[ad_1]

Macroeconomic data, corporate earnings, activity in the IPO market and institutional flows are likely to be in focus on Dalal Street this week, after a week that saw aggressive central bank action rattle global markets. LIC’s initial share sale to raise up to Rs 21,000 crore — India’s biggest public offer of all time — will be in the spotlight as the bidding process draws to a close.

The earnings season will continue to be on investors’ radar with blue-chip companies such as Tata Motors, Asian Paints, SBI, Bank of Baroda and Punjab National Bank slated to report their quarterly numbers.

Besides, foreign fund flows, and news updates on the Russia-Ukraine war and rising COVID infections in parts of the world will also be tracked closely.

The week that was

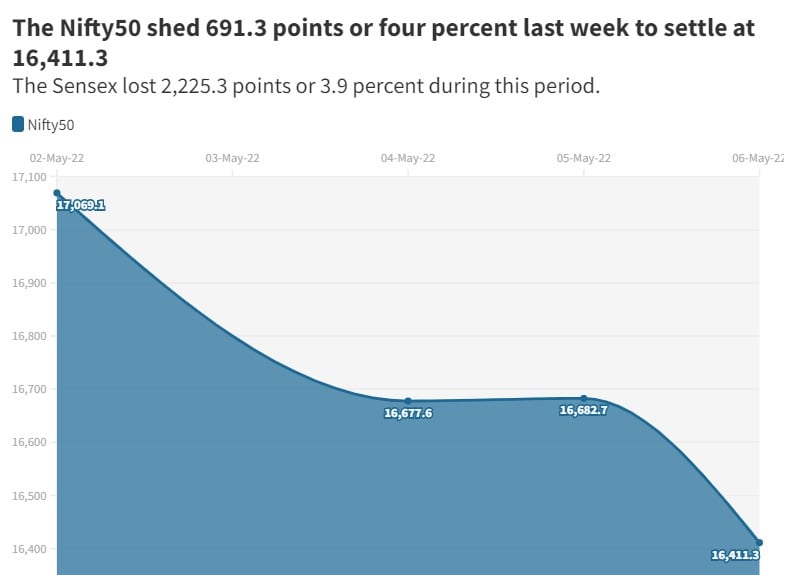

Indian equity benchmarks suffered their biggest weekly loss since November 2021 in the holiday-truncated four-session trading week ended May 6, plunging around four percent each. That marked their fourth weekly losses in a row.

Concerns about worsening inflation and its impact on global growth sent jitters across global markets during the week that saw major central bank including the RBI tighten pandemic-era monetary policies.

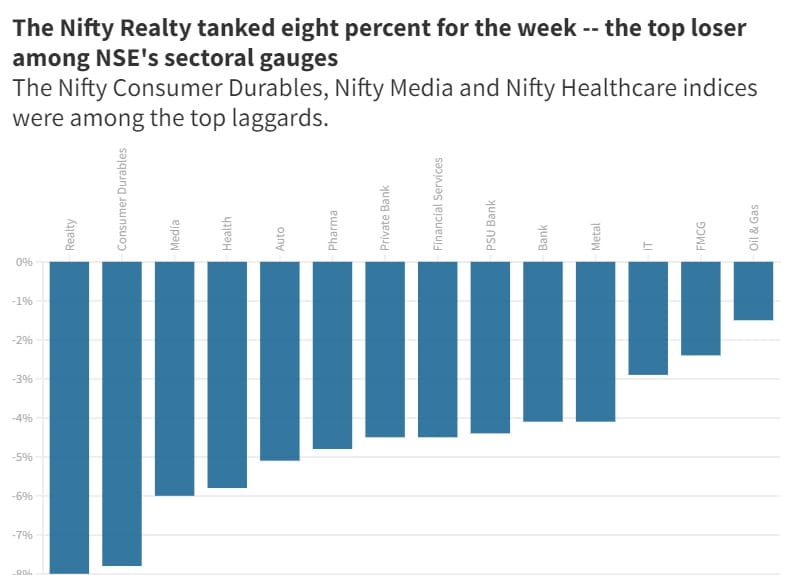

Broader markets mirrored the losses in headline indices.

| Index | Weekly change (%) |

| Midcap 100 | -4.3 |

| Smallcap 100 | -6.8 |

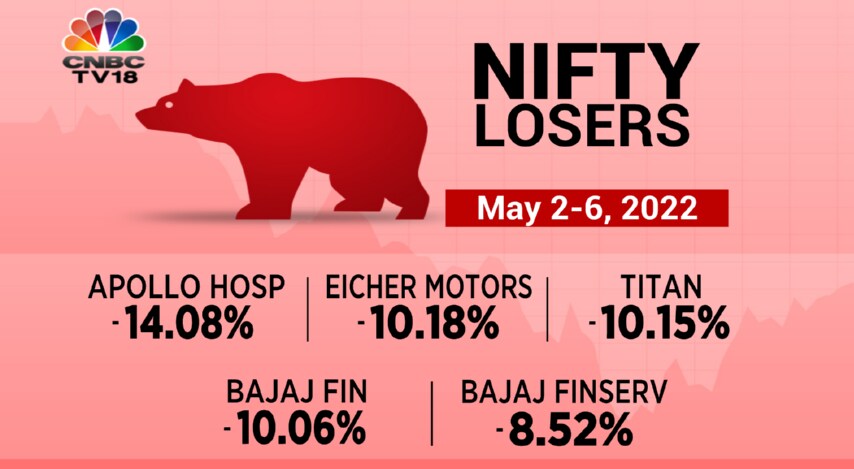

As many as 43 Nifty stocks finished the week below the flatline.

