[ad_1]

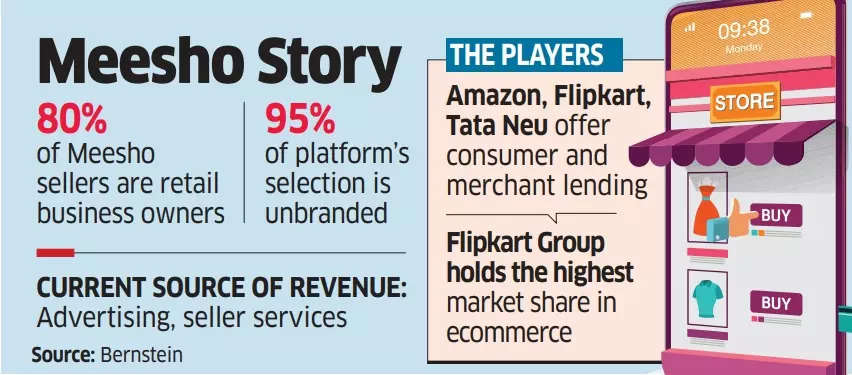

E-commerce firm Meesho aims to build a financial services platform and also scale its grocery delivery business in the next financial year, following a year of focused effort to cut down its spiralling losses, people in the know said. The SoftBank-backed firm’s diversification gambit mirrors its peers, as the online commerce industry intensifies the drive towards profitability.

Walmart-owned Flipkart is building its own fintech business through Super.Money — run by senior executive Prakash Sikaria — and has invested $15-20 million. “Flipkart is already testing a full-stack buy now-pay later and personal loan platform,” said a person aware of the matter. “It’s scaled quite fast and more lending products will be added this year.

Meesho wants to start with a credit marketplace where borrowers will be sourced on behalf of its lending partners — banks and non-banking financial companies (NBFCs). It will earn a commission on every disbursal.

“They (Meesho) are experimenting with a lending platform, but there is a serious focus on this internally. It’s still early days,” said a person aware of plans.

A Meesho spokesperson said pilots into financial services and grocery are just a few examples of the company’s diverse initiatives. She said the startup had identified challenges in accessing credit lines. “Initiatives like providing sellers quicker access to payments are driving both financial inclusion and the growth of small businesses,” the spokesperson said.

The ecommerce company had scaled down its in 2022, but is now planning to offer the service again in one or two cities from April, those cited above said. “They may expand, depending on how it goes,” one person said.

Credit line

A senior fintech executive said, “For ecommerce players with a large user base, offering financial services is understandable, but there are large investments required since it is a regulated space. Also, the quality of the book is important, given the kind of users it caters to.”

Bigger rival Amazon India offers consumer credit and payments through Amazon Pay. Group ecommerce arm Tata Neu also offers lending to consumers through multiple financiers, including Tata Capital.

The executive pointed out that Meesho is not keen to operate just as a lead generator for its lending partners, but aims to build its own credit underwriting models, decision-taking systems, fraud detection and other such capabilities. The goal is to build a full stack of credit products.

The startup’s new initiatives are seen as linked to its plans to clock a higher growth rate in the new fiscal. Multiple people in the know said it is scouting for a senior executive to lead the lending function, while also aiming to build an inhouse credit risk and data science team.

While the focus will initially be on processing merchant loans, Meesho wants to offer lending to consumers too, mostly in non-metros. The average selling price of products on the platform is below Rs 500.

“When you are pitching to large banks and NBFCs for business partnership, you need to give them the right customers and also manage the book so credit losses do not shoot up,” said one person quoted above.

Delivering on grocery

In 2022, Meesho had to significantly scale down its grocery operations amid an internal reset. It used to run the business as Farmiso but rebranded it to Meesho Superstore and integrated it with the main app. At the time, it fired at least 150 on-contract employees, as well as off-roll staff. “The burn is likely to go up in the low-margin grocery business, with expansion. The extent of aggressiveness will determine the scale,” said a person aware of current plans.

At a Flipkart townhall last week, group chief executive Kalyan Krishnamurthy told employees its grocery business grew by 50% on-year during 2023.

Numbers game

In 2023, the Bengaluru-based firm fired 15% of employees, in 251 roles, saying it was optimising for a “leaner organisational structure to achieve sustained profitability.”

In FY23, Meesho narrowed its losses by 48% to Rs 1,675 crore, while operating revenue grew 77% to Rs 5,735 crore. For April-September 2023, it said operating revenue increased 37% year-on-year to Rs 3,521 crore, with a 90% reduction in loss to Rs 141 crore.

In August last year, Meesho said it had turned in maiden profits in July. In a December media statement, it said the September quarter was profitable but did not give numbers.

ET reported on January 25 that Krishnamurthy told employees Flipkart was close to being profitable.

[ad_2]

Source link