[ad_1]

AlexLMX/iStock via Getty Images

Background

The past 10 years have been a tumultuous time for Lynas Rare Earths (OTCPK:LYSCF). From fledgling firm transforming exotic minerals crucial in advanced battery technologies, to inaugurating its first processing facility in Pahang, Malaysia.

This has not been without controversy. Limited community knowledge coupled with a “not in my backyard” public reception plagued the rare mineral processing venture’s Malaysian start-up.

But what initially was perceived in the mining community as a cottage industry has grown staggeringly in terms of strategic importance.

China dominates rare mineral production. Its growing output currently contributes to nano medical research, advanced weaponry, the green transition, and innovation in the digital economy.

Almost by accident, the Australian exotic minerals pioneer has found itself squarely at the crossroads of a geo-political stand-off between China and the West.

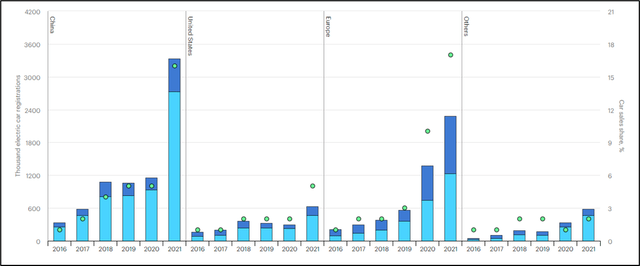

IEA

Battery electric and hybrid electric vehicles have boomed in China and Europe. Adoption is still comparably soft in the United States.

This neglected niche of global mining is swiftly garnering interest. Solvay (OTCQX:SVYSF), the Belgian chemicals titan has just announced a second European site and an upgrading of its La Rochelle Plant in Western France to process a broader mix of 17 rare earths critical to magnet production and wind turbines.

Other rare earth separation projects are seeing light of day. Neo Performance Materials (OTCPK:NOPMF), with a processing facility in Estonia, will try to satisfy skyrocketing demand while the UK touts an upcoming exotic materials separation project through London listed Pensana.

Our demand for rare earths alone will increase fivefold by 2030 – EU Commissioner Thierry Breton

Interest in the sector appears increasingly insatiable. Hence a deeper dive into Lynas Rare Earths seems merited. My outlook for the Australian mining & exotic materials processor is positive.

The $8B company finds itself at the center of a global push to reduce the world’s reliance on China’s exotic materials supply chain. Its US government backing for additional projects in Texas coupled with its West Australian mining pedigree positions it well for the future. Let’s discover more.

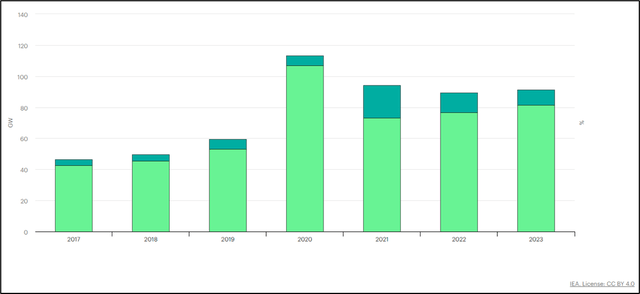

IEA

Onshore & Offshore wind production is expected to continue to grow with 2023 onshore wind representing 81.4 GW and offshore wind representing 10GW.

Company Overview

Lynas Rare Earths engages in the exploration, development, mining, and processing of exotic materials destined for advanced military, science, medical and technological applications. Its flagship Mount Weld project will ultimately produce 17 exotic earths with its Malaysia processing facility the cornerstone of its material transformation footprint.

The company was originally founded in 1983 but has really come to recent prominence given the sector’s growing geopolitical importance.

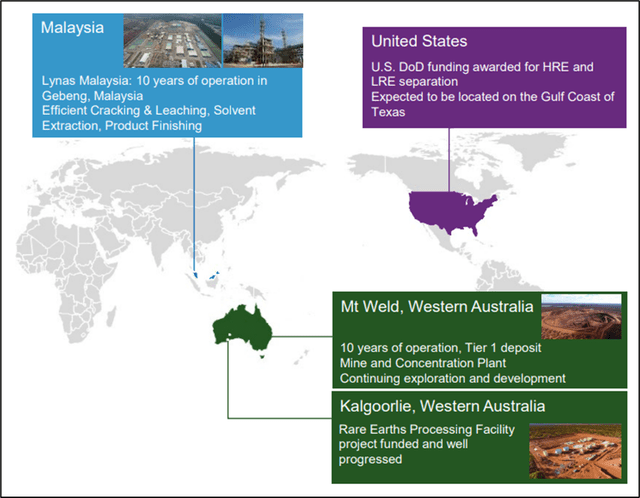

Lynas Rare Earths

The firm’s industrial footprint continues to expand

The company operates the flagship Mount Weld mineral resource, including a tier 1 deposit mine and concentration plant. Exploration and development continue with $500M penned for investment to boost output of Neodymium and Praseodymium.

