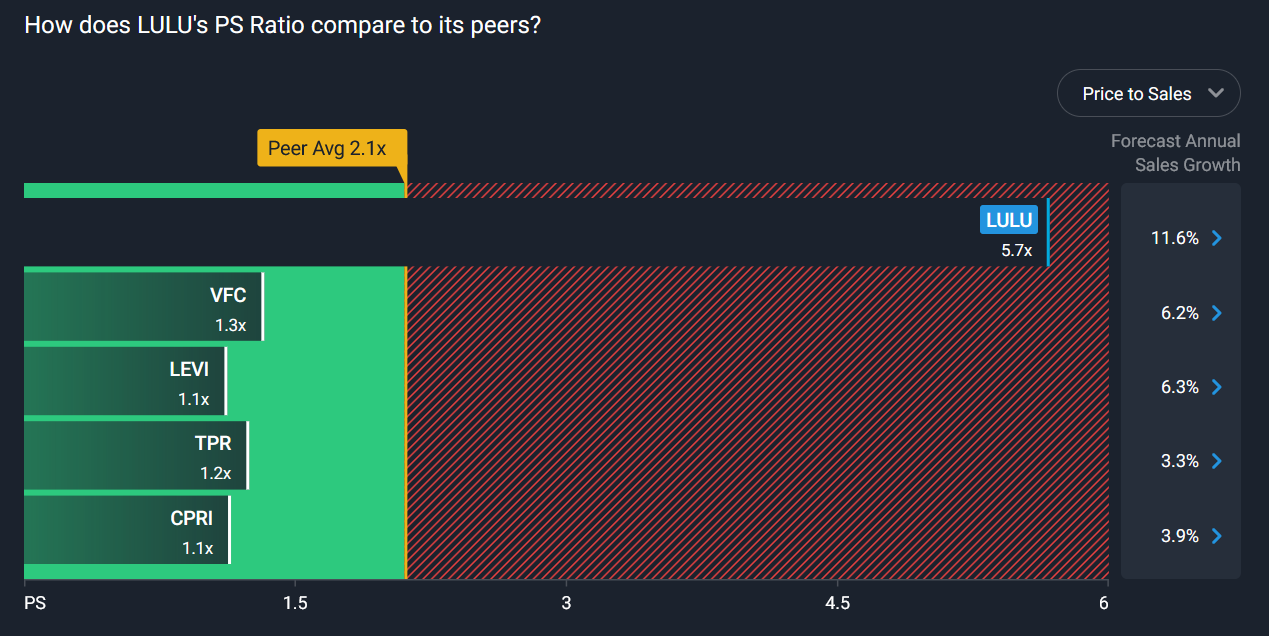

- Stock is trading at a significant premium compared to its peers

Lululemon Athletica Inc. (NASDAQ: LULU) just announced the latest earnings results, surpassing the expectations and showing why it is one of the best in its category – but trading at a premium as well.

For the third time this year, the stock rallied off the lows following the earnings, yet with the ongoing market correction, the stock has been flat in the last 2 years.

Check out our latest analysis for Lululemon Athletica

LULU Second quarter 2023 earnings

- EPS: US$2.27 (up from US$1.60 in 2Q 2022).

- Revenue: US$1.87b (up 29% from 2Q 2022).

- Net income: US$289.5m (up 39% from 2Q 2022).

- Profit margin: 16% (up from 14% in 2Q 2022). The increase in margin was driven by higher revenue.

Revenue exceeded analyst estimates by 5.6%. Earnings per share (EPS) also surpassed analyst estimates by 20%. Over the next year, revenue is forecast to grow 17%, compared to a 9.4% growth forecast for the Luxury industry in the US.

Raised Guidance but Mixed Institutional Reaction

LULU’s guidance has been raised, with FY EPS range now at US$9.75-9.90, from the previous US$9.35-9.50.

Despite these results, some institutions believe Lululemon’s outlook is too aggressive. Jeffries’ analyst Randal Konik reiterated the Underperform rating with a US$200 price target. Then, on the other side of this spectrum is J.P.Morgan’s Matthew Boss, who maintained an Overweight rating, raising the price target to US$396 from US$382 – quoting favoring trends in active lifestyles, growing e-commerce, and international expansions. Lululemon is set to open its first store in Spain, marking the first new European market since 2019.

Is Lululemon Athletica Cheap?

Comparing LULU with its peers shows the price disparity in this category. LULU trades on a completely different level than its peers.

According to our valuation model, the stock is currently overvalued by about 40%, trading at US$314 compared to our intrinsic value of $225.00. This means that the buying opportunity has probably disappeared for now.

But, is there another opportunity to buy low in the future? Lululemon Athletica’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, a good indicator of share price volatility.

What This Means For You

Are you a shareholder? LULU’s optimistic future growth appears to have been factored into the current share price, with shares trading above their fair value. However, this brings up another question – is now the right time to sell? If you believe LULU should trade below its current price, selling high and buying it back up when its price falls towards its real value can be profitable.

Before you make that decision, we would suggest taking a look at whether or not you have other suitable opportunities to invest in, given that the high inflationary environment might not be suitable for holding cash.

Are you a potential investor? If you’ve been keeping tabs on LULU for some time, now may not be the best time to enter the stock. While the company is doing well, overpaying is one of the easiest investing mistakes. The price has surpassed its true value, which means there’s no upside from mispricing. However, the positive outlook is encouraging for LULU, which means it’s worth diving deeper into other factors in order to take advantage of the next price drop. Since every stock has risk, we suggest looking into 1 warning sign for Lululemon Athletica you should know about.

If you are no longer interested in Lululemon Athletica, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Discounted cash flow calculation for every stock

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of any company just search here. It’s FREE.

[ad_2]

Source link