[ad_1]

Houston-based independent Murphy Oil Corp.’s recent wells at its Eagle Ford Shale and Tupper Montney acreage in Western Canada are “exceeding production expectations,” management said earlier this month.

The producer “continues to successfully execute a significant and intricate project in the Gulf of Mexico, while our onshore team has enhanced production volumes and accelerated returns across our North American unconventional business through new completion designs and longer laterals,” CEO Roger Jenkins said during the second quarter earnings call.

“This outstanding execution has enabled us to capitalize on current high oil prices, as the additional production provides excess cash flow to support our delevering strategy, while increasing our dividend.”

Murphy, he said, is “now in a position to disclose a capital allocation framework that will highlight targeted returns to our shareholders through the dividend and share repurchases.”

The exploration and production (E&P) independent in the Eagle Ford in South Texas added 17 wells in Karnes County and six wells to its Catarina assets in Dimmit County.

The Karnes and Catarina wells “have exceeded forecasts,” said Executive Vice President Eric Hambly, who oversees operations. Initial production over 30 days averaged 1,900 boe/d in Karnes and 1,110 boe/d in Catarina, he said.

The “strong production rates,” coupled with fetching an $85/bbl West Texas Intermediate oil price, could allow the producer to achieve “full investment recovery in three to five months for Karnes, and in six to 11 months for Catarina,” Hambly said.

Jenkins credited “enhanced completion designs and longer laterals” for the wells “exceeding production expectations.”

U.S. onshore production for crude oil and condensate reached 26,304 b/d in 2Q2022, down from year-ago production of 31,253. The E&P also reported lower U.S. natural gas liquids (NGL) production, down by 149 boe/d to 5,178 boe/d. For natural gas, onshore production fell 2 Mcf/d year/year to 29,651 Mcf/d.

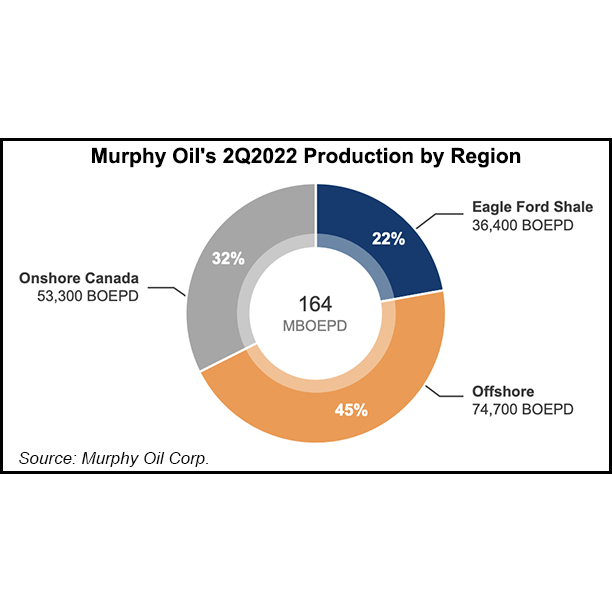

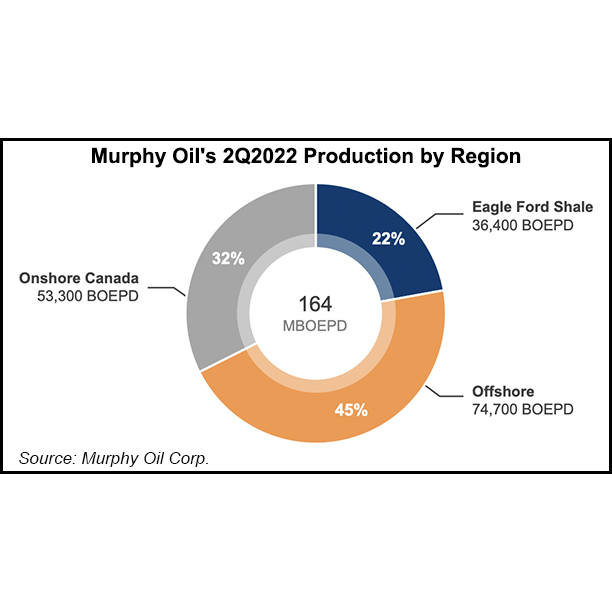

Murphy’s Eagle Ford assets produced an average 36,000 boe/d, 72% weighted to oil.

Because the company’s assets performed at the “high end of guidance,” Jenkins said, Murphy raised midpoint production guidance to 168,000-176,000 boe/d from 168,000 boe/d to 172,000 boe/d.

King’s Quay Progress

In the Gulf of Mexico (GOM), Murphy achieved first oil ahead of schedule during the quarter from the King’s Quay floating production system.

“We have now brought online four wells in our seven-well Khaleesi, Mormont, Samurai field development, with the King’s Quay floating production system, achieving 97% uptime,” Jenkins said.

Combined, the four wells are achieving a total gross production rate of about 70,000 boe/d, with 87% oil. By the end of the year, Murphy is expecting to approach the nameplate capacity for King’s Quay of 85,000 boe/d, Hambly told investors.

A fifth well, and the final well in the Khaleesi/Mormont field, is “anticipated to flow immediately,” he said.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

Northeast of King’s Quay in the GOM, Murphy also completed “accretive, highly economic bolt-on transactions” at its nonoperated Kodiak field, Hambly said. Murphy owns a 29% stake in Kodiak.

Early in the third quarter, Murphy also executed two purchase and sale agreements to acquire a 3.4% additional working interest in the nonoperated Lucius spar, southwest of King’s Quay.

“Following these transactions, we have a total working interest of 59.3% in Kodiak, and 16.1% in Lucius,” Hambly said. “What we like most about these purchases is that they have active opportunities to further increase their value.” The E&P and its partners recently drilled a successful well at Kodiak and are engaged in a two-well program at Lucius.

Oil production in the GOM averaged 63,427 b/d during 2Q2022, down by 5,041 b/d year/year. Natural gas production offshore was also down year/year from 71,962 Mcf/d to 63,703 Mcf/d in 2Q2022. For NGLs, Murphy saw an average of 4,913 boe/d in the GOM, up from 4,763 in 2Q2021.

Across the continuing operations, Murphy reported average crude and condensate production of 98,661 b/d, down more than 10,000 b/d year/year. Net NGL production averaged 10,950 boe/d, down from 11,252 boe/d for the same period the year prior. Average natural gas production was 381,373 Mcf/d for 2Q2022, up 12,548 year/year.

Net income in 2Q2022 was $350.5 million ($2.27/share), compared with a year-ago loss of $63.1 million (minus 41 cents).

[ad_2]

Source link