Commonly known as NdPr, these are the primary ingredients in the production of electric motors critical for both wind turbines and electric vehicles (EVs).

The mine boasts long life reserves with ore reserve estimates of 18.9M tons (average grade 8.3% of rare earth oxide) and earth mineral reserve estimates of 55.2M tons with an average grade of 5.3%.

Lynas Rare Earths

The Kalgoorlie Processing facility is well advanced in its construction phase

The Kalgoorlie Rare Earths processing facility continues to make progress, with plant construction phases well advanced. Maintenance and operations teams have been recruited in anticipation of near-term commissioning.

Capital investment in its Malaysia industrial complex will be a center-piece of the company’s strategy. Repurposing the ~10-year-old plant to enable it to process mixed rare earth carbonate feedstock (MREC) from its Kalgoorlie Rare Earths processing facility is underway.

Solvent extraction and production finishing upgrades to hit 2025 capacity targets (10,500 tons per annum of Neodymium and Praseodymium) are currently on course.

Lynas has also received US government backing to undertake a commercial heavy rare earths separation facility. The US $120M contract from the US Department of Defense will be co-located with a Light Rare Earths separation facility, expected to be strategically positioned in an industrial complex on the Gulf Coast of Texas.

The Commercial Light Rare Earths separation facility adjoining the US state backed industrial complex will have $30M of government funding, with Lynas contributing a matching amount.

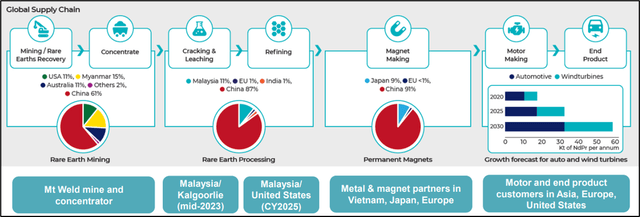

Lynas Rare Earths

The company is increasingly occupying a prominent place in the exotic material mining and processing supply chain.

Financials

The A$7.65B exotic metals and mining pioneer has seen revenues double from A$489M (FY 2021) to A$920M (FY 2022) Gross profit margins have followed accordingly, with the company posting 62% margins (FY2022).

To put this into perspective, the company posted A$186M in gross margins (~38%) on A$489M sales. Enthusiasm around the strategic importance of the industry is starting to reflect heavily in financial print.

EBITDA margins have ballooned (~57%) as has the firm’s A$7.65B market capitalization. Only 6 years earlier, the company posted $184M in total market cap, underscoring eye watering growth in capital structure (40x).

EPS has tripled ($A0.18 in FY 2021), reaching $A0.60 FY 2022. There is nothing too scary on the balance sheet – granted receivables have accelerated but current assets (A$1.13B) comfortably cover current liabilities (A$123M)

A standout feature is the A$965M held by the company in cash. No liquidity worries here. Leverage does not appear to be a major issue either with total debt of A$190M.

Capital expenditure (A$186M) continues to figure distinctly on cash flow from investing as the company continues its plight for industrial expansion. No big credit risk either with the firm posting A$273M in free cash flow. Valuation multiples for the company remain on the higher side with a 17.8X P/E over the next 12 months.

Analysts have a positive outlook for the exotic materials’ miner with CY 2023 at A$952M and CY 2024E at A$1.314B. Net income is expected to take a bit of a hit next year given the vast capital expenditure program to bring industrial assets online (A$431M forecast net income 2023E). All in, the outlook remains positive.

Risks

Risks are not as accentuated as other parts of the mining industry. Products, such as EVs and windfarms, remain heavily supported by sovereign states. Despite economic headwinds, specifically in consumer discretionary, governments are likely to continue providing fiscal stimulus to bolster the energy transition.

The balance sheet is robust so tightening credit markets should not be much of an issue either given cash on hand for growth initiatives. Governments are backing industrial development which is another positive for Lynas Rare Earths.

The biggest risk I presently see is current valuation. At 17x, it appears like a lot of value-added project initiatives may be priced in by the market. Volatility in risk capital has been extremely prominent but the firm is likely to continue benefiting from commodity price upside.

Key Takeaways

There is a lot to like about Lynas Rare Earths. The West Australian exotic metals specialist has a leading role in Western nation’s plight to de-lever from Chinese rare earth dependency.

Accordingly, tax regimes, governments and industry are collectively embracing changes likely to provide lasting positive results. Competition is growing but presently remains largely outpaced by growth of demand.

[ad_2]

Source link