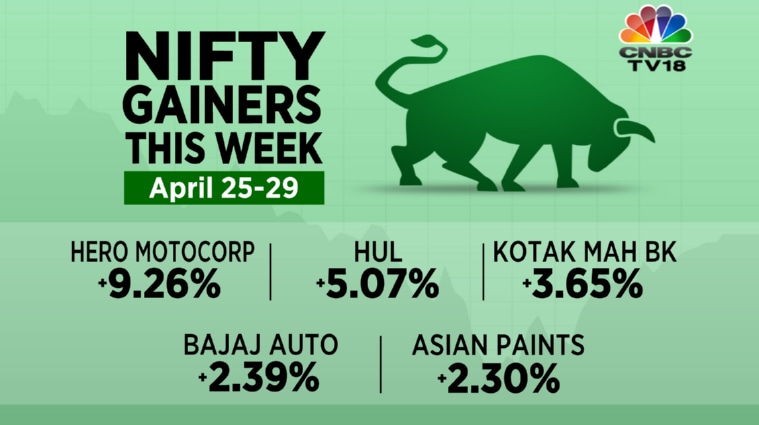

Hero MotoCorp, Hindustan Unilever and Kotak Mahindra Bank were among the few blue-chip gainers.

The road ahead

“In the coming week, the market will track inflation numbers across the globe. Although the numbers will remain high, the chances of a major market reaction are low given that the impact has already been factored in,” said Vinod Nair, Head of Research at Geojit Financial Services.

He suggests sticking with spaces such as banking, IT, pharma and green energy.

Here are the key factors and events that are likely to influence Dalal Street in the week beginning May 9:

GLOBAL CUES

A slew of central bankers are due to speak during the course of the week.

| Date | US | Europe | Asia |

| May 9 | Fed official due to speak | BoE official to speak | Minutes of last BoJ policy meeting |

| May 10 | Four Fed officials to speak | BoE official to speak, ECB official to speak | |

| May 11 | Inflation data, crude oil stockpiles data, two Fed officials to speak | ECB President and two other officials, Germany inflation data | China inflation data |

| May 12 | Jobless claims data | UK GDP data | |

| May 13 | Two Fed officials to speak | Eurozone factory output data, two ECB officials to speak, France inflation data | Hong Kong GDP data |

DOMESTIC CUES

Separate official data on consumer inflation and factory output (Index of Industrial Production) in the country are due on Thursday, May 12.

Earnings

Investors await more of quarterly earnings reports from India Inc for cues. Here are a few noteworthy financial results due this week:

| Company | Earnings |

| Cental Bank of India, UPL, PVR, Dalmia Bharat, Infibeam, Gujarat Narmada Valley Fertilizers, Godrej Agrovet, Vedant Fashions (Manyavar) | May 9 |

| Asian Paints, Cipla, Vodafone Idea, MGL, MRF, Chalet Hotels | May 10 |

| Adani Ports, Punjab National Bank, Indian Bank, Mangalore Refinery, Petronet | May 11 |

| Tata Motors, Aditya Birla Capital, RBL Bank, Apollo Tyres, J&K Bank, CreditAccess, HCC, Ujjivan Small Finance Bank | May 12 |

| SBI, Tech Mahindra, Eicher, Bank of Baroda, Union Bank of India, Uco Bank, Bandhan Bank, Escorts, Emami | May 13 |

IPO

The stock of Campus Activewear will be listed on the bourses on May 9 and that of Rainbow Children’s Medicare on May 10.

Prudent Corporate Advisory Services’ IPO to raise up to Rs 539 crore will hit the Street on Tuesday.

Two other IPOs will be launched the next day, May 11: Delhivery (Rs 5,235 crore) and Venus Pipes & Tubes (Rs 165 crore).

FII activity

Foreign fund flows will remain in focus on Dalal Street. Last week, foreign institutional investors (FIIs) net sold Indian shares to the tune of Rs 12,733.5 crore, though domestic institutional investors (DIIs) made net purchases of Rs 8,533.3 crore, according to provisional exchange data.

Corporate action

| Company | Ex date | Purpose | Record date |

| IndiaMART InterMESH | May 10 | Share buyback | May 11 |

| Laurus Labs | May 10 | Interim dividend Rs 1.2 | May 11 |

| APTECH | May 11 | Interim dividend Rs 5 | May 12 |

| IRB InvIT Fund | May 11 | Income distribution (InvIT) | May 12 |

| Thyrocare Technologies | May 11 | Interim dividend Rs 15 | May 12 |

| Coastal Corp | May 12 | Interim dividend Rs 2 | May 13 |

| HDFC Bank | May 12 | Final dividend Rs 15.5 | May 13 |

| Indian Card Clothing | May 12 | Special dividend Rs 25 | May 13 |

| Procter & Gamble Health | May 12 | Interim dividend Rs 41 | May 13 |

| Sinclairs Hotels | May 12 | Share buyback | May 13 |

| Vikram Thermo (India) | May 12 | Bonus issue 4:1 | May 13 |

| Aarnav Fashions | May 13 | Interim dividend Rs 0.5 | May 17 |

| Black Box | May 13 | Stock split from Rs 10 to Rs 2 | May 17 |

| BLS International Services | May 13 | Bonus issue 1:1 | May 17 |

| Dolfin Rubbers | May 13 | Bonus issue 1:3 | May 17 |

| GM Breweries | May 13 | Final dividend Rs 5 | – |

| Indus Towers | May 13 | Interim dividend Rs 11 | May 17 |

| OFSS | May 13 | Interim dividend Rs 190 | May 17 |

| Sadhna Broadcast | May 13 | EGM | – |

| Suven Pharmaceuticals | May 13 | Interim dividend | May 17 |

| Visagar Financial Services | May 13 | EGM | – |

[ad_2]

Source link