[ad_1]

Private sector producers in Mexico reported record oil volumes of 106,120 b/d in August, up from 63,414 b/d a year earlier, according to upstream regulator Comisión Nacional de Hidrocarburos (CNH)

Three private sector-operated shallow water fields – all of which were awarded through the Round 1.2 bidding process in 2015 – reported record oil production for the month. These comprised the CNH-R01-L02-A1 contract operated by Eni SpA, CNH-R01-L02-A2 operated by Hokchi Energy and CNH-R01-L02-A4 operated by Fieldwood Energy.

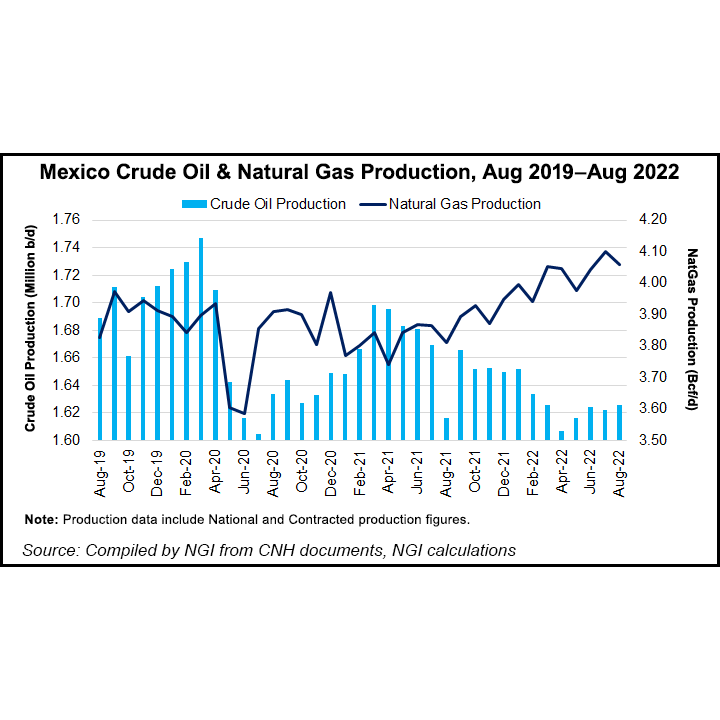

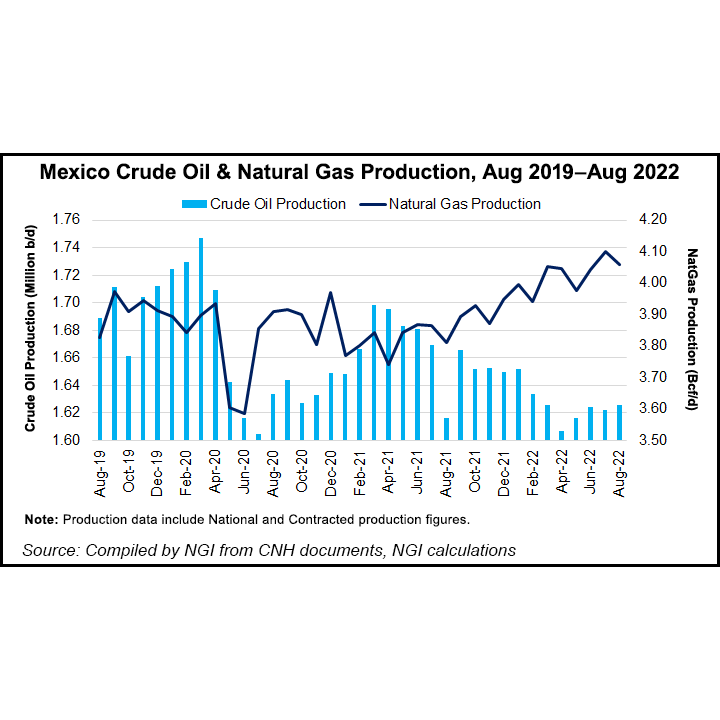

The country’s total oil production averaged 1.63 million b/d in August, up from 1.62 million b/d in August 2021. State oil company Petróleos Mexicanos (Pemex) produced 1.52 million b/d, down from 1.55 million b/d in the year-ago month.

Mexico’s top oil-producing fields were Maloob (274,000 b/d), Zaap (239,000 bbl), Ayatsil (89,000 bbl), Xanab (79,000 bbl) and Yaxche (52,000 bbl). Pemex operates all five fields.

Mexico’s natural gas output, meanwhile, averaged 4.06 Bcf/d in August, up from 3.81 Bcf/d in August 2021, CNH data show.

Pemex accounted for 3.82 Bcf/d of the total, up from 3.61 Bcf/d in the year-ago month but down from 3.86 Bcf/d in July.

Private sector operators produced 238.5 MMcf/d, up from 196.9 MMcf/d a year earlier.

The top gas-producing fields, all operated by Pemex, were Quesqui (477 MMcf/d), Ixachi (304 MMcf), Maloob (303 MMcf), Akal (253 MMcf) and Onel (190 MMcf).

Dry gas production from Pemex processing centers averaged 2.29 Bcf/d, the company said, up from 2.15 Bcf/d in August 2021.

[Mexico Matters: Cross-border energy trade between the U.S. and Mexico reached $42 billion last year. Understand this burgeoning trade flow — the projects, politics and natural gas prices — with NGI’s Mexico Gas Price Index. Know more.]

Mexico sources most of its natural gas via pipeline from the United States, a trend forecast to continue for the foreseeable future. Multiple planned LNG export plants are in varying stages of development on Mexico’s Pacific and Atlantic coasts, mostly with the goal of re-exporting gas imported by pipeline from the United States.

President Andrés Manuel López Obrador said this week that a liquefied natural gas export hub in the port of Coatzacoalcos, Veracruz, could potentially help Europe wean itself off Russian gas.

Imported natural gas supplied 87% of Mexico’s demand in May, excluding gas produced and consumed by Pemex, according to CNH. This is down from 91% in May 2021.

On the upstream side, Mexico’s Hydrocarbon Companies Association (AMEXHI) urged the Senate this month to expedite the appointment of a new chairman of CNH, following the resignation of Rogelio Hernández.

AMEXHI stressed the “importance of guaranteeing the regulatory continuity of the hydrocarbons sector,” and the need to maintain “the technical and impartial profile of the commission.”

Pemex, meanwhile, continues to face financial difficulties despite benefitting from high oil and natural gas prices.

“Elevated oil prices in 2022 were a lost opportunity to materially improve” Pemex’s standalone credit profile, said Fitch analysts Saverio Minervini and Carlos Morales in a research note this month.

[ad_2]

Source link